Euro to shrug off grim GDP knowledge as outlook brightens on restoration plan – Foreign exchange Information Preview

Euro to shrug off grim GDP knowledge as outlook brightens on restoration plan – Foreign exchange Information Preview

Posted on July 29, 2020 at 10:55 am GMTRaffi Boyadjian, XM Funding Analysis Desk

GDP knowledge out of the Eurozone on Thursday and Friday are anticipated to indicate the continent is going through its worst financial disaster because the second world conflict. But, the euro is wanting probably the most bullish towards the US greenback in a really very long time. A powerful stimulus response, mixed with relative success in bringing the COVID-19 outbreak underneath management, has raised confidence in Europe’s capability to not solely combat the disaster however to return out of it stronger. Therefore, worse-than-expected readings are more likely to be ignored, whereas constructive surprises may additional empower the only forex.

Germany to outperform different EU states

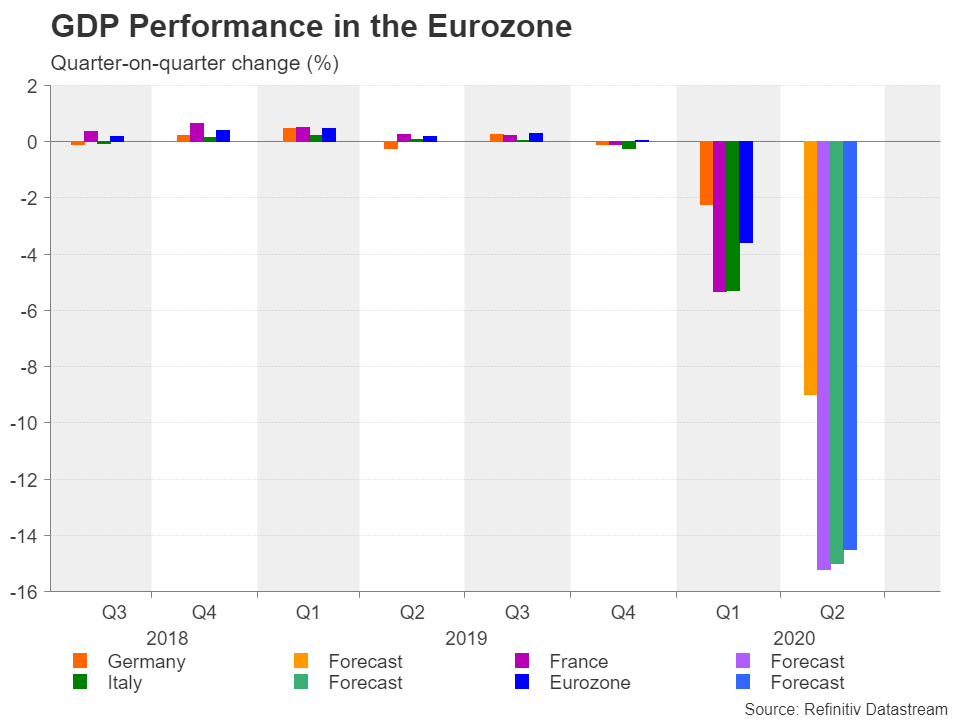

Germany would be the first to report its GDP print for the June quarter on Thursday (0800 GMT), with its financial system anticipated to have contracted by 9% in comparison with the primary quarter. France and Italy will publish their numbers on Friday at 0530 GMT and 0800 GMT respectively. The French financial system possible suffered a staggering 15.2% contraction in Q2, whereas Italian GDP is forecast to have shrunk by a equally terrible 15.0%.

The disparity between nations highlights the larger reliance of nations corresponding to France and Italy on the tourism business and the broader companies sector than a producing powerhouse like Germany. Larger authorities spending and a considerably looser lockdown than lots of its European friends may additionally have helped Germany to carry out notably higher through the peak of the disaster.

As for the entire of the euro space, financial output is projected to have declined by a document 12% on a quarterly foundation, taking the annual price all the way down to 14.5%. Following the three.6% contraction in Q1, the Eurozone financial system is now formally in recession.

Europe headed for a V-shaped restoration

However none of this will likely be something new for the markets and with the most recent PMI indicators pointing to an accelerating restoration in July, the area is about for a powerful bounce again within the third quarter. The European Union’s swift and difficult response to the coronavirus pandemic, at the very least when in comparison with the USA, has paved the way in which for a clean reopening. Furthermore, the re-imposition of lockdowns resulting from contemporary flare-ups have thus far been confined to regional districts, that means Europe isn’t going through the identical bumpy restoration as America is.

With that in thoughts and EU politicians lastly resolving their variations on a €750 billion virus rescue fund, the prospect of a V-shaped restoration is wanting good. Merchants are actually paying attention to this constructive shift within the Eurozone’s outlook because the euro has skyrocketed to close 2-year highs versus the greenback.

Euro primed for additional positive aspects

Higher-than-forecast GDP figures may add extra gasoline to the euro’s rally, pushing it in direction of the 261.8% Fibonacci extension of the June downleg at $1.1835. Clearing this hurdle would flip consideration to the $1.19 deal with.

Nevertheless, if the numbers disappoint, though they’d don’t have any impression in denting the optimism, they may nonetheless set off some revenue taking, with the 161.8% Fibonacci extension of $1.1580 being the first assist space to the draw back.

Within the extra medium time period, the euro is more likely to lengthen its uptrend if the European Central Financial institution turns into much less dovish over time and the US Federal Reserve indicators that additional financial easing is on the playing cards. However after all, Europe isn’t completely out of the woods simply but and virus circumstances may escalate once more at any level. Thus, the virus knowledge will proceed to be as important an indicator as financial ones.

EURUSD