At this time marks the primary buying and selling day of October and the Buck is struggling vs the majors. For the EUR/USD, charges are up a modes

At this time marks the primary buying and selling day of October and the Buck is struggling vs the majors. For the EUR/USD, charges are up a modest 22 pips as Brexit is as soon as once more dominating the Eurozone information cycle. Given Brexit, the U.S. election, and COVID-19 fallout, market uncertainty is at an all-time excessive. For now, it appears to be like like foreign exchange gamers are content material limiting publicity to the USD.

This morning’s U.S. financial calendar has been jam-packed with market-moving occasions. Listed here are the highlights:

Occasion Precise Projected Earlier

Persevering with Jobless Claims (Sept. 18) 11.767M 12.225M 12.747M

Preliminary Jobless Claims (Sept. 25) 837Okay 850Okay 873Okay

ISM Manufacturing PMI (Sept.) 55.4 56.3 56.0

Merely put, these figures recommend that the economic system continues on its path to restoration. People are going again to work and manufacturing is in constructive territory. So, how briskly can U.S. financial output return to pre-COVID-19 ranges? For now, the reply to that query stays to be seen.

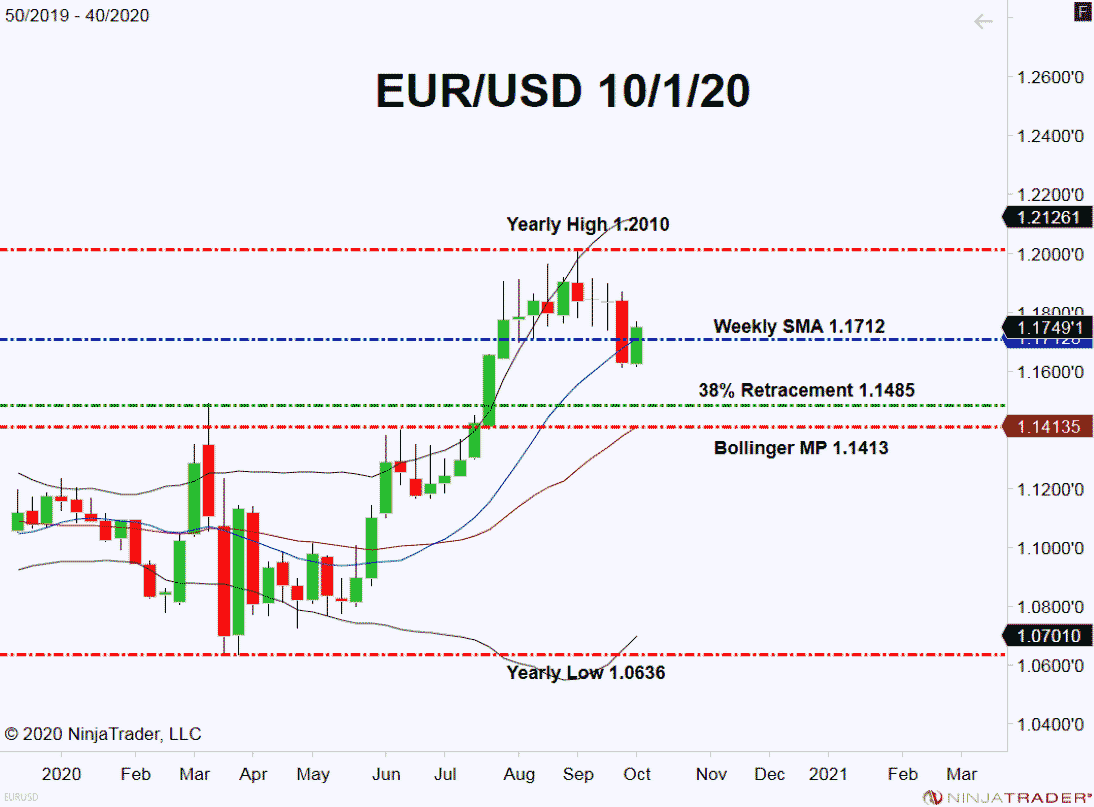

Summer time 2020 introduced a weak greenback and spike within the EUR/USD. At press time, charges stay in long-term bullish territory and October is positioned to retest the 1.2000 degree.

EUR/USD Holds Firmly In Bullish Territory

The EUR/USD weekly chart under offers us a superb take a look at the prevailing uptrend. Charges are properly above the 38% Retracement Degree (1.1485) and Weekly SMA (1.1712). Each recommend bullish sentiment continues to dominate this market.

+2020_40+(10_32_02+AM).png)

Listed here are the degrees to look at going into Friday’s session:

- Resistance(1): Yearly Excessive, 1.2010

- Help(1): Weekly SMA, 1.1712

- Help(2): 38% Retracement, 1.1485

Backside Line: If we see the EUR/USD pullback forward of Friday’s U.S. Non-Farm Payrolls report, a protracted commerce alternative might come into play. Till then, I’ll have purchase orders within the queue from 1.1713. With an preliminary cease loss at 1.1693, this commerce produces 20 pips on a regular 1:1 danger vs reward ratio.