EUR/USD Worth, Information and Evaluation:European Fee downgrades progress forecasts, outstanding dangers to the draw back.EUR/US

EUR/USD Worth, Information and Evaluation:

- European Fee downgrades progress forecasts, outstanding dangers to the draw back.

- EUR/USD slips decrease, US greenback grabs a small bid.

Really useful by Nick Cawley

Model New Q3 Euro Guides

The most recent European Financial Forecast (Summer time interim) means that the collapse in financial output within the euro space is ‘prone to even deeper within the second quarter’ of the yr reflecting the unfold of COVID-19 and the intensification of containment measures. The euro space economic system is now anticipated to contract by 8.7% in 2020 – in comparison with -7.7% within the Spring forecast – whereas the restoration in 2021 is now seen at 6.1% in comparison with 6.3% within the earlier report. The Fee additionally warns that uncertainty encompassing this forecast is ‘very excessive’ and that ‘dangers surrounding the expansion projections are extreme and most of them are on the draw back’.

Three member states are actually anticipated to be hit by double-digit financial contraction in 2020. France is anticipated to contract by 10.6% this yr earlier than rising by 7.6% in 2021 (-8.2% and +7.4% within the Spring forecast), Spanish GDP is anticipated to contract by 10.9% this earlier than rising by 7.1% in 2021 (-9.4% and +7.0%) whereas the Italian economic system is ready to contract by 11.2% this yr and develop by 6.1% subsequent yr in comparison with -9.5% and +6.5% within the final forecast.

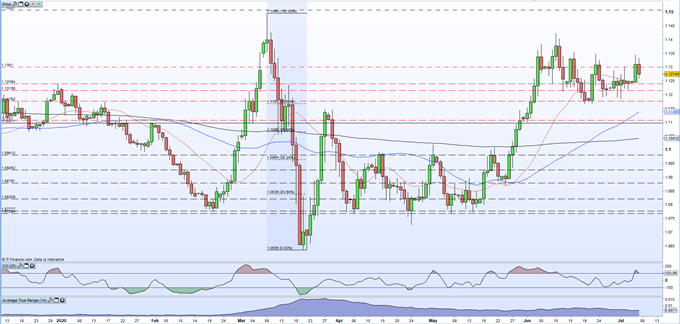

EUR/USD is again beneath 1.1300 after hitting 1.1333 earlier than the brand new forecasts have been launched. The pair profit from help off the 20-dma at the moment at 1.1248 whereas a cluster of latest lows ought to present stronger help all the best way right down to 1.1168. Three latest each day highs between 1.1346 and 1.1353 present resistance and guard the June 10 multi-month excessive at 1.1423.

The most recent Dedication of Merchants Report reveals merchants liquidating a few of their longs positions, and rising their quick positions over the week, leading to a USD2.85 billion lower in web lengthy positions.

Euro Sentiment Softens, Are US Greenback Bears Heading for the Exit? – CoT Report

EUR/USD Day by day Worth Chart (December 2019 – July 7, 2020)

| Change in | Longs | Shorts | OI |

| Day by day | 11% | -3% | 2% |

| Weekly | 1% | 2% | 1% |

What’s your view on EUR/USD – bullish or bearish?? You possibly can tell us by way of the shape on the finish of this piece or you possibly can contact the creator by way of Twitter @nickcawley1.