Many individuals at the moment are acquainted with on-line buying and selling and in reality thousands and thousands are buying and selling themse

Many individuals at the moment are acquainted with on-line buying and selling and in reality thousands and thousands are buying and selling themselves. Foreign currency trading has moved on-line and is finished by digital buying and selling platforms, which are available many shapes and kinds.In addition to discovering a great dealer, foreign exchange merchants should discover a good buying and selling platform as nicely, which isn’t that easy, particularly because the competitors has incentivized many suppliers of buying and selling platforms to provide you with many inventions and improve them repeatedly.

So, whereas lots of options are comparable, everybody has their very own particular ones developed for PC, Net buying and selling or Cellular platforms, which make their foreign exchange platforms totally different. It is a good factor, since there are a lot of merchants with totally different wants on the market. Many brokers have their very own inbuilt platforms which they’ve developed, however there additionally fairly just a few white label platforms, like cTrader or Ninja Dealer which many brokers provide. Though, a big a part of the white label market share is taken by MetaQuotes Company, with its MetaTrader4 and MetaTrader5 platforms. On this article, we’ll introduce a few of these buying and selling platforms and try execs and cons of each forms of them.

Prime 5 Buying and selling Platforms

MetaTrader4 MT4

Everybody is aware of the MetaTrader4 platform by now. That was the primary main breakthrough for the MetaQuotes Company, launched in early 2000s and is essentially the most well-known buying and selling platform. The MT4 is just like the Fb of foreign exchange platforms. It’s fairly straightforward to make use of and has a pleasant interface. The MT4 was essentially the most dependable third occasion foreign exchange platform for on-line retail buying and selling for a very long time. The MT4 set the bar for everybody within the enterprise, principally providing all instruments and options {that a} primary dealer wants to investigate markets and commerce, reminiscent of one-click buying and selling, publicity, account historical past, information, alerts, mailbox, market, foreign exchange alerts, skilled advisors, journal, and so forth.

MT4 launched some new orders within the business

| Options | Professionals | Cons |

A number of accountsAutomated buying and sellingKnowledgeable advisersMulti charting9 time-framesPending ordersRestrict/Cease ordersCellphone alertsOver 50 chart indicatorsOperating simultaneous MT4 platformsHedging solely on MT4 |

Simple to knowLow PC sourcesA number of accountsAccepted in lots of PC programsAutomated buying and sellingSimple to make use of indicatorsMQL4 buying and sellingBuying and selling stage alerts |

Execution time variesNo personalized time frame chartsHistoric knowledge not all the time correctNo excessive frequency buying and selling |

MetaTrader5 MT5

MetaTrader5 platform was the subsequent neatest thing that the MetaQuotes Software program launched to the web buying and selling neighborhood. The neighborhood was already used to its earlier MT4 buying and selling platform, so the MT5 was in demand immediately with foreign exchange merchants. It introduced fairly just a few new options with the MT5. Whereas the MT5 was particularly designed for foreign currency trading, the MT5 was designed to offer merchants with entry to CFDs, shares and futures. The interface is just like that of the MT4, which is an efficient factor, since merchants don’t like to vary an excessive amount of from one platform to a different and it has many extra time-frames than the MT4, other than companies and different benefits. Two extra forms of orders have been added to the MT5, with Purchase Cease-Restrict and Promote Cease-Restrict on prime of the 4 forms of orders already current in MT4.

Distant buying and selling is straightforward on the MT5 cell platform

| Options | Professionals | Cons |

Market statistics on numerous monetary devicesElevated variety of timeframe chartsCustomed monetary devices6 various kinds of ordersFinancial calendarMQL5 programming languageHedging by request and netting |

Limitless variety of chartsNetting allowed38 built-in technical indicatorsPurchase stop-limit and promote stop-limitDepth of Market DOP liquidityFinancial calendarAppropriate with PC/smartphone programsPartial order filling 21 time-frames |

Difficult on account of superior instrumentsBuy required for allHedging solely by requestMost MT4 EAs not importable |

Ninja Dealer

The Ninja Dealer platform has been one of many rivals of the MetaTrader platforms over the last 15 years. Ninja Dealer was developed in 2003 and since conception it was supposed to rival the MT4 buying and selling platform, because it provided inventory and futures buying and selling, in addition to simply foreign exchange just like the MT4. In case you have a funded account, the NinjaTrader platform is free to make use of for charting, market evaluation, and dwell buying and selling, whereas the SIM model is free even when you don’t have a funded account. Merchants with excessive exercise of buying and selling finds the Ninja Dealer platform fairly useful to make use of on account of its nice charting options, innumerable functions from third-party builders, additionally for the brokerage it gives as nicely.

Ninja Dealer has some superior charting

| Options | Professionals | Cons |

Nice charting with nice instrumentsPartial and full automationSimulation and back-testing obtainableSimpler to construct buying and selling appsMany third-party buying and selling appsNice studying steerage for the platformBuying and selling straight from charts |

Wonderful chartingChart dealer order entry instrumentHundreds of buying and selling appsPlatform guides, video libraryFree every day webinarsDepth of Market DOP liquidityVery quick to submit and handle SL and TP ordersOne cancels the opposite orders OCOFree primary demo platform |

Restricted information analysisCost for premium optionsNo supported brokers for fairness and cryptoNot personal smartphone platformInformation feed not included |

ProTrader

The Protrader platform is one other highly effective and superior buying and selling platform within the foreign exchange business, in addition to one other rival for the MT4. This platform was launched in 2003, making it one of many oldest platforms for retail merchants with a handful others, by PFSOFT, a Ukrainian firm of buying and selling and IT specialists. The intention when it was designed, was to create a innovative platform for on-line retail foreign exchange merchants, which might provide them entry to most main markets, reminiscent of foreign exchange, commodities, choices market, inventory markets and so forth. The Protrader platform is already fairly consumer pleasant, however it additionally permits merchants to rearrange the platform as they need, which implies that it’s absolutely customizable. Talking of customizing platforms, Protrader permits you to execute a number of trades without delay, which is sweet for information buying and selling, in addition to inserting restrict orders direct from the chart. This platform can be fairly hospitable to 1000’s of third occasion EAs and buying and selling programmes, in addition to providing depth of market instruments too.

ProTrader has some good scalping options

| Options | Professionals | Cons |

Highly effective and pleasant interface and chartingTotally customizable platformAlgoStudio for programming functions and back-testing of algorithmic methodsOne-click chart pending restrict orders obtainableBasket buying and selling for a number of commerce executionScalper’s panel for fast buying and sellingChoice’s Grasp for choices |

Pleasant interface designBasket buying and sellingNice for scalpingTotally adjustable terminalNewbie {and professional} workspacesChart pending orders Choices Grasp |

Restricted order varietiesSmall charting space |

cTrader

The cTrader platform was launched in 2010 by Spotware, which raised the requirements of the web buying and selling business. The cTraders was designed for use by ECN brokers, with a number of prime names already utilizing this buying and selling platform, so it’s a fascinating platform for these merchants who like buying and selling straight by an ECN. The principle features of the platform are two, charting and commerce execution. Subsequently, cTrader charting and interface may be very clear and it is extremely straightforward to make use of due to its easy UI. In addition to, merchants are issued with tickets containing all the small print and there’s a map possibility obtainable to investigate all of the commerce efficiency as a complete, for particular person pairs, for a sure time and so forth. cTrader has the Open API for merchants to construct their very own buying and selling programmes. cTrader is utilized by a number of well-known brokers, reminiscent of Alpari.

cTrader has quite a few technical indicators reminiscent of volumes

| Options | Professionals | Cons |

Digital communications community platformDependable and quick executionThe spreads are very low and go to zero pips in liquid occasionsObtainable to observe different merchantsValue feed from many feed suppliersPlatforms for Home windows, Net, CellularOver 60 Indicators |

Alerts Commerce tickets with all the small printMap evaluation of efficiencyA number of supply pricingVery low spreadsSuperior order varietiesQuick entry and executioncTrader Copy |

Not absolutely customizableLow variety of EA and customized indicatorsUse of C# language as a substitute of MQL |

6 Prime Dealer Platforms

eToro

As foreign currency trading grew to become more and more fashionable, social buying and selling additionally grew to become fashionable. eToro which was based in 2007 is without doubt one of the first brokers to introduce social buying and selling en masse. In actual fact, that’s what eToro is most well-known for. There’s numerous eToro merchants which type a vibrant neighborhood. The eToro platform gives this function with nice effectivity and likewise gives the translate possibility for merchants of many international locations. Though, the perfect function of the eToro platform is the eToro CopyTrader which evaluates prime merchants in response to a sensible efficiency evaluation, carried out by algorithms evaluating leverage, publicity, variety of trades open, volatility of traded belongings and so forth. Merchants may also have prepared made portfolios, which is one other nice function. Portfolios can both be for Market Portfolios for sure CFDs and Shares based mostly on algo methods, or Prime Dealer Portfolios, the place anybody on eToro can observe quite a lot of prime merchants with the perfect efficiency rating. If you’re an skilled dealer, you may also provide your companies for a payment for different merchants to repeat your trades.

eToro is most well-known for its social buying and selling community and options

| Options | Professionals | Cons |

Social buying and selling platform for merchants to judge their commerce conceptseToro TradeCopier permits merchants to repeat prime merchants2 Forms of copy portfolios: market portfolios and Prime Dealer portfoliosQuick account opening course ofTotally digitalized opening course ofThe demo account stays lively for limitless technique testing and training time$5 withdrawal payment and $10 inactivity payment after 1 12 months$200 minimal account depositLow CFD spreadsCovers foreign exchange, CFDs and cryptocurrency marketsAgain-testing and foreign exchange technique optimization |

Non-expiring demo accountVibrant buying and selling neighborhoodLow withdrawal and inactivity chargesSocial buying and sellingCommerce copierTwo forms of copy portfoliosTop quality trainingBuying and selling instrument sentiment indicator |

Restricted stop-loss features for cryptosOne base forex, the USDNo information streamingPartially personalized platformNo streaming informationInactivity payment |

IG

The IG Group is a London based mostly monetary agency, based in 1974. The dealer is regulated by the Monetary Conduct Authority (FCA) within the U.Ok. and the Australian Securities and Funding Fee (ASIC) in Australia, which makes it fairly protected. In addition they provide a variety of monetary markets to commerce, which we cowl in an unique article about IG, from foreign exchange to choices, futures, commodities, cryptocurrencies, indices and bonds. However, in addition to that, in addition they provide quite a lot of buying and selling platforms to selected, from the same old third occasion platforms such because the MT4, the we based mostly platform which is their principal buying and selling one, the cell utility, the IG Markets L2 Vendor, which is especially designed for inventory merchants and the IG ProReal Time, which incorporates greater than 100 indicators, however comes with a payment, which is refundable when you commerce sufficient every month. IG has additionally launched a brand new function, the IG Sensible Portfolio, which is an EA advisory service for merchants to pick out amongst routinely managed low-cost portfolios.

IG gives a variety of markets and devices

| Options | Professionals | Cons |

A really big selection of markets linedAlerts to set off when a market strikes an quantity, hits a worth stage or meets your technical situationsThreat mitigation to guard accounts, together with assured stops for watertight safety.Limitless entry to Thomson Reuters’ information streaming serviceDigital personal server to put in algorithms that automate buying and sellingOver 15,000 monetary devices to commerceIG Sensible Portfolio managed routinelyIndicators seem solely if you faucet on IG Cellular App |

Assured cease lossesInterbank ECNIG Sensible PortfolioSimple to entry internet platform1,000+ indicators for IG ProRealMulti-source worth feed |

Dormant account chargesNo interbank for foreign exchangeNo social/copy buying and sellingAdministration charges + % charges for Sensible Portfolio |

Oanda Commerce

Oanda is without doubt one of the most well-known brokers within the retail foreign exchange business. Aside from the MT4 platform, Oanda gives its personal buying and selling platforms, the Oanda Commerce Net, desktop and cell utility. Compared to the MT4, the Oanda Commerce platform is extra fashionable trying. The coloring is much less retro, the chart placement is healthier, in addition to the format of chart indicators. Charts are supplied by TradingView, whereas the feed is supplied by 25 central banks, which makes it an ECN dealer. The desktop platform is absolutely customizable and it additionally gives refined dealer evaluation, in addition to providing a variety of monetary devices.

Oanda gives quite a lot of totally different chart layouts

| Options | Professionals | Cons |

Greater than 10 forms of charts + chart layoutsTotally personalised chart layoutsCapability to tug charts to totally different screens50+ drawing instrumentsVery low spreads throughout liquid occasionsSubtle commerce evaluationUp to date market evaluation |

GSLOs assure to exit tradesInterbank ECNNo minimal deposit requirementUp-to-minute informationFinancial calendarMulti-source worth feedUp to date market evaluationMany academic movies and webinars$zero minimal deposit |

Wider unfold throughout illiquid occasionsCharges when GDLOs are triggeredInactivity costsSolely foreign exchange and CFDsNo worth alerts$5/lot foreign exchange fee |

Dukascopy

Dukascopy is one other respected title within the buying and selling business. Dukascopy is a Swiss regulated financial institution, which gives dealer companies as nicely, and a few of the finest companies in our opinion. Aside from being a protected dealer to do enterprise with , it gives its personal buying and selling platform JForex, which supplied entry to the SWFX – Swiss FX Market, which is a technological resolution for buying and selling, utilizing a novel centralized-decentralized market mannequin. Dukascopy gives a variety of markets to commerce and a variety of orders, reminiscent of market order, restrict order, cease, take revenue, cease loss, cease restrict, trailing cease, place bid/provide, OCO, IFD and so forth. In addition to that, Dukascopy platform gives the choice to regulate the slippage when opening a commerce. So, Dukascopy is an all-rounded dealer.

The Dukascopy platform is world class

| Options | Professionals | Cons |

A really big selection of markets linedWealthy and superior platformGreater than 250 indicators to make use ofMany uncommon orders varieties, reminiscent of cease restrict, place bid/provide, OCO, IFDSlippage management possibility to regulate most worth slippage on executionPlatform inbuilt plug-in buyer helpMulti-language interface for JForex PlatformInformation and financial calendarManaged account possibility by skilled merchants |

A regulated financial institution dealerInterbank CCNSlippage management operateTrendy buying and selling platformPAMM accountsMulti-source worth feedEsiSwisse deposit insurance coverage schemePlatform-built buyer help250+ buying and selling indicatorsMulti-language platform |

Excessive minimal depositExcessive commissionsRestricted leverage14 days solely demo accountNo US merchants allowedRestricted funding choices |

AvaTrade

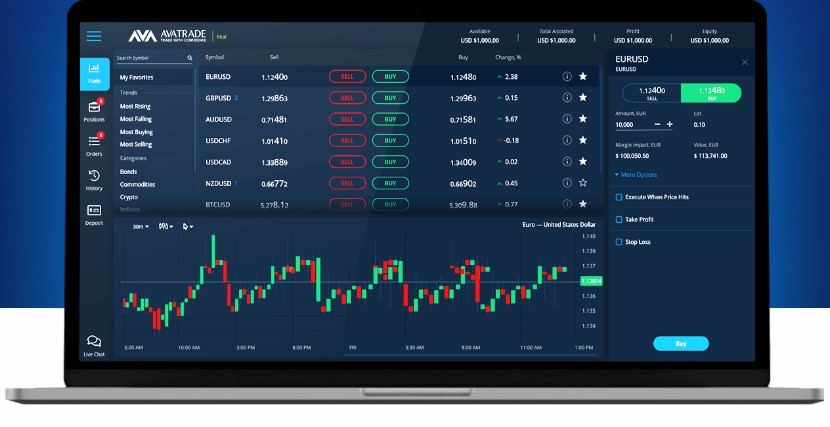

AvaTrade is a foreign exchange dealer regulated in Eire amongst different international locations, based in 2006. Aside the MT4 and MT5 platforms, it additionally gives its personal internet buying and selling platform, in addition to the cell AvaTradeGo platform. The net buying and selling platform is kind of easy to know, use and commerce, though it consumes PC sources. With AvaTrade platforms you get entry to knowledge on purchase/promote positions from AvaTrade merchants. The net platform, in addition to the AvaTradeGo platform, have some fascinating instruments, indicators and options, one among which is the AvaProtect possibility, which you purchase for a worth. That’s a function to guard your trades for a sure period of time after you will have opened it, with the choice to resume it when the time bought ends. However one of many downsides is that the product portfolio is proscribed because it gives solely CFDs, foreign exchange, and cryptos, which is sufficient for a lot of merchants, however some merchants may need entry to extra markets.

Ava WebTrader platform is rather well designed

| Options | Professionals | Cons |

A simple and absolutely digitalized course of to open an accountNo deposit and withdrawal chargesOne cease store register and deposit cell platformValue alerts on AvaTradeGoAvaProtect possibility for safer buying and selling5 base currenciesNet platform pleasant and nicely designed, however not customizable$100 minimal depositAvaOptions platform inside AvaTradeGo for CellularCFDs for cryptocurrencies |

$zero withdrawal/deposit chargesLow CFD spreadsSimple account opening course ofSimple to entry internet platformAvaProtect order varietiesAvaTradeGo together with AvaOptions |

Restricted variety of buying and selling devicesOccasional crashes of AvaTradeGo platform$50/quarter inactivity chargesAdministration charges |

FXCM

Foreign exchange Capital Market which is abbreviated into FXCM is one other famend on-line retail dealer which began in 1999 and relies in UK, providing foreign exchange and CFDs. The account opening course of is fairly simple with this dealer and the standard of the training content material is kind of excessive. FXCM gives its personal buying and selling platform, the Buying and selling Station, which is FXCM’s proprietary platform and obtainable by way of desktop obtain, internet or cell machine. The Net platforms is clear and recent trying and the cell can be fairly straightforward to make use of, however lacks superior options. Though, the obtain model has some fairly good technical analysis instruments.

FXCM gives plenty of studying contents, reminiscent of video libraries, webinars, and so forth.

| Options | Professionals | Cons |

Covers corex, CFDs and cryptocurrency marketsAcademic content material is of top qualityQuick account opening course ofTotally digitalized opening course ofNice technical analysis instrumentsNo deposit/withdrawal charges and low buying and selling prices$50 cost for one 12 months of inactivityLow CFD spreadsUp to date information and calendar partAgain-testing and foreign exchange technique optimizationExcessive variety of orders, reminiscent of One-Cancel-Different (OCO), Good-Until-Date (GTD), Good-Until-Cancel (GTC), Rapid or Cancel (IOC) and Fill or Kill (FOK) |

Assured cease lossesHTML5 for MT5 EAsMinimal deposit for non-EU purchasers at $50Very low spreads on ActiveTraderKey buying and selling rangesForeign exchange technique optimizationTop quality training |

$50 dormant account chargesLow variety of base currencies, three restricted buying and selling merchandiseCellular platform not consumer pleasantNo worth alerts |

How you can Choose the Greatest Foreign exchange Buying and selling Platform for You

Foreign exchange brokers are available many shapes and kinds, with totally different gives and merchandise, as do merchants, which have totally different necessities. In case you don’t know what kind of dealer you might be, you need to undergo our dealer selecting information, to be able to make it simpler to select a dealer appropriate in your wants.

Somebody should first know themselves what kind of dealer they’re, earlier than selecting a dealer or a platform. Merchants who specialize on brief time period buying and selling and scalping can be higher off with an ECN dealer which gives low spreads throughout liquid occasions, reminiscent of Oanda or brokers who provide the cTrader platform. Merchants new within the enterprise may wish to go along with brokers that present prime quality training reminiscent of FXCM.

Merchants who commerce in a single day and need their positions protected whereas they’re asleep, may choose AvaTrade for the AvaProtect possibility. Frequent merchants ought to keep away from brokers with excessive buying and selling charges, however long run merchants, reminiscent of skilled ones which don’t thoughts such prices would fortunately pay for dealer with a variety of market {and professional} protection reminiscent of Dukascopy.