Ethereum value is hovering close to its all-time excessive as demand for the community continues. The foreign money’s value has doubled up to

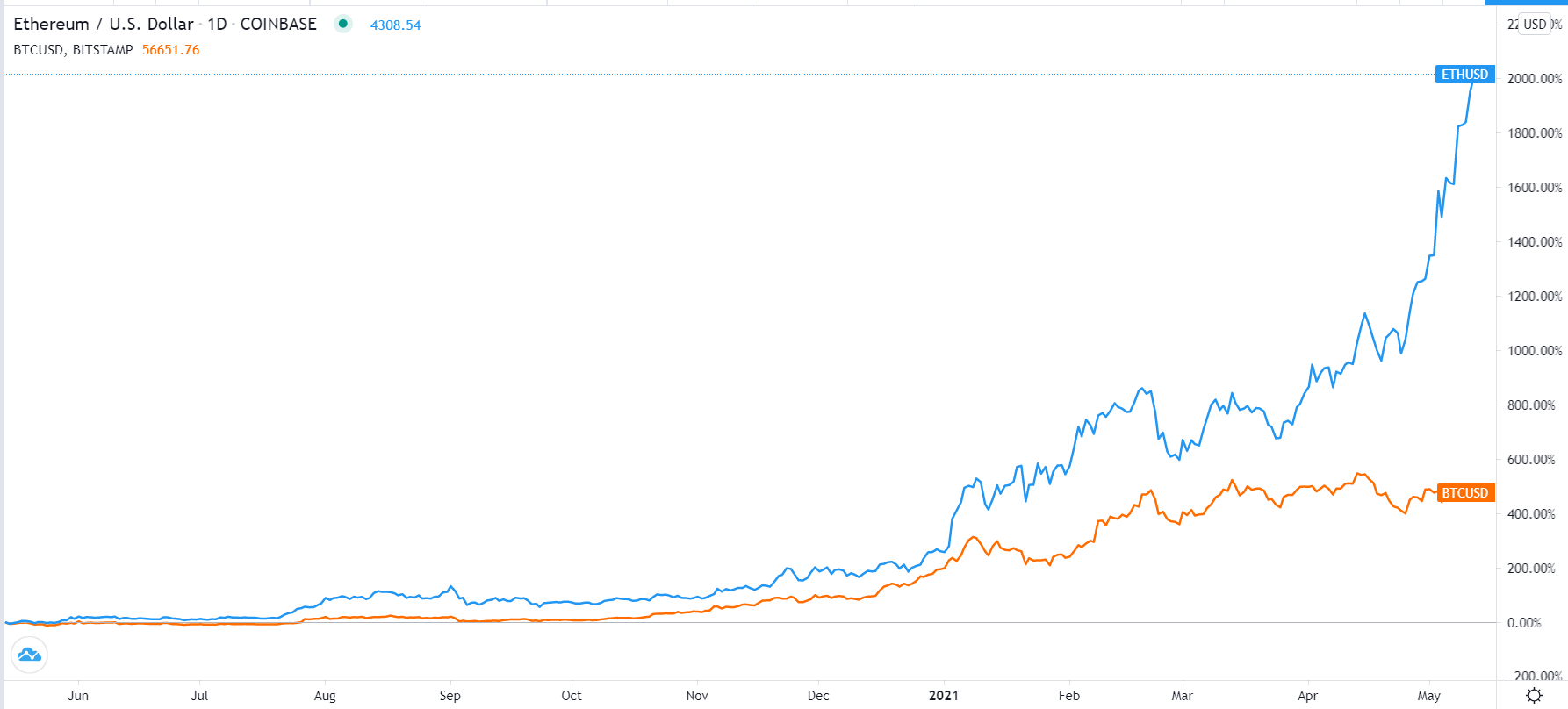

Ethereum value is hovering close to its all-time excessive as demand for the community continues. The foreign money’s value has doubled up to now 30 days. Bitcoin, alternatively, has struggled, having dropped by about 5% up to now 30 days. Certainly, Ether has additionally outperformed BTC by far up to now 12 months. It has gained by virtually 2,000% whereas BTC has risen by lower than 500%.

Ether vs BTC 1-year chart

Bitcoin Has Lagged Ethereum

Bitcoin surged to an all-time excessive of $64,947 in April. It then declined by 27% to $46,988. Since then, the foreign money has struggled to retest its all-time excessive. Its current makes an attempt to retest these highs discovered a considerable resistance at $59,515.

Ethereum, alternatively, additionally retreated in April after reaching its all-time excessive of $2,550. Nevertheless, it managed to rapidly get well and rise by greater than 120% from its lowest degree on April 15.

There are three causes for the divergence between ETH and BTC. First, many retail merchants view Ether as a extra reasonably priced asset to spend money on than Bitcoin. It is because one Bitcoin can purchase 12 Ethers. Subsequently, because the two currencies have a detailed correlation, many traders imagine that ETH is a greater asset to spend money on.

Second, the use case of Ethereum continues to increase. Previously few months, this progress was pushed by Decentralized Finance (DeFi). That is an business that’s disrupting the monetary sector by shifting management from a single supply to the customers.

Previously three years, the whole worth locked within the ecosystem has moved from zero to virtually $90 billion. Analysts count on that this progress will proceed within the subsequent few years. Many of the greatest DeFi initiatives are constructed on Ethereum’s blockchain.

Previously few months, the use case of Ethereum has expanded into non-fungible tokens (NFT), which is one other fast-growing business. All this has pushed ETH and gasoline costs to a file excessive.

Third, whereas many establishments are shopping for Bitcoin, instantly and not directly, analysts see Ethereum as the subsequent asset to observe. Lately, Jim Cramer, the revered host of CNN and former hedge fund supervisor stated that he had purchased Ether. Additional, Grayscale Ethereum Belief has moved from a small a part of Digital Foreign money Group (DCG) to change into its second greatest. The GraySscale Ethereum Belief belongings have risen to greater than $12 billion.

Ethereum Value Technical Forecast

ETH has been on a powerful upward development as evidenced by the four-hour chart. The chart exhibits that ETH has shaped an ascending channel sample. It’s at the moment barely beneath the higher line of this channel. Additionally, the value is between the center and higher traces of the Bollinger Bands. The upward development can also be being supported by the 50-day exponential shifting common.

Subsequently, whereas the upward development will probably proceed, the foreign money will in all probability have a wholesome pullback as bears goal the decrease aspect of the channel. This prediction will likely be invalidated if the value manages to maneuver above the higher aspect of the channel.

.png)

ETH 4-hour chart

Bitcoin Value Prediction

The four-hour chart exhibits that the BTC/USD pair has shaped an ascending channel whose higher aspect is at $59,588 and the decrease aspect is beneath $53,000. The worth is hovering barely above the 50% Fibonacci retracement degree. It has additionally moved beneath the 50-day shifting common. Subsequently, the pair will probably retreat as bears try to check the decrease aspect of this channel, which is barely above the 61.8% retracement degree.

BTC 4-hour chart

BTC 4-hour chart