Bitcoin, Ethereum, Cryptocurrencies, BTC/ETH Ratio, Technical Evaluation – Speaking Factors:Ratio evaluation means that Ethereum

Bitcoin, Ethereum, Cryptocurrencies, BTC/ETH Ratio, Technical Evaluation – Speaking Factors:

- Ratio evaluation means that Ethereum will proceed to outperform Bitcoin within the close to time period.

- Ethereum poised to proceed pushing to recent all-time highs as worth stays constructively poised above key help.

- Bitcoin costs are consolidating inside a Descending Triangle sample. Is a topside breakout on the playing cards?

Bitcoin costs have tumbled in current weeks, falling as a lot as 31% from the file excessive set on January 8 (41969). In the meantime, Ethereum has continued to intention increased, with second-most common cryptocurrency gearing as much as exceed its respective all-time excessive.

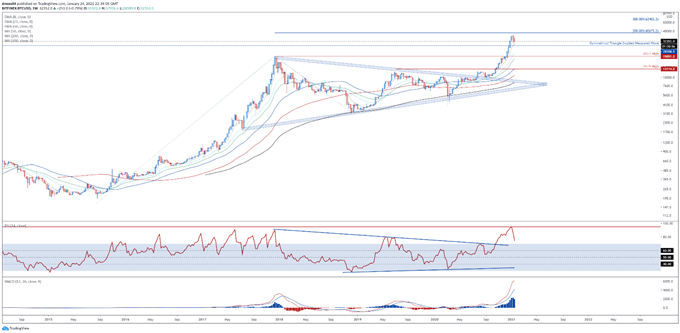

BTC/ETH Ratio Every day Chart

BTC/ETH ratio day by day chart created utilizing Tradingview

Certainly, Ethereum’s outperformance seems set to endure within the close to time period, because the BTC/ETH ratio breaks to its lowest ranges since August of 2018. That being stated, each cryptocurrencies appear poised to maneuver increased within the coming weeks, as bullish technical setups take form on a number of timeframes. Listed here are the important thing technical ranges to observe for BTC and ETH.

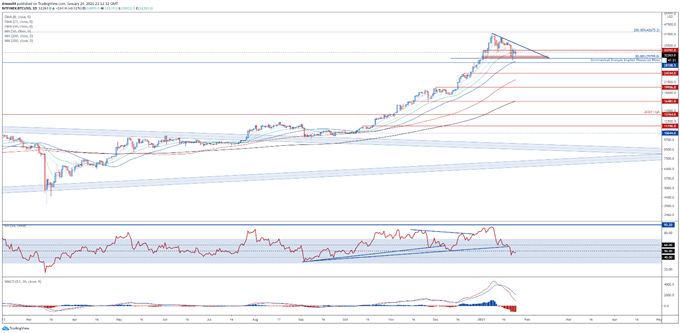

Bitcoin (BTC) Weekly Chart – Consolidating above 28,000

BTC weekly chart created utilizing Tradingview

The longer-term outlook for Bitcoin stays skewed to the upside, as worth holds constructively above the Symmetrical Triangle sample’s implied measured transfer (28108) and the 8-week exponential transferring common (29309).

Though the RSI has aggressively turned decrease, costs have but to erase the positive aspects seen within the week ending January 4, which means that the trail of least resistance is skewed to the topside.

Finally, a convincing push above the 200% Fibonacci (42673) is required to sign the resumption of the first uptrend and clear a path for costs to problem the psychologically imposing 60,000 mark.

Alternatively, sliding again under 28,000 may intensify promoting strain and drive costs again in direction of former resistance-turned-support on the 2017 excessive. Clearing that possible brings the 2019 excessive (13174) into focus.

Bitcoin (BTC) Every day Chart – Descending Triangle in Play

BTC day by day chart created utilizing Tradingview

Zooming into the day by day chart reinforces the comparatively bullish outlook depicted on the weekly timeframe, as costs consolidate inside a Descending Triangle above the 50% Fibonacci (29799).

Breaching triangle resistance and the 35,000 mark would possible ignite an impulsive topside transfer to problem the yearly excessive (41969). The Descending Triangle’s implied measured transfer suggesting costs may climb an extra 31% from present ranges to probe the 47,000 mark.

Conversely, a day by day shut under the month-to-month low (28540) may propel worth again in direction of former resistance-turned-support on the December 20 excessive (24244). The sample’s implied measure transfer suggesting that worth may fall as a lot as 45% from present ranges to check the sentiment-defining 200-day transferring common (16508).

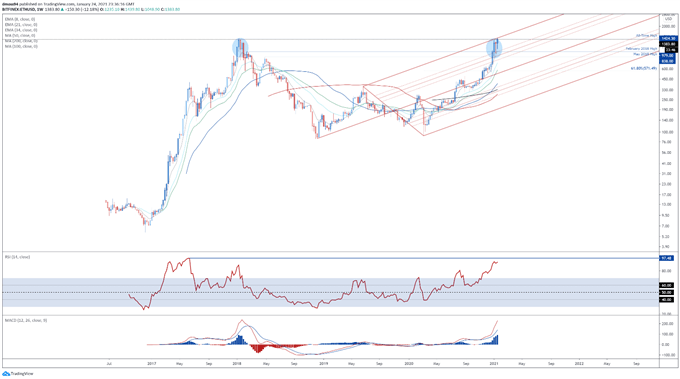

Ethereum (ETH) Weekly Chart – Double High or Parabolic Surge?

ETH weekly chart created utilizing Tradingview

Ethereum, then again, has a slightly combined technical outlook as costs carve out a possible Double High sample at Pitchfork parallel resistance and the 1400 mark.

Nevertheless, this might show to be the beginning of a parabolic surge increased, in a similar way to that seen in 2017, as a bullish ‘golden cross’ takes place on the 50- and 200-week transferring averages.

Finally, a weekly shut above the 2018 excessive (1424.3) is required to neutralize near-term promoting strain and carve a path for patrons to probe the 2000 mark.

Then again, if the pitchfork parallel stays intact, a brief time period pullback in direction of the February 2018 excessive (979) might be on the playing cards.

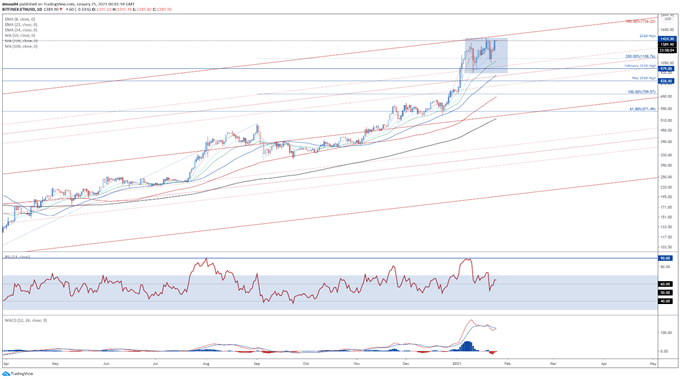

Ethereum (ETH) Every day Chart – Bullish MA Stacking Hints at Additional Upside

ETH day by day chart created utilizing Tradingview

Scrolling into the day by day timeframe hints at additional upside for Ethereum, as costs proceed to trace above all six transferring averages and psychological help at 1300.

Bullish transferring common stacking, in tandem with the RSI persevering with to trace above 60 and the MACD indicator gearing as much as cross above its ‘slower’ sign line counterpart, the trail of least resistance appears increased.

A day by day shut above the Pitchfork parallel and January excessive (1439.8) would most likely propel worth in direction of the 1500 mark, with a convincing break above bringing the 100% Fibonacci growth (1726) into focus.

Quite the opposite, failing to hurdle 1425 may set off a pullback to the 21-day EMA (1188). Clearing that most likely opens the door for sellers to problem psychological help at 1000.

— Written by Daniel Moss, Analyst for DailyFX

Observe me on Twitter @DanielGMoss

Beneficial by Daniel Moss

High Buying and selling Classes