The Dollar is posting one other bearish session, led by a spike within the EUR/USD. As we roll towards the weekend break, USD losses vs the euro,

The Dollar is posting one other bearish session, led by a spike within the EUR/USD. As we roll towards the weekend break, USD losses vs the euro, British pound, and Swiss franc have headlined the foreign exchange Friday. With one other US$1 trillion stimulus bundle being negotiated on Capitol Hill, greenback devaluation is changing into a recurring theme.

Proper now, it’s all about stimulus, COVID-19, and U.S./China tensions. Under is a fast take a look at the most recent in every market driver:

- U.S. COVID-19 infections proceed to rise, led by Arizona, Florida, and Texas. Dr. Anthony Fauci took to airwaves commenting that he “wouldn’t get on a aircraft or eat inside a restaurant.” As he has all 12 months lengthy, Fauci has as soon as once more raised public angst over the unfold of COVID-19.

- U.S./China tensions proceed to escalate following closure of China’s Houston, Texas consulate. In retaliation, China has ordered the U.S. consulate in Chengdu to stop operations. As of now, one has to marvel how lengthy final January’s “Part One” commerce deal shall be honored.

- On the stimulus entrance, Republican management has unveiled a brand new US$1 trillion public COVID-19 bailout bundle. The plan is up for Congressional debate and is predicted to be handed within the coming weeks.

All in all, not one of the information helps the USD. Foreign exchange gamers have prolonged their bearish Dollar bets, as evidenced by the breakout rally within the EUR/USD.

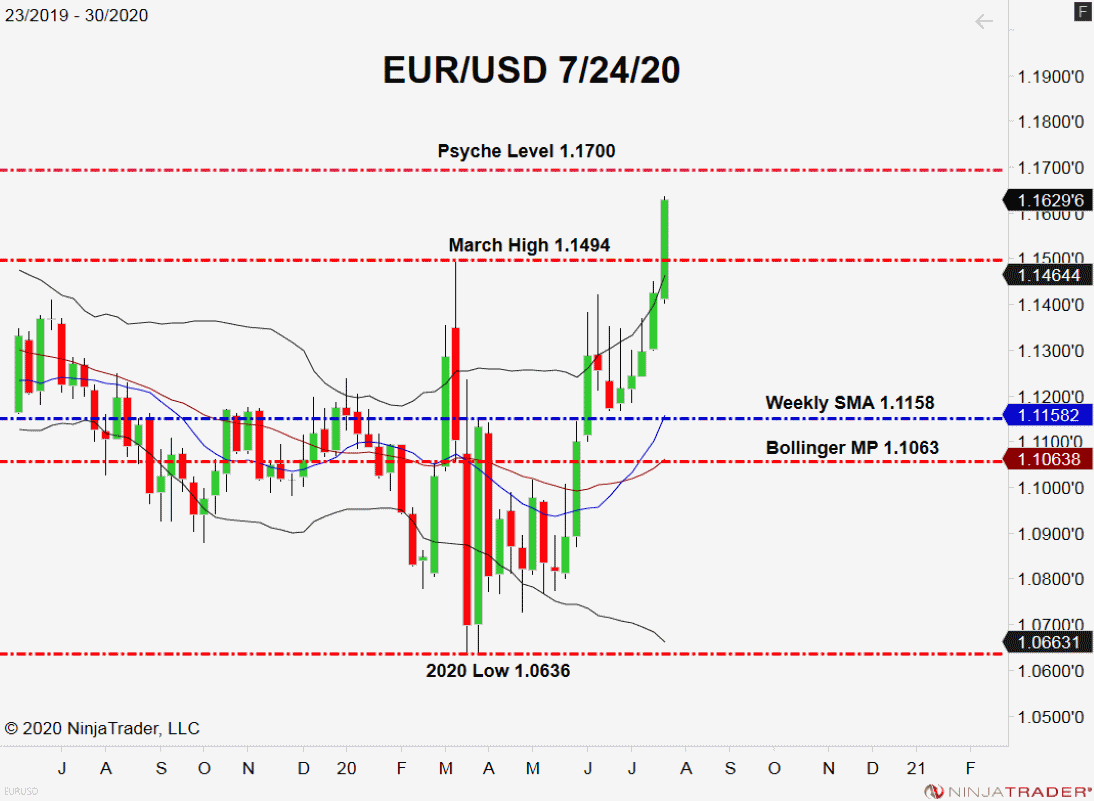

EUR/USD Closes In On 1.1700

The EUR/USD is on a tear greater, reaching ranges not seen since 2018. Bidders are stepping in above each big-round-number, driving the bullish break. Now, the subsequent obstacles up for scrutiny are 1.1650 and 1.1700.

+2020_30+(10_19_26+AM).png)

Backside Line: Whereas subsequent week’s FED assembly might sluggish bids towards the EUR/USD, proper now it’s all techniques go. If the present sentiment continues, a check of 1.1700 is more likely to come sooner slightly than later.

Till elected, I’ll have promote orders within the queue from 1.1694. With an preliminary cease at 1.1709, this commerce produces 30 pips on a short-term rejection of 1.1700.