Euro (EUR/USD, EUR/GBP) AnalysisEuro Sell-off Continues as Periphery Bond Premium Spikes HigherThe Euro continued to sell-off after Emmanuel Macron’s

Euro (EUR/USD, EUR/GBP) Analysis

Euro Sell-off Continues as Periphery Bond Premium Spikes Higher

The Euro continued to sell-off after Emmanuel Macron’s dissolved parliament and called for a snap election after his party’s dismal showing in European elections. The high stakes wager centers around the belief that voters will side with President Macron’s party when it really matters, as the European elections have a history of being a ‘protest vote’ to express dissatisfaction with the status quo but ultimately voters have backed away from populist parties when electing lawmakers.

However, the first round of elections takes place as soon as the 30th of June with a wave of populist parties sweeping across Europe, most recently seen in Italian politics and now, seemingly making a reappearance in France.

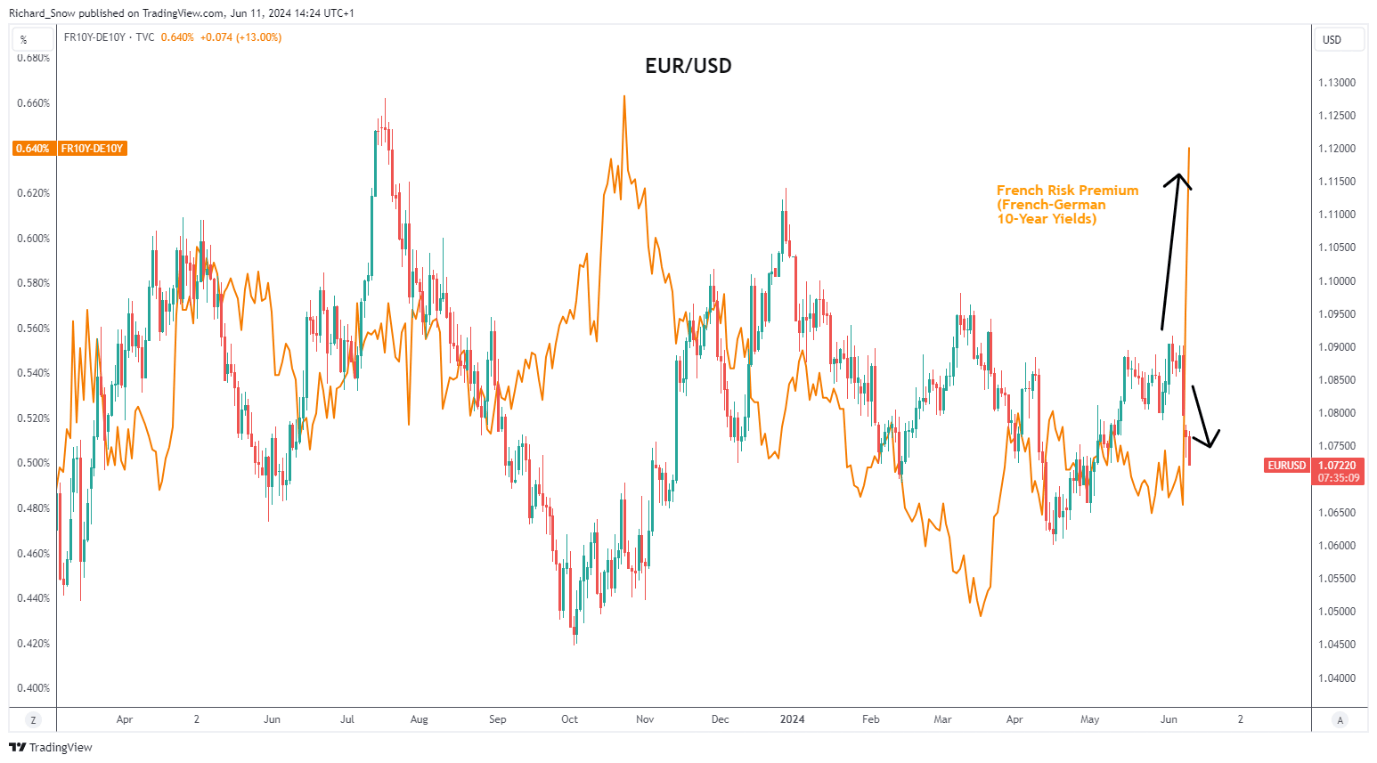

The chart below shows the rise in risk premium for French Government bonds (representative of a higher perceived risk of holding French bonds) over safer German bonds of the same duration. When riskier bonds in the euro zone start to sell-off, investors may recall the European debt crises of 2011 when periphery bonds sold-off massively and the euro followed suit. The chart below shows the recent spike higher in French-German yields while EUR/USD continues its sell-off which, to be fair, originated on Friday after a massive upward surprise in US NFP data.

EUR/USD Alongside French-German Bond Yield Spreads

Source: TradingView, prepared by Richard Snow

EUR/USD is one of the most liquid currency pairs in the world, offering short-term trades with a cost effective and convenient market to trade. Discover the real benefits of trading liquid pairs and find out which pairs qualify:

Recommended by Richard Snow

Recommended by Richard Snow

How To Trade The Top Three Most Liquid Forex Pairs

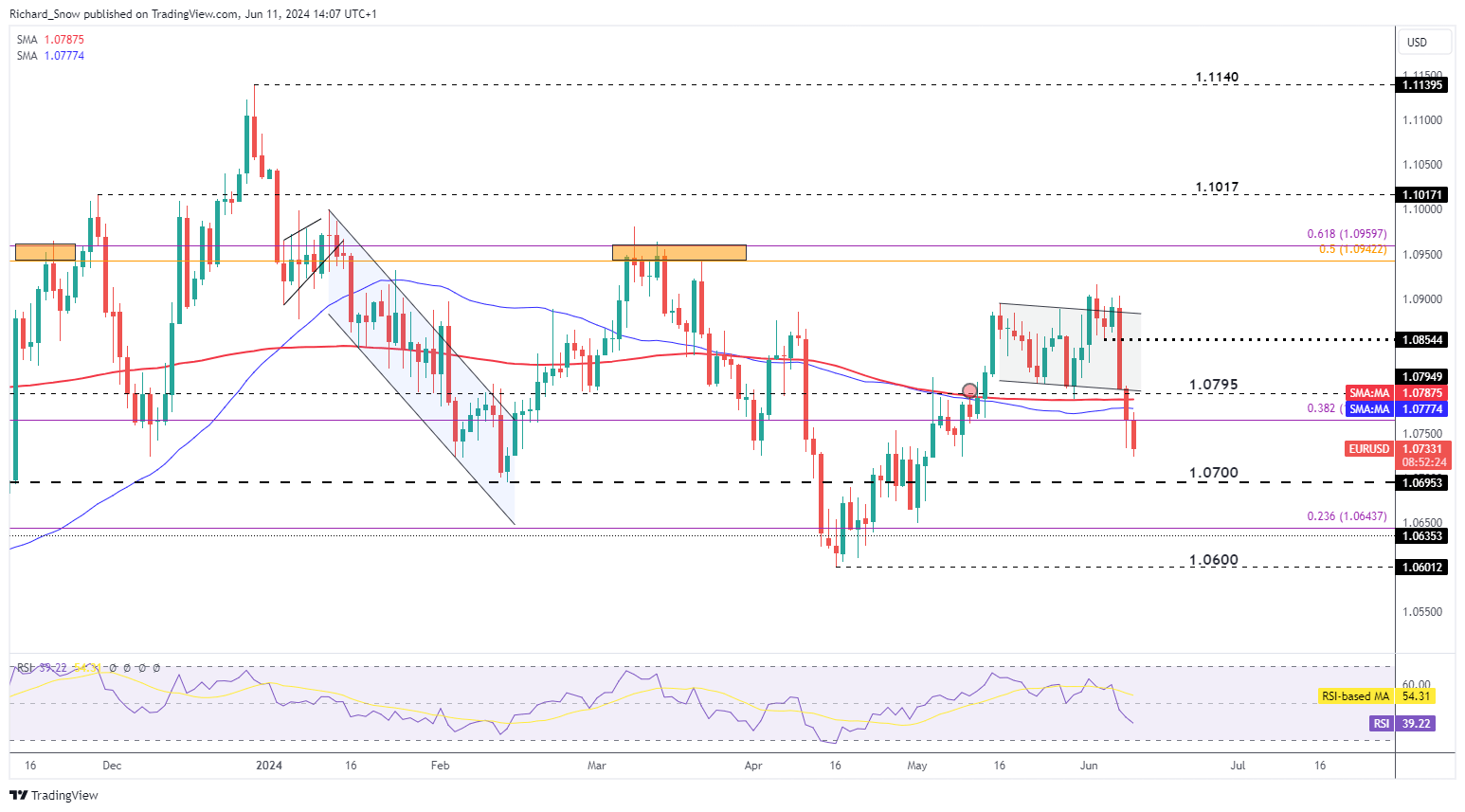

EUR/USD Falls – US CPI and/or the FOMC Meeting Could Extend the Pain

EUR/USD not only broke below the recent channel, but fell through the zone of support around 1.0800 and the 200 day simple moving average (SMA). The pair runs the risk of trading towards 1.0700 if US inflation surprises the market tomorrow or the Fed decide to shave off two rate cuts from its 2024 Fed funds outlook, or both. In an extreme case 1.0600 may come into focus later this week.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

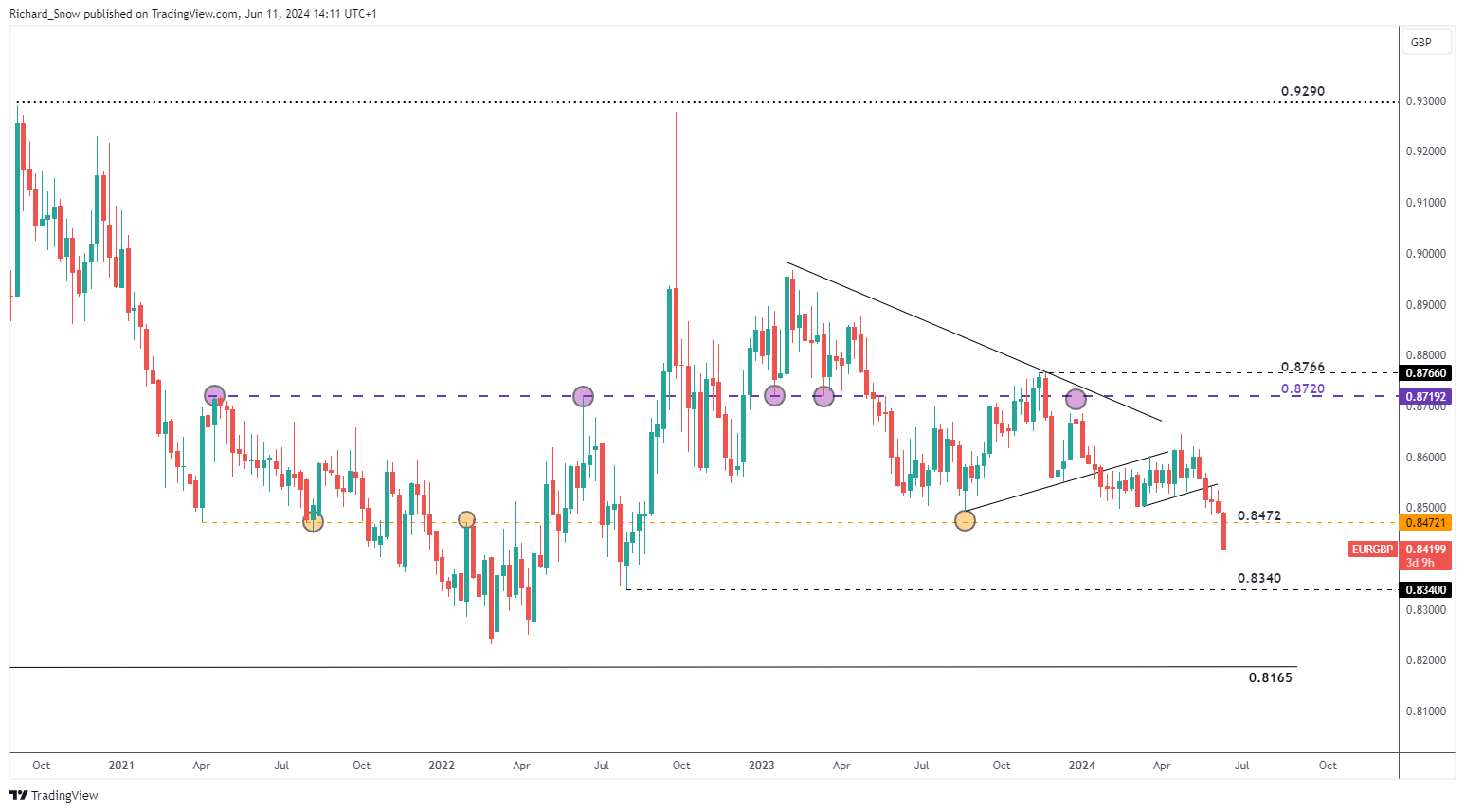

EUR/GBP falls through major level of support with little to stop it

EUR/GBP has breached a longer-term level of significance around 0.8472, as the pair hurtles towards 0.8340 – the July 2022 swing low.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

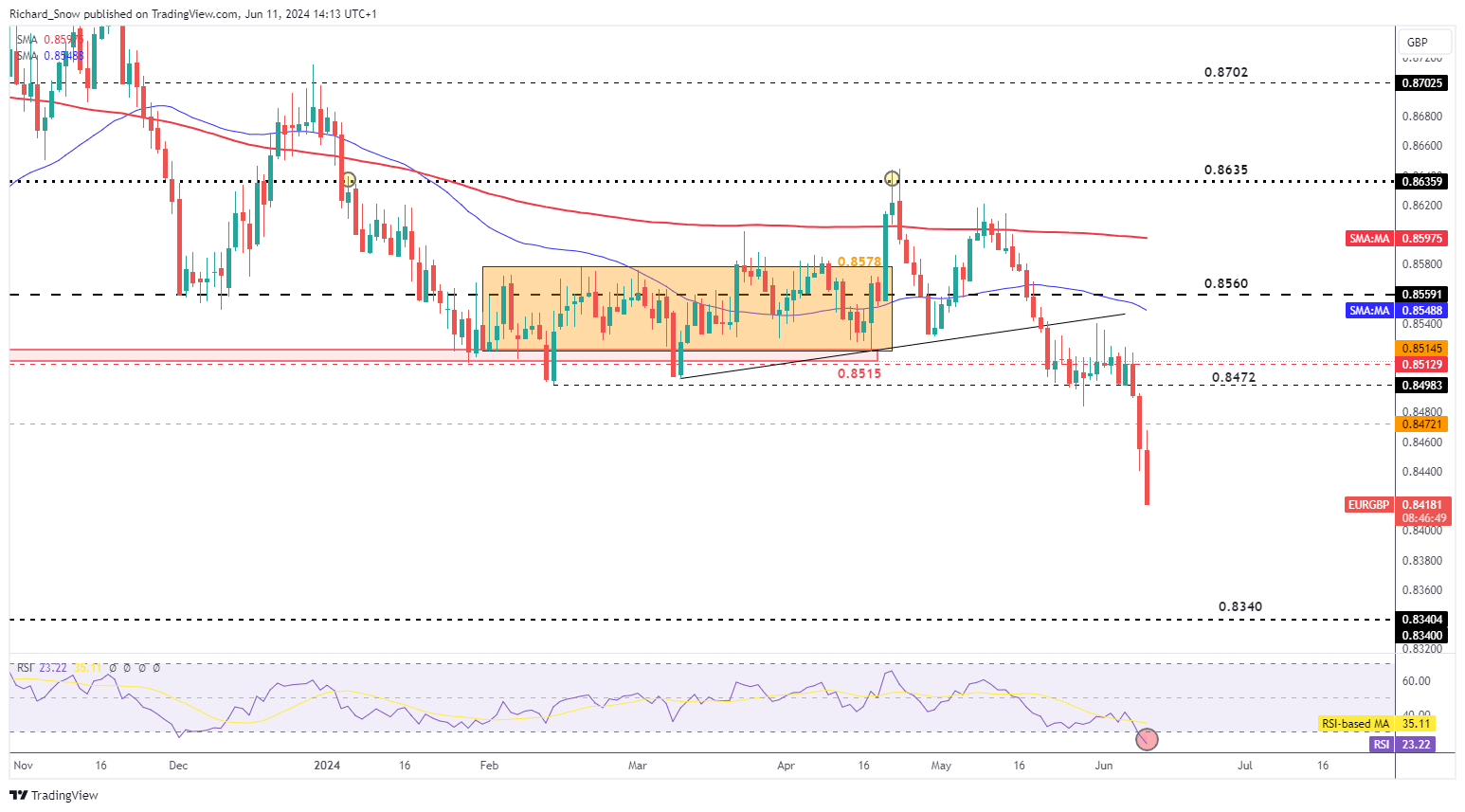

The daily chart shows the move in greater detail. Price action previously lacked the necessary catalyst/ follow through to trade decisively below the 0.8472 level, but now has managed to achieve this despite UK jobs data revealing further easing in Great Britain. The RSI is flashing red, meaning oversold conditions may begin to weigh if incoming data prints inline with expectations. Any notable deviations from general consensus in either US CPI, UK GDP or FOMC will likely add to the recent volatility.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

Discover the power of crowd mentality. Download our free sentiment guide to decipher how shifts in EUR/GBP’s positioning can act as key indicators for upcoming price movements:

| Change in | Longs | Shorts | OI |

| Daily | 6% | 1% | 5% |

| Weekly | 8% | -1% | 6% |

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS