It has been a stable week for the Dollar, with values rising throughout the majors. For the EUR/USD, foreign exchange gamers have despatched charg

It has been a stable week for the Dollar, with values rising throughout the majors. For the EUR/USD, foreign exchange gamers have despatched charges south, bringing a key Fibonacci help stage into play. With solely a modest U.S. financial calendar on faucet for immediately, it seems to be like merchants are starting to favor the greenback to kick-off 2021.

All in all, it was a quiet morning for financial releases. Right here’s a fast have a look at a couple of of the extra notable stats:

Occasion Precise Earlier

Redbook MoM (Jan. 9) -2.6% 0.5%

Redbook YoY (Jan. 9) 2.1% 5.5%

JOLTS Job Openings (Nov.) 6.527M 6.632M

To sum up, these figures don’t look good. The retail sector seems to have taken a short-term hit as has American employment. Along with these experiences, the NFIB Enterprise Optimism Index (Dec.) got here in at 95.9, effectively beneath November’s 101.4. So, it seems to be like many enterprise operators are bracing themselves for a tough 2021.

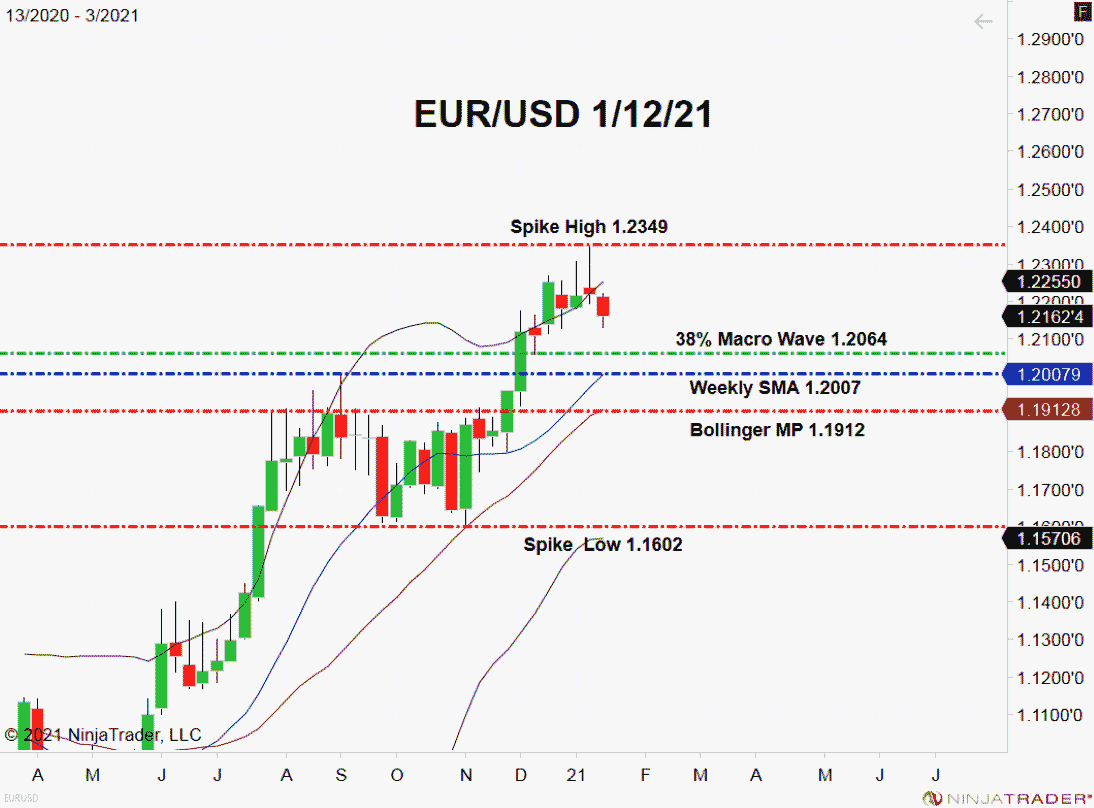

At this time has been extraordinarily tight for the EUR/USD. Let’s dig into the weekly technicals and try a key Fibonacci help stage.

EUR/USD Challenges The 1.2100 Stage

Though it’s solely Tuesday, the EUR/USD is able to put up uncommon back-to-back shedding weeks. If charges proceed to slip, an vital intermediate-term help stage will come into play.

+2021_03+(10_16_35+AM).png)

Listed below are a couple of ranges to observe for the rest of the week:

- Resistance(1): Spike Excessive, 1.2349

- Help(1): 38% Macro Wave Retracement, 1.2064

Backside Line: Whereas immediately has been a quiet session on the foreign exchange, issues are as a consequence of warmth up within the coming 24 hours. A slew of inflation numbers is due out throughout Wednesday’s U.S. premarket hours, which will definitely influence USD sentiment. In the event that they outperform expectations, the EUR/USD will likely be poised to check draw back help.

So long as the Spike Excessive stays intact, I’ll have purchase orders within the queue from 1.2069. With an preliminary cease loss at 1.2044, this commerce produces 25 pips on a typical 1:1 danger vs reward ratio.