FOMC, EUR/USD, Europe Open, S&P 500, Financial Coverage - Speaking Factors:Danger belongings shrugged of coronavirus consider

FOMC, EUR/USD, Europe Open, S&P 500, Financial Coverage – Speaking Factors:

- Danger belongings shrugged of coronavirus considerations throughout Asia-Pacific commerce, pushing larger regardless of confirmed instances surpassing 9 million globally

- The Federal Reserve’s steadiness sheet shrank by $74 billion final week. Might that be behind the latest resurgence within the US Greenback?

- EUR/USD perched at 61.8% Fibonacci help after 4-days of losses, with technical research suggesting there could also be additional to go.

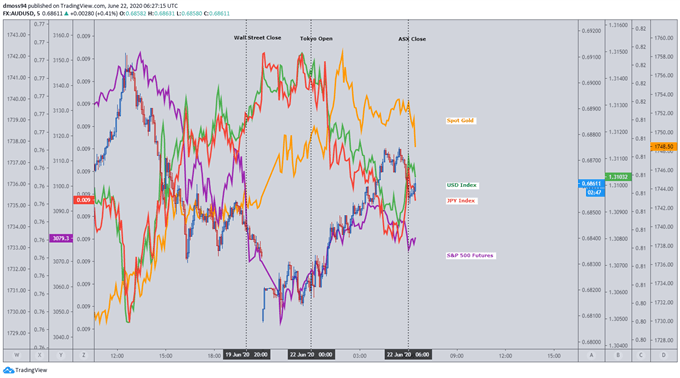

Asia-Pacific Recap

Regardless of gapping decrease early within the Asia-Pacific session, the Australia Greenback clawed again misplaced floor as RBA Governor Philip Lowe “finds it exhausting to argue” that the native foreign money “is over-valued”.

Danger belongings shook off coronavirus considerations, regardless of international instances surpassing 9 million, because the haven-associated US Greenback and Japanese Yen plunged. S&P 500 futures adopted the ASX 200 larger.

Gold pushed again above $1,750 for the primary time in over a month while yields on US 10-year Treasuries dipped again under 70 foundation factors.

Trying ahead, speeches from Bundesbank President Jens Weidmann and Financial institution of Canada Governor Tiff Macklem headline the financial docket, with current dwelling gross sales for Might offering an perception into the preliminary restoration of the US housing market.

Cross-asset evaluation chart created utilizing TradingView

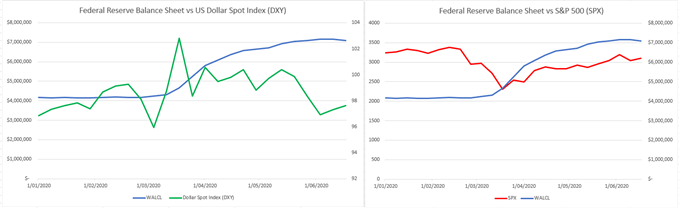

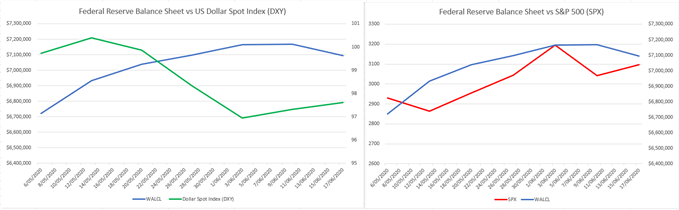

Federal Reserve Stability Sheet Contraction Halts S&P 500 Rally

The latest restoration within the haven-associated US Greenback, and the simultaneous decline within the S&P 500, has been broadly attributed to danger aversion as international coronavirus instances proceed to climb.

Nonetheless, a serious underlying issue behind the present weak point in US fairness markets could also be as a result of $74 billion contraction of the Federal Reserve’s steadiness sheet within the week ending June 17. This prompts an apparent query: is there actually no restrict to the central financial institution’s quantitative easing (QE) program?

After increasing by a mean of $250 billion per week from March 18 by means of to the top of Might, the Federal Reserve has severely scaled again its asset buying program, averaging a measly $14 billion per week within the month of June.

Supplys – Federal Reserve, Yahoo Finance

With the central financial institution including a staggering $2.93 trillion to its steadiness sheet in 2020, some could also be led to imagine that the Fed has ‘run out of ammo’ in its struggle towards the fallout from the Nice Lockdown.

The latest introduction of the Secondary Market Company Credit score Facility (SMCCF) rapidly debunks that notion,because the central financial institution begins “shopping for a broad and diversified portfolio of company bonds to help market liquidity and the supply of credit score for giant employer”.

Making an attempt to derive an satisfactory rationalization of the latest contraction quantities to pure hypothesis, however the pattern itself might proceed to be an attention-grabbing dynamic because the US ‘restoration’ continues, with a sustained discount within the Federal Reserve’s steadiness sheet presumably fuelling additional danger aversion and draw back for international fairness markets.

Really helpful by Daniel Moss

Traits of Profitable Merchants

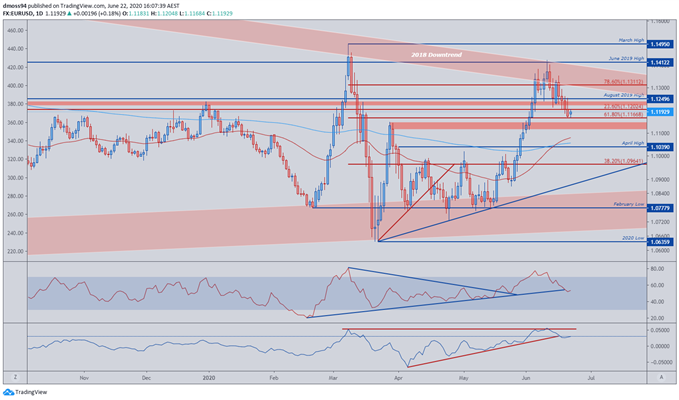

EUR/USD Every day Chart – Worth Perched at Key 61.8% Fibonacci Assist

EUR/USD chart created utilizing TradingView

The 61.8% Fibonacci retracement (1.1167) of the March vary has halted EUR/USD four-day slide after worth failed to shut above the 2018 downtrend.

Regardless of the RSI surging into overbought territory worth was unable to breach a well-recognized inflection level on the June 2019 excessive (1.1412) suggesting the trade fee might have additional draw back to return.

Bearish bias could also be strengthened by the event of the RSI and momentum indicators, as they snap their constructive uptrends from early March.

A reduction rally might eventuate ought to worth overcome resistance on the August 2019 excessive (1.1250) presumably carving a path again to the June excessive (1.1422), though latest worth developments recommend this stays unlikely.

A detailed under the 61.8% Fibonacci might invigorate promoting stress, with a break of key help on the Might excessive (1.1145) presumably seeing worth fall again to the 200-MA (1.1058) and April excessive (1.1039)

— Written by Daniel Moss

Observe me on Twitter @DanielGMoss

Really helpful by Daniel Moss

Constructing Confidence in Buying and selling