At the moment’s slate of financial numbers are in and U.S. shares proceed to grind larger. On the midway level of the Wall Avenue session, the DJI

At the moment’s slate of financial numbers are in and U.S. shares proceed to grind larger. On the midway level of the Wall Avenue session, the DJIA DOW (+92), S&P 500 SPX (+15), and NASDAQ (+102) are within the inexperienced. In the meanwhile, a optimistic Sturdy Items Orders report from June is drawing bids to the markets.

Right here’s a fast take a look at this morning’s numbers:

Occasion Precise Projected Earlier

Sturdy Items Orders (June) 7.3% 7.2% 15.1%

Sturdy Items Orders ex Protection (June) 9.2% 18.6% 15.2%

Dallas FED Manufacturing Index (July) -3.0 NA -6.1

Sturdy Items Orders (June) have eclipsed expectations, as has the Dallas FED Manufacturing Index (July). Maybe the largest financial information was the steep drop in Sturdy Items Orders ex Protection (June). All in all, this isn’t a foul group of financial numbers contemplating the fallout from the COVID-19 pandemic.

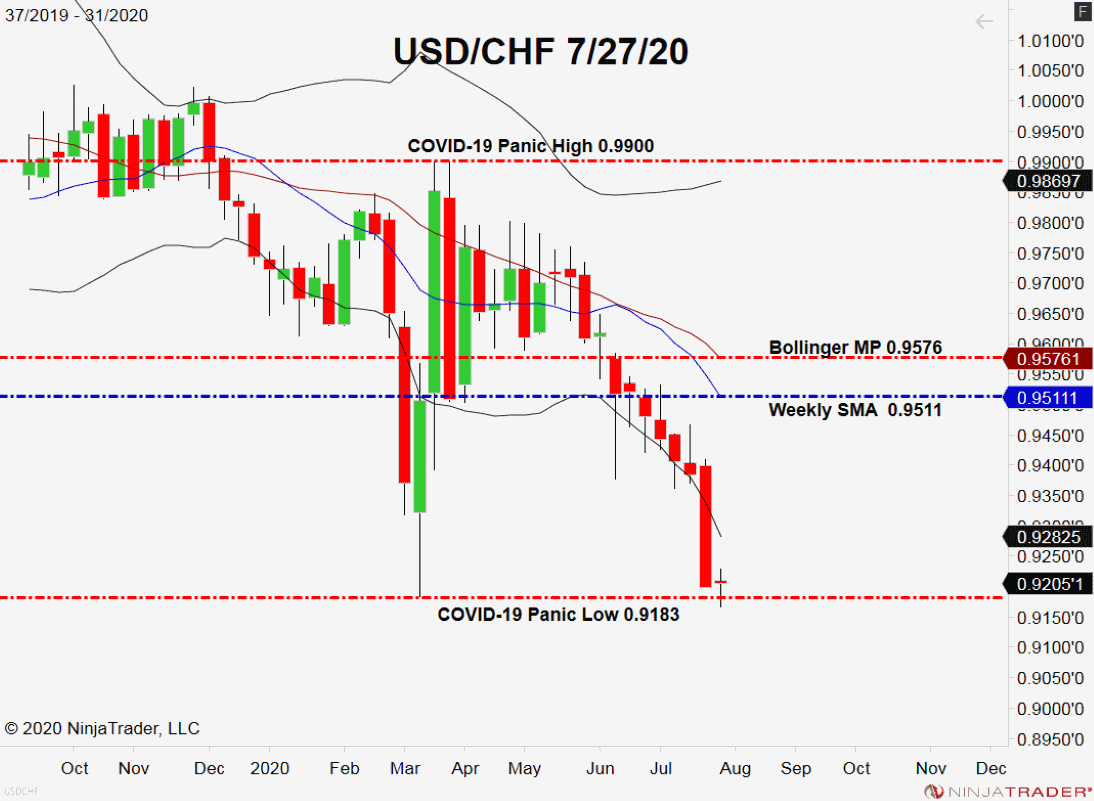

Financial Numbers Stout, USD/CHF Continues To Pattern South

In a Reside Market Replace from final week, I outlined the significance of the COVID-19 Panic Low within the USD/CHF (0.9183). To this point, the extent has held up as assist as charges are again above the 0.9200 deal with.

+2020_31+(10_27_24+AM).png)

Overview: In the meanwhile, it seems that the USD is poised to proceed its bearish methods. Nevertheless, the financial outlook is bettering and Wednesday’s FED assembly is quickly approaching. Maybe a instructed shift in coverage could deliver bidders again to the USD for the primary time since March.