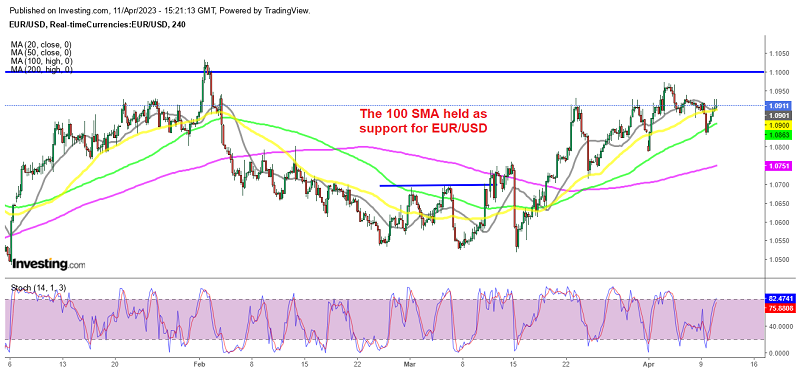

Although the liquidity has been thin due to the Easter holiday and today that traders came back, the decline in the USD has resumed and EUR/USD is hea

Although the liquidity has been thin due to the Easter holiday and today that traders came back, the decline in the USD has resumed and EUR/USD is heading for 1.10 again. Now this forex pair is trading slightly above the 1.0900 level. The optimism of European indexes, which returned from a long weekend, contributed to the decline in demand for the US Dollar. The Euro was also supported by positive Eurozone data, as the April Sentix Investor Confidence improved from -11.1 in March to -8.7, and Retail Sales in March decreased by 0.8% compared to the previous month as expected, but the year-on-year comparison was slightly better than anticipated.

Although European equities markets initially rose, they later lost some momentum and reduced their gains. This led to some recovery of the US Dollar before the US market opened. Wall Street is expected to open in the negative zone, while government bond yields are hovering around the levels seen at Monday’s closing.

www.fxleaders.com