Powell commented on asset purchases, sustaining the present price of $120 B per thirty daysPowell’s speech comes amidst rising ex

- Powell commented on asset purchases, sustaining the present price of $120 B per thirty days

- Powell’s speech comes amidst rising expectations of a robust financial restoration.

- DXY barely stronger in fast commerce, fairness indices combined

Fed Chair Powell speaks on the state of the financial system, USD rises barely

Federal Reserve Chair Jerome Powell painted a bleak image for US employment throughout a speech given on Wednesday. In his speech, Powell outlined his dedication to remaining patiently accommodative given the weak spot proven in employment knowledge lately. “Absolutely realizing the advantages of a robust labor market will take continued help from each near-term coverage and longer-run investments…” stated Powell.

Powell continued to state that the reported unemployment quantity “dramatically understated” the harm finished to the home labor market during the last twelve months. “Regardless of the shocking pace of restoration early on, we’re nonetheless very removed from a robust labor market whose advantages are broadly shared,” stated Powell. Whereas Powell remained assured that the Fed’s strategy will produce passable outcomes, he remained adamant that financial coverage alone is not going to resolve our financial issues.

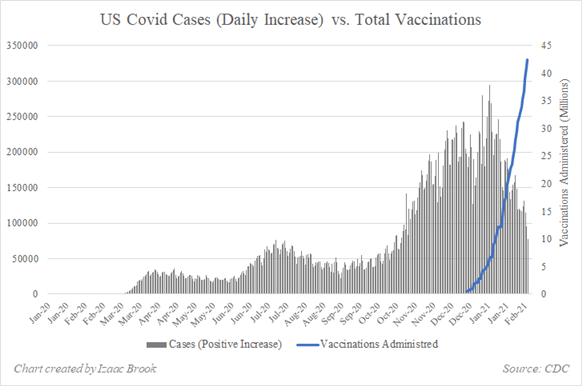

Powell’s cautious outlook is echoed by the truth that almost 10 million Individuals are nonetheless with out work. Nonetheless, Chair Powell highlighted the mixture of mass vaccinations and applications such because the Paycheck Safety Program as inexperienced shoots for a restoration in retail employment. Powell additionally reiterated his dedication to preserving short-term rates of interest close to zero, whereas sustaining the present tempo of asset purchases at $120 billion per thirty days.

Advisable by Izaac Brook

Buying and selling Foreign exchange Information: The Technique

January’s FOMC assembly noticed little change within the Fed’s coverage stance. Statements from the assembly did observe that the financial restoration had moderated in current months. Nonetheless, new virus circumstances have continued to say no because the final time the FOMC met. The vaccine rollout continues throughout the nation, providing a light-weight on the finish of the tunnel.

Powell’s commentary comes amidst rising expectations of a robust US financial restoration. The Biden administration has opted to move their $1.9 trillion stimulus bundle by way of the funds reconciliation course of, permitting the administration to move the stimulus bundle with a easy majority.

US yields and financial expectations have reacted strongly to the approaching stimulus bundle. Yields on the 10yr Treasury rose as excessive as 2% in early February, hitting their highest ranges since March 2020. Relatedly, 10yr inflation breakevens have risen to their highest ranges since 2014, reflecting rising expectations of upper inflation. Inflation has develop into a serious theme amongst market commentators and politicians.

Advisable by Izaac Brook

Get Your Free USD Forecast

DXY 1 Minute Chart

Created with TradingView

S&P 500 1 Min Chart

Chart created with TradingView

— Written by Brendan Fagan & Izaac Brook, DailyFX Interns