It’s Wednesday mid-session, and that implies that the weekly crude oil stock cycle is now full. Earlier this morning, the U.S. Vitality Info Compa

It’s Wednesday mid-session, and that implies that the weekly crude oil stock cycle is now full. Earlier this morning, the U.S. Vitality Info Company (EIA) reported a second-consecutive week-over-week provide construct. That is an attention-grabbing development as rising late-spring provides contradict conventional crude oil seasonal tendencies. For now, the oil provide is robust and WTI pricing has entered heavy rotation.

EIA Studies Uptick In Oil Provides

To this point, June’s demand for refined fuels has been comparatively stagnant. Subsequently, the outcomes are rising provides and WTI consolidation. Right here’s a fast take a look at this week’s figures:

Occasion Precise Projected Earlier

API Crude Oil Shares 3.857M NA 8.420M

EIA Crude Oil Shares 1.215M -0.152M 5.720M

Though the weekly enhance in crude oil provides has dropped dramatically week-over-week, inventories are nonetheless on the rise. Nevertheless, there are just a few vibrant spots for WTI bulls. Gasoline provides fell by 1.7 million barrels and storage on the Cushing, Oklahoma hub fell by 2.6 million barrels. So, not less than the demand for refined fuels is displaying indicators of life transferring into the summer season months.

WTI Futures Roll From July To August

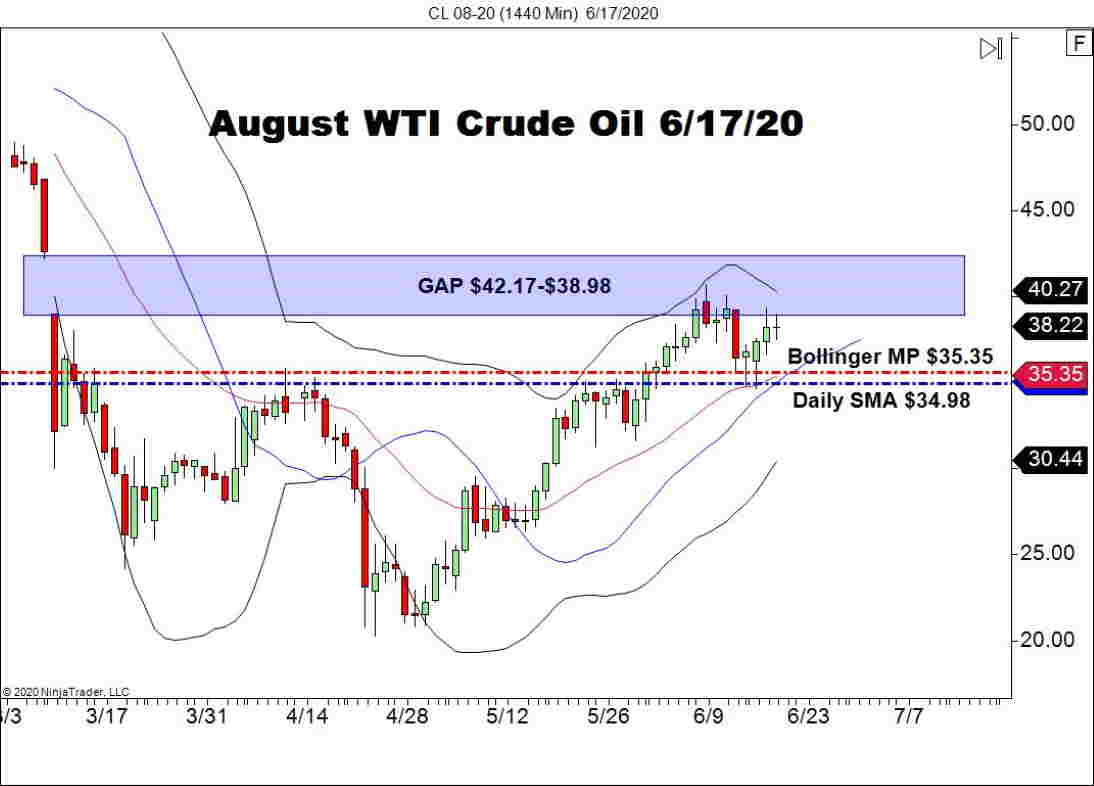

The main target is now upon August WTI crude oil futures, with at this time’s traded volumes gaining a 6/5 benefit over July. Costs are holding agency simply above $38.00 and inside placing distance of the early-March GAP space.

++6_17_2020.jpg)

Listed below are the important thing ranges to look at on this market:

- Resistance(1): GAP Space, $42.17 – $38.98

- Assist(1): Bollinger MP, $35.35

- Assist(2): Each day SMA, $34.98

Overview: The primary half of June has introduced us a take a look at and rejection of the day by day GAP space ($42.17-$38.98) in August WTI crude. Nonetheless, the intermediate-term uptrend is undamaged and a bullish bias warranted. Ought to we see a drop in oil provides in coming weeks, a take a look at of the higher bounds of the GAP at $42.17 will turn out to be possible. If not, costs are more likely to maintain agency in anticipation of conventional summertime seasonality.