Markets had been uneven for probably the most half this previous week. Main inventory indices traded broadly sideways as did gold and crude oil c

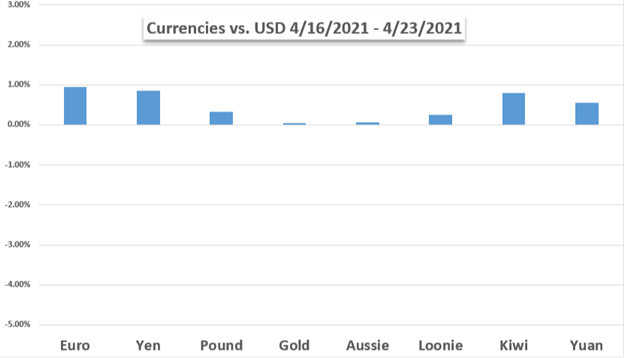

Markets had been uneven for probably the most half this previous week. Main inventory indices traded broadly sideways as did gold and crude oil costs, although foreign money volatility appeared to select up fairly a bit. The Nasdaq and S&P 500 Index had been little modified on stability regardless of studies that US President Joe Biden plans to suggest a 43.4% company tax fee. The FTSE 100 and DAX 30 peeled again barely from their newest swing highs, declining -1.1% and -1.2% respectively, as bulls eased off the fuel pedal. Euro value motion was pretty muted through the ECB fee resolution, however the bloc foreign money completed the week robust in opposition to key FX friends just like the US Greenback and Pound Sterling.

EUR/USD spiked 115-pips to a seven-week excessive, for instance, whereas EUR/GBP gained 55-pips to increase its rebound off 14-month lows. US Greenback promoting strain accelerated as widespread weak point despatched the broader DXY Index spiraling almost -0.9% decrease. This appeared to comply with extra softness throughout Treasury yields, which weighed negatively on US rate of interest differentials. The Canadian Greenback noticed an inflow of demand mid-week after a reasonably hawkish BoC assertion revealed that the central financial institution is tapering its QE program and likewise bringing ahead its subsequent fee hike forecast from 2023 to the second half of subsequent yr.

Advisable by Wealthy Dvorak

Foreign exchange for Inexperienced persons

Seeking to the week forward, we are able to see that the financial calendar is suffering from high-impact occasion danger and information releases. Merchants will probably be maintaining a eager eye out for anticipated financial coverage updates from financial coverage updates from the Financial institution of Japan and Federal Reserve. The BoJ and Fed are scheduled to launch their newest rate of interest selections on 27 April at 03:00 GMT and 28 April at 18:00 GMT, respectively. Inflation information is anticipated is anticipated out of Australia and the Eurozone subsequent week as effectively.

Market volatility may additionally intensify round 1Q GDP studies due from main economies like the USA and Germany. To not point out, earnings season is ready to kick into full gear with quarterly outcomes anticipated from tech stalwarts like Tesla, Microsoft, Alphabet’s Google, Fb, Apple, and Amazon amongst a number of others. The upcoming OPEC+ assembly stands to weigh notably on the course of crude oil. Moreover, President Biden is on deck to handle congress in a joint session on Wednesday the place he’ll probably tout his $2.3-trillion infrastructure bundle and general profitable vaccine rollout. What else is in retailer for markets within the week forward?

Advisable by Wealthy Dvorak

Introduction to Foreign exchange Information Buying and selling

FUNDAMENTAL FORECASTS

US Greenback Forecast: Fed in Focus Amid Company and Capital Beneficial properties Tax Hike Bets

The US Greenback stays in a difficult setting as company and capital beneficial properties tax hike bets convey the Federal Reserve into the highlight because the April assembly nears.

S&P 500 Forecast: Will Sturdy Earnings Shelter Shares from Tax-Motivated Promoting?

Sturdy Q1 earnings and upbeat financial information might shelter the US inventory market from tax headwinds. Buyers are eyeing FAANG outcomes this week amid worsening pandemic conditions elsewhere on the planet.

Euro Forecast: EUR/USD Outlook Nonetheless Constructive After Break Above 1.20

Final week noticed EUR/USD break above 1.20 for the primary time since early March; now it is going to probably pause for breath earlier than presumably strengthening additional.

Bitcoin (BTC), Ethereum (ETH) Crumble, Alt-Cash Hammered – Will Consumers Step Again In Once more?

The cryptocurrency market took a pointy leg decrease in a single day, with the alt-coin house hit significantly laborious. Is that this the most recent likelihood to purchase cheaper inventory?

Gold Worth Outlook Hinges on FOMC as US 10 Yr Yield Defends April Low

The Federal Reserve rate of interest resolution might preserve the value of gold afloat because the central financial institution depends on its non-standard instruments to realize its coverage targets.

Australian Greenback Forecast: AUD/USD Eyes Inflation, Danger Tendencies

AUD/USD value motion seems to be teed as much as resume its ascent following a interval of consolidation. Can broader danger tendencies and inflation information due for launch ignite Australian Greenback energy subsequent week?

Mexican Peso Weekly Forecast: USD/MXN Bears Stay in Management

The Mexican Peso holds its floor in opposition to the US Greenback regardless of gradual vaccinations and a transfer away from danger.

Advisable by Wealthy Dvorak

Traits of Profitable Merchants

TECHNICAL FORECASTS

US Greenback Technical Forecast: DXY Weak spot Might Discover Respite in Week Forward

The US Greenback weakened for the third consecutive week, with the DXY index dropping 0.86%. Now, the Buck faces technical assist that will finish the development decrease.

Gold Weekly Technical Forecast: Time For Gold Bulls to Shine?

Gold posts a 3rd weekly rise for the primary time since December, falling actual yields bode effectively for gold.

GBP Technical Forecast: GBP/USD Bullish Above Longer-term Help

Cable broke out of a bull-flag final week, however spent a number of days retracing that preliminary transfer; search for the outlook to stay bullish above longer-term development assist.

Crude Oil Technical Forecast: Lack of Momentum to Foster Consolidation

Though the longer-term technical outlook for crude oil costs stays skewed to the upside, fading bullish momentum may see a interval of consolidation ensue within the close to time period.

Japanese Yen Technical Forecast: USD/JPY Reversal, EUR/JPY Help

It was an enormous Q1 for the Japanese Yen, however Q2 has to this point proven a far completely different theme. Will JPY bears discover a option to flip the tides in USD/JPY?

US DOLLAR WEEKLY PERFORMANCE VS MAJOR FX PEERS & GOLD

factor contained in the

factor. That is most likely not what you meant to do!nn Load your software’s JavaScript bundle contained in the factor as an alternative.www.dailyfx.com