European PMIs: Extra excellent news for the euro? – Foreign exchange Information Preview

Posted on July 23, 2020 at 12:23 pm GMTMarios Hadjikyriacos, XM Funding Analysis Desk

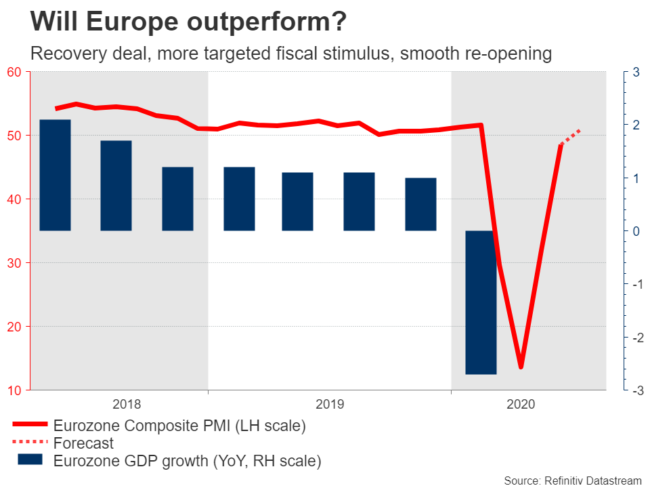

With the EU restoration fund deal now within the rear-view mirror, euro merchants will flip their sights to the Eurozone’s preliminary PMIs for July, due at 08:00 GMT Friday. Forecasts level to an uptick in all indices, reflecting the sleek re-opening course of in Europe. In that case, this might be one other piece of fine information for the high-flying euro, whose rally should still have room to run, particularly if the Fed hurts the greenback subsequent week.

Europe vs America?

It’s been virtually twenty years for the reason that monetary group was extra bullish on the euro space than the US, however right here we’re. A consensus appears to be rising that the Eurozone has accomplished a greater job of dealing with each the healthcare emergency and the financial disaster, and that it will assist it recuperate quicker than America. Not solely did Europe take a extra proactive strategy to the lockdowns, however the fiscal stimulus – despite the fact that smaller in dimension – was extra focused to supporting wages and jobs, limiting the injury to the labor market.

Extra importantly, European leaders used the disaster to push for larger fiscal transfers between economies – one thing unthinkable only a few months in the past. There was some kicking and screaming, however finally, the EU accepted a big restoration fund that can distribute loans and grants to help essentially the most devastated economies. Grants are handouts that don’t need to be paid again, thereby serving to extremely indebted nations like Italy get again on their toes.

Make no mistake, this can be a recreation changer. For a very long time, this was the Eurozone’s Achilles’ heel – its lack of an actual federal authorities like within the US that may assist particular person states when they’re in bother. Although this newest step continues to be miles away from a correct fiscal union, it units a really vital precedent that may finally give rise to an actual risk-sharing instrument, like Eurobonds.

Extra excellent news

On Friday, we’ll get some recent clues as as to whether the euro space’s restoration goes easily. The manufacturing PMI is predicted to the touch the 50 stage, which might sign stagnation, from contraction beforehand. The companies print is predicted to cross again above 50, indicating a return to progress.

In actuality, even numbers a lot above 50 wouldn’t essentially indicate a return to pre-crisis progress, as these surveys merely ask companies how properly they’re doing relative to final month. Therefore, if final month was horrible, the index may bounce above 50 however that doesn’t imply the sector is rising at something near pre-crisis ranges. That stated, it’s nonetheless a step in the fitting path that will add extra gas for the euro.

The French and German prints shall be launched forward of the Eurozone prints, at 07:15 and 07:30 GMT respectively, and any market response may start with them.

Euro can transfer greater nonetheless, if the greenback craters

Certainly, the forex market appears to assume that Europe will outperform, judging by the substantial features within the euro these days. The query now’s whether or not the rally nonetheless has legs, or whether or not the excellent news is already mirrored within the value, leaving the only forex uncovered to a pullback.

Admittedly, a lot of the optimistic euro story appears priced in, however euro/greenback can nonetheless transfer greater, totally on greenback weak point.

The Fed meets subsequent week, and with the US financial restoration stalling, policymakers shall be beneath stress to behave once more. They may as an illustration strengthen their ahead steering, pledging to not elevate charges once more till inflation hits some goal. In that case, that would add extra draw back stress for the greenback.

Taking a look at euro/greenback technically, one other wave of advances could stall close to the latest excessive of 1.1600, which isn’t removed from the October 2018 peak of 1.1620.

On the draw back, a transfer again beneath 1.1560 might open the door for a check of the 1.1505 zone initially.

EURUSD