EUR/CHF Forecast:Fibonacci Holds Consumers at BaySince April 2018, bears buying and selling EUR/CHF have dominated the market, wi

EUR/CHF Forecast:

Fibonacci Holds Consumers at Bay

Since April 2018, bears buying and selling EUR/CHF have dominated the market, with a robust downward development prevailing for a lot of the time since. Nonetheless, in Might 2020, bulls got some grace when the development reversed of their favor till operating into a significant degree of resistance in June. Since then, worth motion has remained in a confluent zone between key Fibonacci ranges whereas bulls and bears proceed to battle it out in an effort to drive out of its range-bound state.

Begins in:

Stay now:

Aug 04

( 17:08 GMT )

Serious about worth motion? Be a part of James Stanley’s Webinar

Buying and selling Value Motion

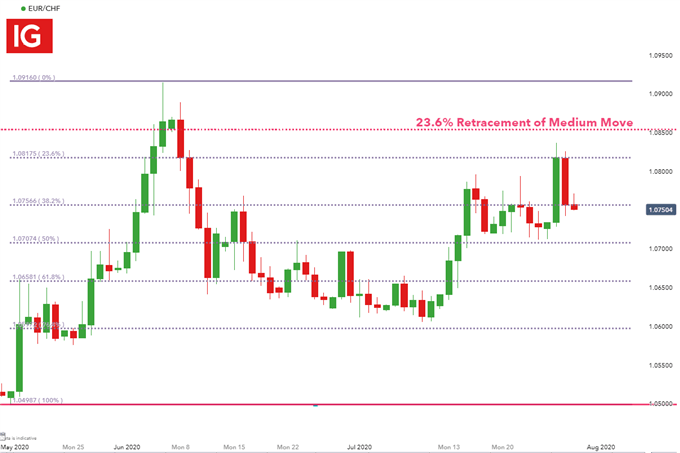

The every day chart beneath highlights the Fibonacci ranges from two main strikes. The primary Fibonacci retracement (pink) represents the medium-term transfer between the April 2018 excessive to the Might 2020 low, whereas the second Fibonacci retracement (purple), represents the short-term transfer between the Might 2020 low and the June 2020 excessive.

EUR/CHF Every day Chart

Chart Ready by Tammy Da Costa, IG

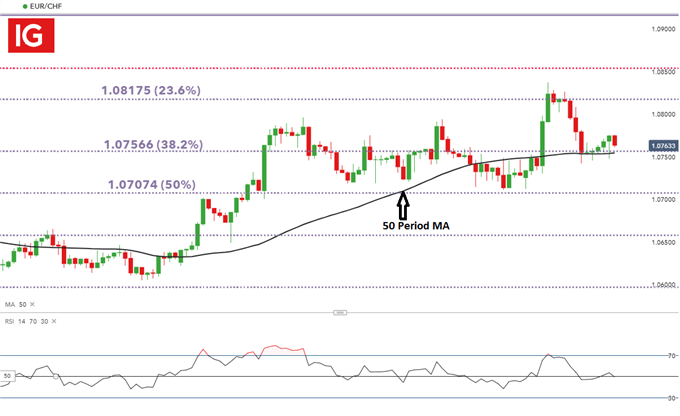

Transferring Common Varieties Further Help

An extra software utilized by many merchants to find out the development is the shifting common (MA) which measures the typical worth of a monetary instrument over a specified interval. By making use of the 50 interval MA to the four-hour chart beneath, the shifting common now acts as further help, with costs fluctuating round this line, indicating that the development should still be trapped in a variety. Additional affirmation of this may be seen utilizing the Relative Power Index (RSI), which stays across the impartial degree of 50, displaying no choice to consumers or sellers.

EUR/CHF 4-Hour Chart

Chart Ready by Tammy Da Costa, IG

Transferring Ahead

Whereas bulls could also be on the lookout for indicators of a bullish continuation sample, a breakout above 1.07566, the 38.2% retracement of the medium-term transfer, might end result within the psychological degree of 1.08 forming as resistance. A breakout above this degree, might lead to upward stress in the direction of 1.08175, the 23.6% retracement of the short-term transfer.

Really helpful by Tammy Da Costa

Uncover the primary mistake made by merchants

Quite the opposite, a break beneath 1.07566 might result in additional draw back with 1.07074, the 50% retracement of the short-term Fibonacci, forming a brand new degree of help.

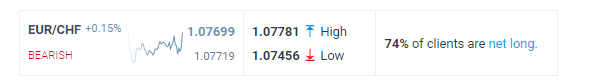

Consumer Sentiment

In keeping with consumer sentiment, on the time of writing, majority of retail merchants are displaying a bullish bias in the direction of EUR/CHF, with 74% of merchants holding lengthy positions. We sometimes take a contrarian view to crowd sentiment, and the very fact merchants are net-long means that costs might proceed to fall.

Begins in:

Stay now:

Jul 30

( 15:07 GMT )

Discover ways to determine developments with dealer sentiment

Dealer’s Toolbox: The best way to Determine Value Developments with Dealer Sentiment

— Written by Tammy Da Costa, DailyFX.com

Contact and observe Tammy on Twitter: @Tams707

https://www.dailyfx.com/schooling/technical-analysis-tools/moving-average.html