FOMC KEY POINTS:The FOMC comes out all guns blazing and raises the federal funds rate by 75 basis points to 1.50-1.75%, delivering

FOMC KEY POINTS:

- The FOMC comes out all guns blazing and raises the federal funds rate by 75 basis points to 1.50-1.75%, delivering the biggest single meeting hike since 1994

- The policy statement acknowledges that officials are highly attentive to inflation risks

- Policymakers signal the benchmark rate will end 2022 at 3.4%, up from 1.9% forecast in March, implying 150 bp of additional tightening over the remaining four meetings of the year

Most Read: S&P 500, Nasdaq 100 Outlook – Buckle Up, Here Comes the Fed

PUBLISHED WED, JUN 15 2022 2:15 PM EDT

The Fed did something today that it has not dared or needed to do since 1994 in a single meeting: it raised borrowing costs by 75 basis points, bringing the federal funds rate to 1.5%-1.75% – aligning the decision with market forecasts. Today’s forceful hike, the third during the ongoing tightening cycle, should be taken as a clear indication that the FOMC is getting very nervous about blistering price pressures in the economy and is desperate to regain control of the narrative after being criticized for falling behind the curve by waiting too long to start removing accommodation.

Until last week, Wall Street had anticipated a half-point adjustment identical to the one delivered last month and in line with central bank guidance, but expectations for a larger move firmed in recent days after May’s U.S. CPI blew past market estimates, soaring 8.6% y-o-y, its highest level since 1981, squashing hopes that inflation has peaked.

Wednesday’s 75 bp increase, which runs counter to previous communications, is likely to boost policy uncertainty and create confusion about how the institution reacts to new information by suggesting officials are losing confidence in their own forecasts. All of this raises the possibility that the FOMC could deviate from prior guidance in the future at the drop of a hat if inflation figures continue to surprise to the upside, a situation that could fuel further volatility around the release of key economic reports.

Related: The Federal Reserve Bank – A Forex Trader’s Guide

POLICY STATEMENT

The FOMC communique took a somewhat positive tone on the economy, indicating that activity appears to have picked up and that the labor market remains strong. On the inflation front, the FOMC indicated that it is highly atttentive to inflation risks. With respect to monetary policy, the statement language didn’t change much, noting that the committee anticipates that ongoing increases in the target range will be appropriate. This time the Fed hiked by 75 bps, so the language may mean additional 75 bp moves in the future.

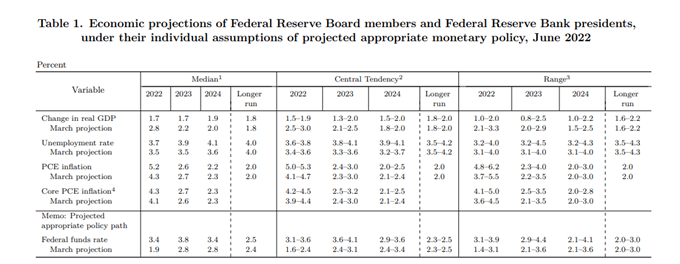

SUMMARY OF ECONOMIC PROJECTIONS

It May Interest You: A Guide to GDP and Forex Trading

GDP AND UNEMPLOYMENT

The Fed downgraded its gross domestic product for the entire forecast horizon, reinforcing fears that economic activity is rapidly decelerating amid mounting risks to the outlook, including tighter monetary policy. That said, 2022, 2023 and 2024 GDP projections were cut to 1.7%, 1.7% and 1.9%, respectively, down from 2.8%, 2.2% and 2.0% in the March assumptions.

For unemployment, this year’s estimate was raised to 3.7% from 3.5%. For 2022 and 2023, the metric was revised upwards to 3.9% and 4.1% from 3.5% and 3.6% correspondingly, an acknowledgement that the labor market is on track to weaken in a context of slowing growth.

Related: Inflation and Forex – How CPI Data Affects Currency Prices

INFLATION

Core PCE, the Fed’s favorite inflation gauge, was marked up higher for the next two years. Looking at the details, the 2022 forecast was raised to 4.3% from 4.1% three months ago. For next year, the index is seen at 2.7% from 2.6% previously. Finally, the core CPI was left unchanged at 2.3% for 2024, indicating that inflation will stay above the U.S. central bank’s 2% target for several years.

You May Like: Hawkish vs Dovish – How Monetary Policy Affects FX Trading

DOT PLOT

For 2022, the median dot shifted upwards to 3.4% from 1.9% in March, implying 150 basis points of additional tightening over the four remaining meetings of the year and that the monetary policy will have to turn restrictive to crush inflation and ensure expectations do not become unmoored. Restrictive rates at a time of rapidly slowing activity will become an additional drag on economic growth, raising the probability of a recession in the medium term.

For 2023 and 2024, officials penciled in a benchmark rate of 3.8% and 3.4% respectively. That compares with 2.8% and 2.8% in the previous quarterly forecast. Meanwhile, the longer run interest rate estimate was increased by one tenth of a percernt to 2.5%

The hawkish outlook for monetary policy will complicate the Fed’s job to steer the economy towards a soft landing, creating a challenging backdrop for stocks. If GDP downshifts aggressively, U.S. companies may soon begin issuing negative profit guidance and slash EPS expectations ahead of the second quarter earnings season, generating another headwind for risk assets.

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG’s client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

—Written by Diego Colman, Market Strategist for DailyFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com