Federal Reserve, Jackson Gap, Common Inflation, EUR/USD – Speaking Factors:Threat urge for food notably improved throughout Asia-

Federal Reserve, Jackson Gap, Common Inflation, EUR/USD – Speaking Factors:

- Threat urge for food notably improved throughout Asia-Pacific commerce on the again of cooling geopolitical tensions and vaccine optimism

- The upcoming Jackson Gap symposium might dictate the near-term outlook for the haven-associated US Greenback

- EUR/USD charges appear poised to rise as worth carves out a Bull Flag at key resistance.

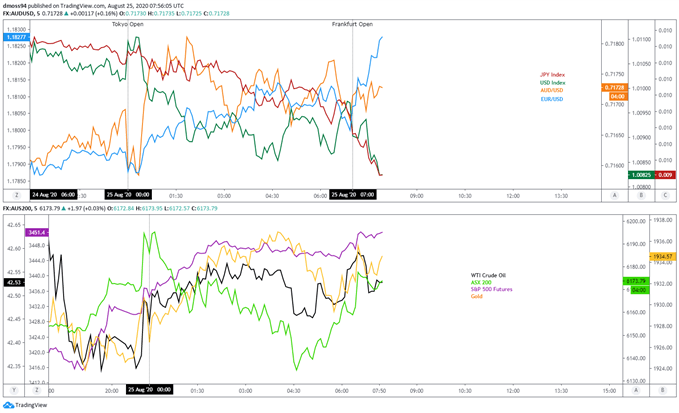

Asia-Pacific Recap

A broad risk-on tilt was seen all through Asia-Pacific commerce as cooling US-China commerce tensions and coronavirus vaccine optimism buoyed fairness markets.

The Australian ASX 200 index climbed 0.52% alongside S&P 500 futures because the haven-associated US Greenback and Japanese Yen misplaced floor in opposition to their main counterparts.

Crude oil nudged greater alongside the commodity-sensitive Australian Greenback, while EUR/USD charges bounced again above 1.18.

Trying forward, US new residence gross sales for July headline a relatively mild financial docket as investor’s flip their consideration to Federal Reserve Chair Jerome Powell’s speech on Thursday on the Jackson Gap Financial Coverage Symposium.

Market response chart created utilizing TradingView

Highlight on Jackson Gap Symposium

The eyes of the investing world will flip to the Federal Reserve’s annual Jackson Gap symposium on Thursday the place Chairman Jerome Powell is scheduled to ship a speech titled “Financial Coverage Framework Evaluation”.

Powell’s a lot awaited speech is anticipated to shine a light-weight on the thought of common inflation concentrating on, which has been recommended by a number of Federal Open Market Committee (FOMC) members together with Minneapolis Fed President Neel Kashkari, who believes that the central financial institution “should stroll the stroll and truly permit inflation to climb modestly above 2%” earlier than rolling again present stimulus measures.

With policymakers backing away from “offering better readability relating to the possible path of the goal vary for the federal funds price” on the FOMC’s financial coverage assembly in July, a scarcity of significant steering from the Fed Chair may considerably bitter investor sentiment.

Nevertheless, this appears comparatively unlikely given the Federal Reserve’s dedication “to utilizing its full vary of instruments to assist the US economic system on this difficult time, thereby selling its most employment and worth stability targets”.

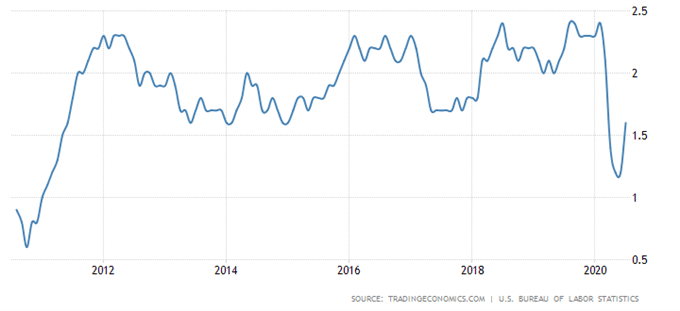

Due to this fact, with the present US unemployment price remaining above the height seen within the 2008 world monetary disaster (10.2%) and client worth inflation nonetheless nicely beneath 2%, it seems accommodative financial coverage settings are right here to remain for the foreseeable future which in flip might proceed to hamper the US Greenback in opposition to its main counterparts.

However, the Dollar may stage a short-term rebound if Powell’s speech disappoints market members, in all probability leading to a marked pullback in EUR/USD charges.

United States Core Inflation

Supply – TradingEconomics

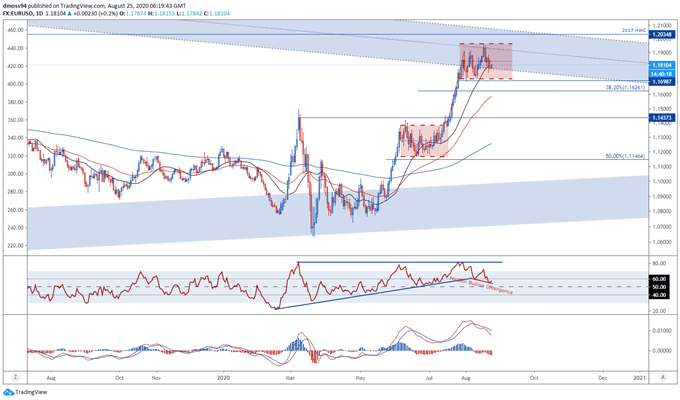

EUR/USD Day by day Chart – Value Consolidating in Bull Flag

EUR/USD charges proceed to consolidate in a Bull Flag continuation sample simply shy of psychological resistance on the 1.19 stage.

Hidden bullish RSI divergence, alongside the steepening slopes of the 50- and 200-day shifting averages, suggests the trail of least resistance is greater.

With that in thoughts, a each day shut above the flag midpoint (1.1832) might open the door to retest the month-to-month excessive (1.1965).

A breach of key resistance on the psychologically imposing 1.20 stage is required to validate a topside break of the bullish continuation sample, with the implied measured transfer indicating a push to 1.22 might be within the offing.

EUR/USD each day chart created utilizing TradingView

| Change in | Longs | Shorts | OI |

| Day by day | 1% | 10% | 7% |

| Weekly | 19% | -11% | -2% |

— Written by Daniel Moss, Analyst for DailyFX

Comply with me on Twitter @DanielGMoss

Advisable by Daniel Moss

Constructing Confidence in Buying and selling