Right this moment has been an lively day on the markets, fueled by the recession of political uncertainty. The massive winners have been the NASDA

Right this moment has been an lively day on the markets, fueled by the recession of political uncertainty. The massive winners have been the NASDAQ (+1.88%), the Canadian greenback (USD/CAD,-0.65%), and WTI crude oil (+0.75%). Conversely, Henry Hub pure fuel futures are off greater than 2.5%, setting the tempo for decliners. Within the first hours of the fledgling Biden administration, shares are up and the Dollar is down.

Within the coming weeks and months, politics will play a significant function in establishing intermediate-term expectations towards the USD. Subsequently, questions concerning the way forward for U.S. COVID-19 stimulus, lockdowns, and financial restrictions can be answered. Additionally, the primary Biden-era price range is due out throughout the subsequent month. Most market analysts cite “deficit spending” as the first theme, with the brand new administration selecting to “go large” to spice up financial progress. At the very least for the primary half of 2021, the availability of USDs in circulation is poised to extend considerably.

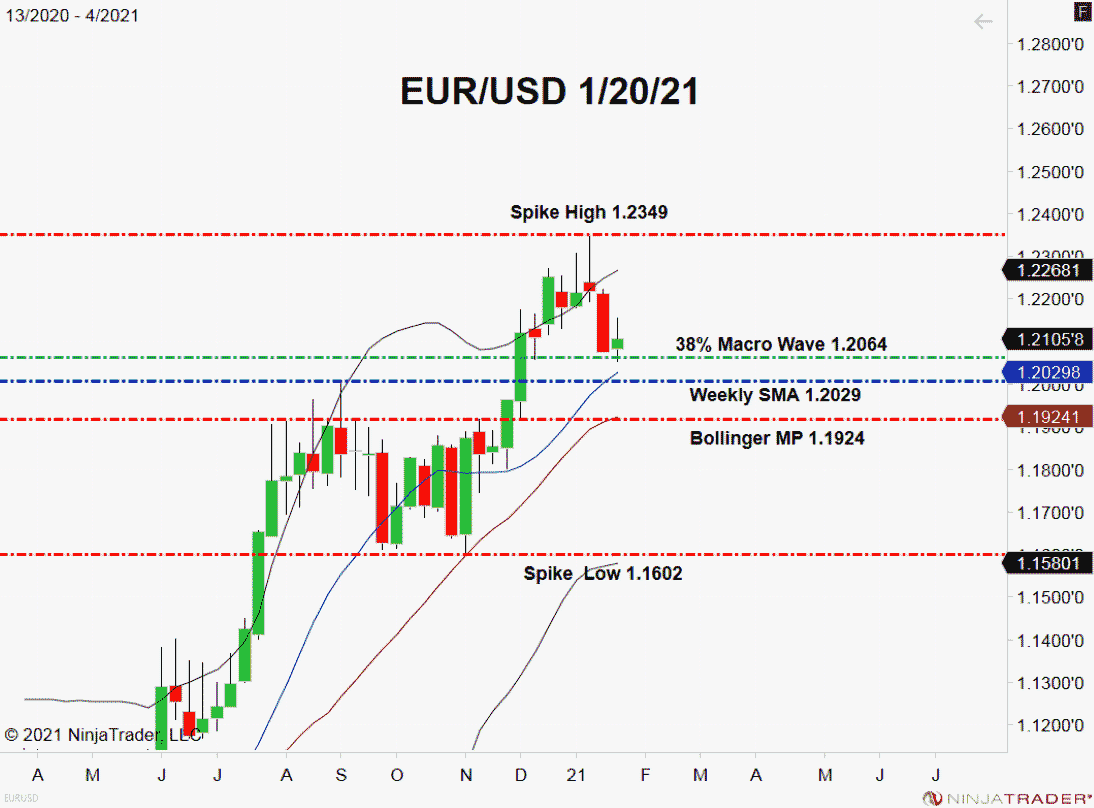

Regardless of these forecasts, the EUR/USD is simply modestly up on the week. Let’s dig into the important thing technicals and see the place this market stands.

EUR/USD Checks Key Fibonacci Assist Stage

In a Dwell Market Replace from final week, I outlined an extended commerce for the EUR/USD. The play turned out to be successful, producing a fast 25 pip revenue. If you happen to acquired in on the motion, effectively executed!

+2021_04+(10_36_28+AM).png)

For the close to future, there can be two ranges on my radar:

- Resistance(1): Spike Excessive, 1.2349

- Assist(1): 38% Macro Wave, 1.2064

Overview: The true x-factor going through all asset courses continues to be the development of COVID-19. Lately, consideration is being turned to a extremely contagious COVID-19 variant generally known as B.1.1.7. If this pressure prompts a governmental response much like that of final spring, then all bets are off towards the Dollar and EUR/USD.

If you happen to’re lively within the foreign exchange, be on the look ahead to information concerning B.1.1.7 and any insurance policies addressing the variant from the Biden White Home.