EUR/USD News and AnalysisWorld economic leaders provide updates in Davos: EU response to the US Inflation Reduction Bill announced to delegatesRelativ

EUR/USD News and Analysis

- World economic leaders provide updates in Davos: EU response to the US Inflation Reduction Bill announced to delegates

- Relatively calmer end to the week in terms of economic data favors trend continuation

- IG client sentiment becomes complicated as a result of recent longs muddying the water

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Find out what our analysts foresee for the euro in Q1

World Economic Leaders Provide Updates in Davos

On the back of Joe Biden’s green-focused ‘Inflation Reduction Act’ (IRA), EU officials have announced their intention boost the energy transition with a range fiscal spending measures that supports technological innovation in the green energy space. The support is set to include the mobilization of state aid as well as a sovereignty fund in an attempt to keep firms from moving to the US.

Earlier, the executive director of the International Energy Agency (IEA), Faith Birol, told a World Economic Forum (WEF) panel that the biggest driver of climate investment is energy security. The statements come at a time when western governments look to wean themselves off of Russian energy in search of more sustainable, independent sources, which has only accelerated the drive for green energy initiatives and innovation.

Fewer Economic Releases Favor Trend Continuation

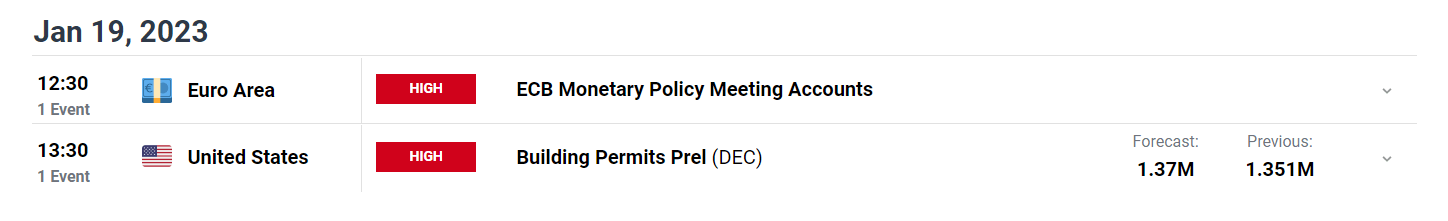

The rest of this week is fairly light on the economic calendar which tends to support existing trends. Today the US releases the retail sales data and PMI numbers are expected to show support for dissipating inflation. The rest of the week we have the ECB Monetary Policy Meeting Accounts following the hawkish December meeting and US building permits which acts as a indicator for the real estate sector and general appetite for property construction.

Customize and filter live economic data via our DailyFX economic calendar

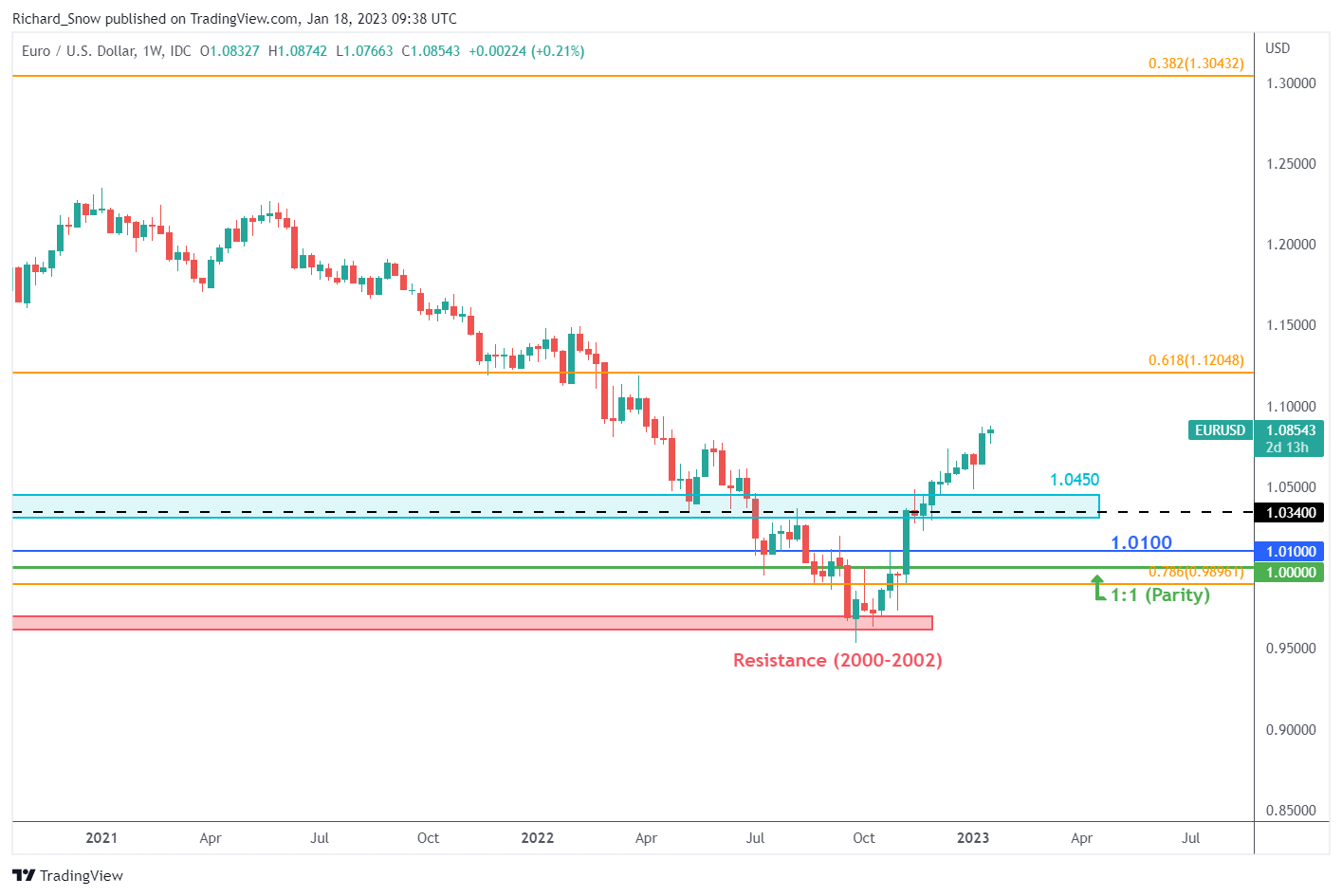

The EUR/USD weekly chart highlights the sharp turnaround in the euro’s fortunes against the dollar, as encouraging inflation data in the US sends US yields and US dollar valuations lower. The ‘v’ shaped response doesn’t quite resemble the rounded underside of a cup and handle formation, nevertheless, the current posture appears to be shaping up for further gains.

EUR/USD Weekly Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Building Confidence in Trading

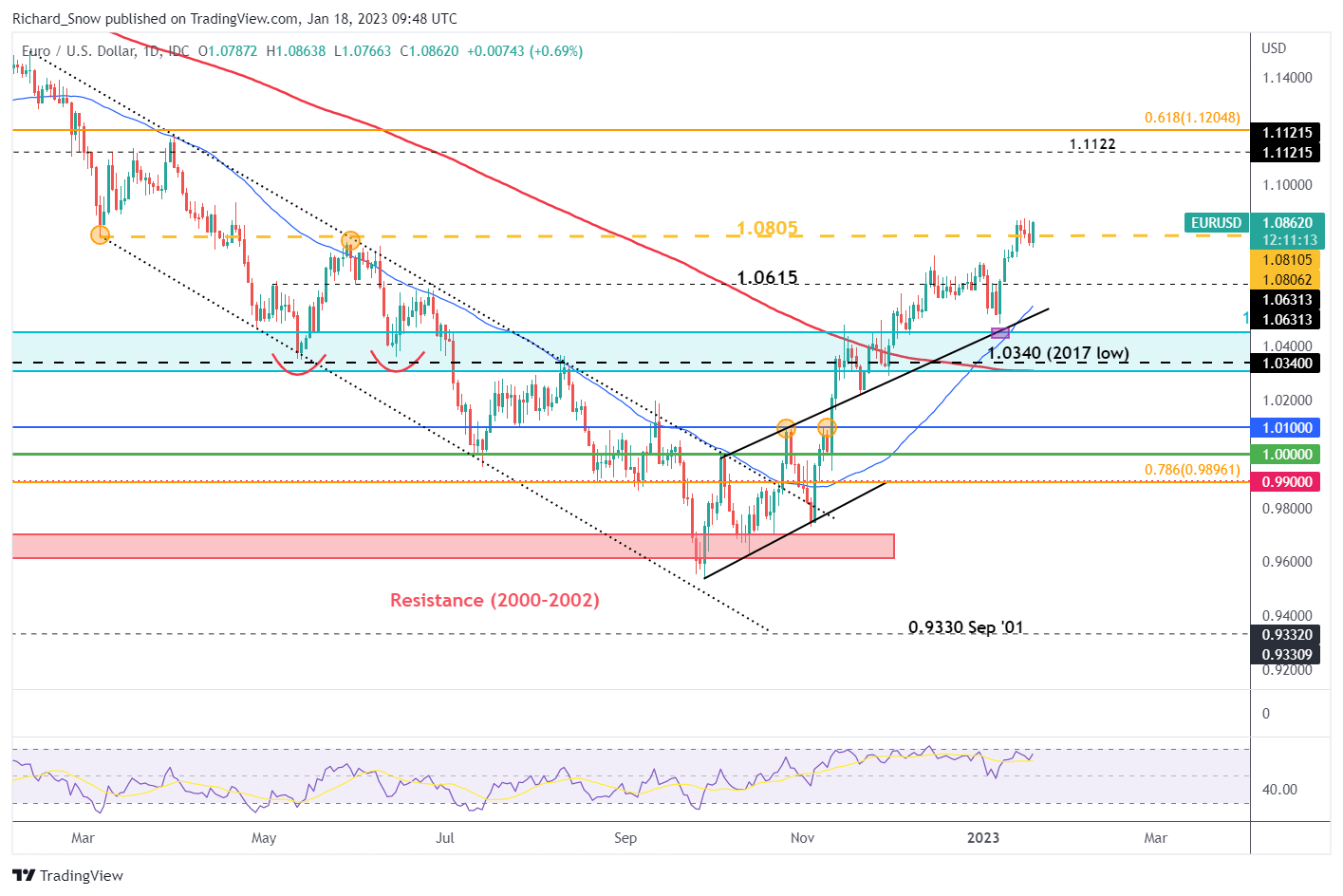

EUR/USD Trades Higher, Towards the Top of the Short-Term Range

EUR/USD trades up, above the 1.0805 level which provided a pivot point for the pair on March and May of 2022. Recent movement has oscillated above and below the level where yet another test of the recent high (1.0874) can be seen. Support and resistance appear rather far away as the pair move into ‘clean air’ to borrow a motorsport analogy. Resistance up at 1.1122 while immediate support comes in at 1.0805 followed by 1.0615.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

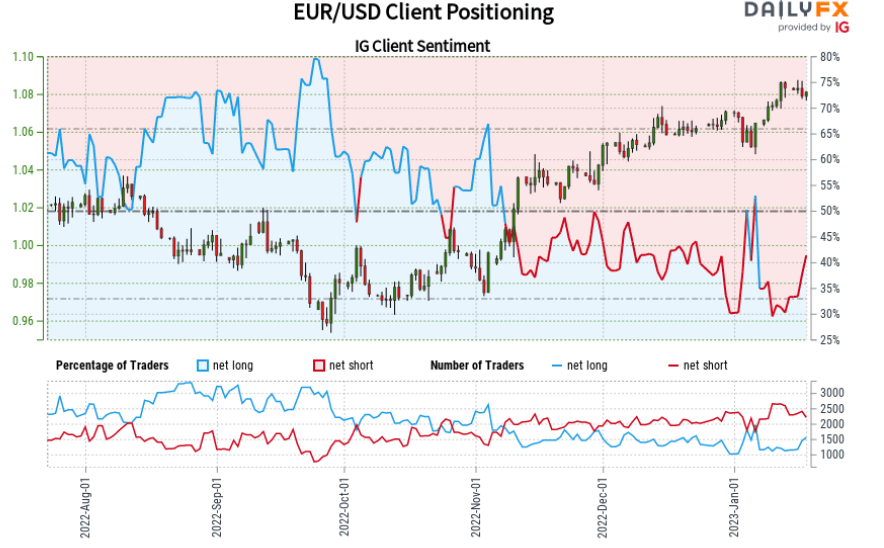

Recent Rise in EUR/USD Longs Complicates the Sentiment Outlook

EUR/USD: Retail trader data shows 41.24% of traders are net-long with the ratio of traders short to long at 1.42 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

The number of traders net-long is 8.84% higher than yesterday and 27.49% higher from last week, while the number of traders net-short is 7.13% lower than yesterday and 18.51% lower from last week

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

news.google.com