The weekly crude oil stock cycle is full and provides proceed to shrink. In keeping with the U.S. Vitality Info Administration (EIA), crude oil st

The weekly crude oil stock cycle is full and provides proceed to shrink. In keeping with the U.S. Vitality Info Administration (EIA), crude oil stocks-on-hand decreased by 1.001 million barrels for the week of October 16. Whereas not an enormous drawdown, it appears to be like like oil demand is stabilizing as we transfer deeper into the autumn season.

The Weekly API And EIA Stories Are In…

October has introduced surprisingly robust demand for crude oil. Final week bolstered this concept, because the API and EIA numbers got here in as anticipated:

Occasion Precise Projected Earlier

API Crude Oil Shares (Oct. 16) 0.584M NA -5.420M

EIA Crude Oil Shares (Oct. 16) -1.001M -1.021M -3.818M

All in all, these figures recommend a comparatively “secure” North American crude manufacturing setting. In fact, one has to wonder if demand is absolutely selecting up or output has crashed because of the COVID-19 downturn in fracking. For now, power merchants are skeptical and have bought off December WTI crude oil futures. At press time (1:30 PM EST), costs have fallen beneath the $40.00 deal with.

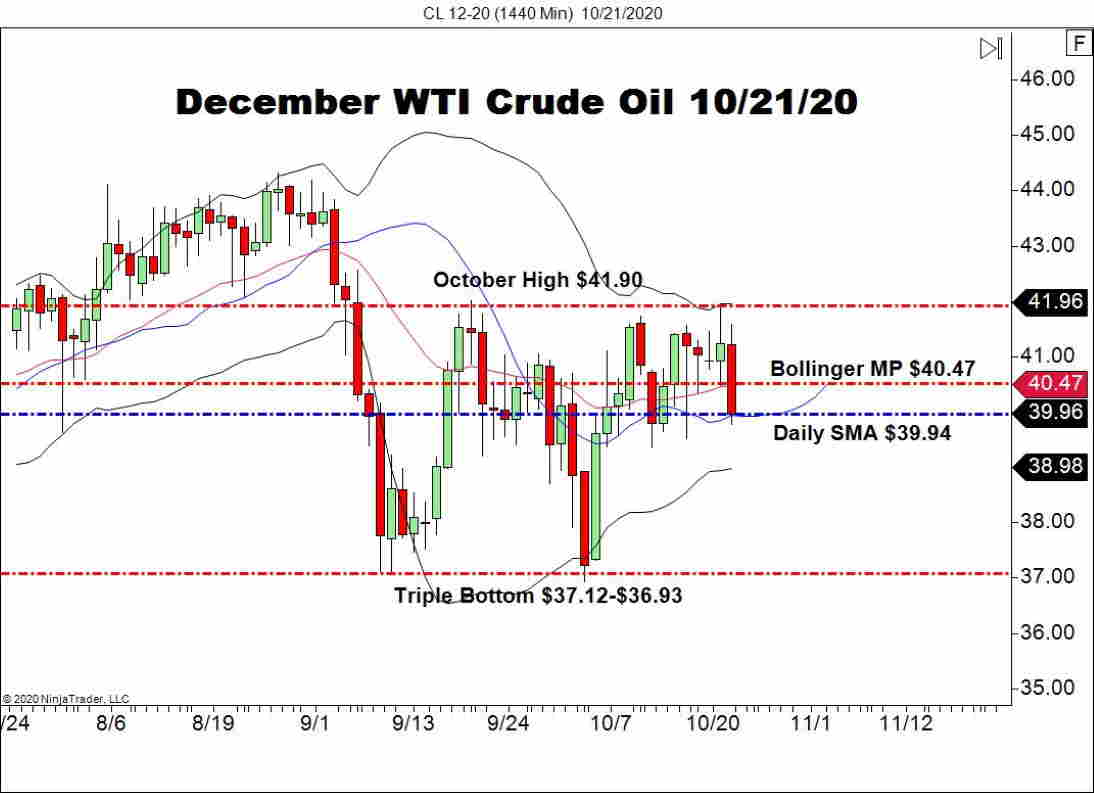

December WTI Futures Plunge Beneath $40.00

It’s been a tough day for December WTI futures, with costs plunging almost $2.00 per barrel. It seems that merchants and traders are biased to the brief facet of this market as 2020 winds down.

++10_21_2020.jpg)

Overview: Whereas there’s a robust case to be made for bearish crude oil till not less than spring 2021, WTI pricing isn’t all that weak. Costs stay within the $40.00 space as power merchants cope with the approaching U.S. election, USD volatility, and pending OPEC+ manufacturing cuts. In actuality, oil valuations may very well be a lot decrease than they at present are.

Right this moment’s EIA report means that demand is returning to the markets amid this yr’s COVID-19 financial turbulence. Finally, solely time will inform if this assertion is appropriate. Nonetheless, financial exercise is selecting up and oil provides are reducing ― each are good indicators for power bulls.