USD, EUR/USD, USD/JPY Worth Evaluation & InformationForeign money Volatility Stays Subdued Regardless of USD BreakoutUSD/JPY

USD, EUR/USD, USD/JPY Worth Evaluation & Information

- Foreign money Volatility Stays Subdued Regardless of USD Breakout

- USD/JPY Eyes 200DMA

- Euro Cracks 1.20

Foreign money Volatility Stays Subdued Regardless of USD Breakout

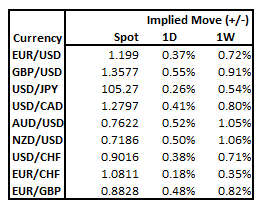

The US Greenback has continued its climb with the buck now firmly above the 91.00 deal with, which in flip has seen EUR/USD journey beneath the psychological 1.2000 degree. That stated, wanting on the choices market, implied volatility stays at comparatively subdued ranges, with the Euro 1-weekly implied volatility at a 43% 1-year percentile. As such, ought to USD upside persist, the transfer is more likely to be a drift increased versus a pointy acceleration. The desk beneath exhibits the implied each day and weekly % transfer. Of notice, there’s a decide up within the GBP vols given the Financial institution of England assembly.

Supply: Refinitiv, DailyFX

Implied Volatility: What’s it & Why Ought to Merchants Care?

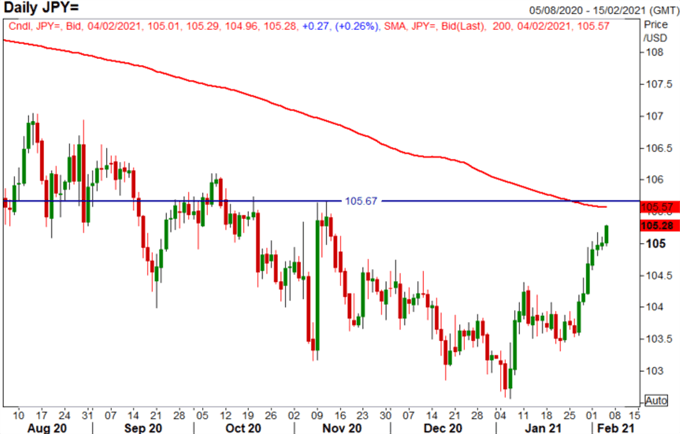

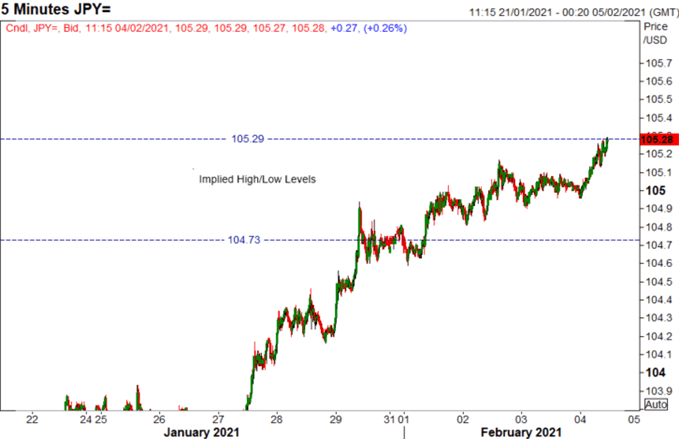

USD/JPY Eyes 200DMA

No matter main pair you’re looking at, it’s evident that the US Greenback is in restoration mode as key ranges break. USD/JPY has damaged by means of its downtrend and now edging in the direction of the 200DMA (105.57) the place the transfer increased has been underpinned by the rise in US yields. Needless to say USD/JPY is likely one of the most positively correlated main pairs with US Treasury yields. The primary actual check for this current uptrend will probably be resistance 105.55-65, which can immediate indicators of exhaustion.

USDJPY Chart: Day by day Time Body

Supply: Refinitiv

USD/JPY Implied volatility ranges

Supply: Refinitiv

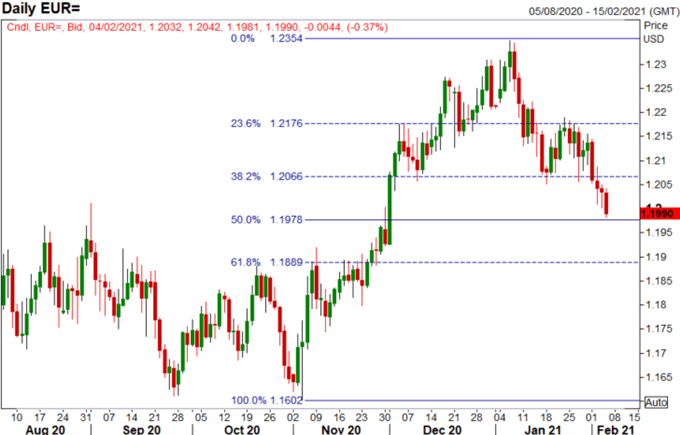

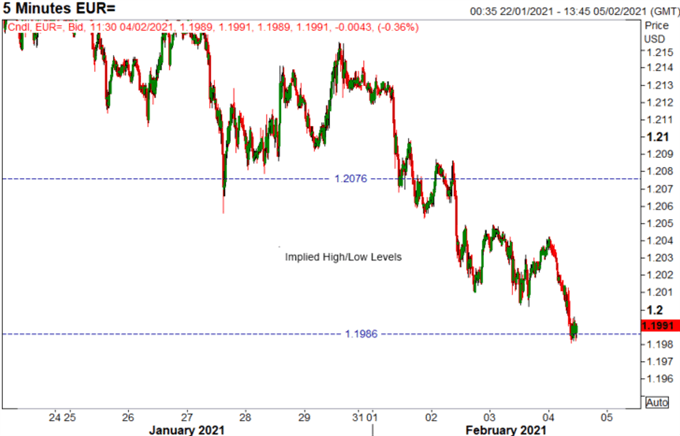

Euro Cracks 1.20

Going again the Euro, dangers stay tilted to the draw back, notably if there’s a shut beneath the 1.2000 deal with. Of notice, there’s round 1yard of possibility expiries at 1.2000-05, which in flip might even see spot worth magnetised across the 1.2000 deal with till the 10am New York lower off. Within the short-term help is located at 1.1978, marking the 50% Fibonacci retracement (Nov 2020-Jan 2021 rise). Taking a better have a look at the choice implied ranges, the Euro is at present holding the implied low 1.1986.

EUR/

USD Chart: Day by day Time Body

Supply: Refinitiv

EUR/USD Implied volatility ranges

Supply: Refinitiv