Yesterday markets calmed compared to Monday, while today volatility is expected to increase again due to the RBNZ rate cut, US GDP and Au

Yesterday markets calmed compared to Monday, while today volatility is expected to increase again due to the RBNZ rate cut, US GDP and Australian inflation.

The day started with the Bank of Japan Core CPI inflation report, which showed yet another slowdown, from 1.7% to 1.5%, against an increase of 1.8% expected. That raises the odds of a rate hike by the Bank of Japan, which supported the yen, sending USD/JPY 1.5 cents lower on the day.

In Europe, stock markets were trading sideways as risk sentiment remained damp, while in the US session the sentiment improved, sending the S&P 500 and Dow Jones to new record highs one again. The New Home Sales disappointed in the US, while CB Consumer Confidence showed another improvement, which further supported the USD.

Today’s Market Expectations

Attention is on the upcoming Personal Consumption Expenditures (PCE) index release, a critical measure of inflation that heavily influences Federal Reserve decisions. The headline PCE is projected to rise on an annual basis, climbing to 2.3% from the previous 2.1%, while the monthly rate is expected to remain steady at 0.2%. For core PCE, which excludes volatile food and energy prices, the year-over-year figure is anticipated to edge up to 2.8% from 2.7%, with the monthly rate holding at 0.3%. The second Q3 GDP reading is expected to remain unchanged at 2.8%.

The U.S. Jobless Claims report remains a vital gauge for assessing labor market conditions due to its timeliness and relevance in reflecting employment dynamics. This release is particularly important for understanding short-term trends and evaluating the state of the workforce. Initial jobless claims have maintained a relatively stable range between 200,000 and 260,000 since 2022, signaling a consistent labor market with minor fluctuations. This week, initial claims are expected to increase slightly to 217,000, compared to 213,000 recorded the previous week. Meanwhile, continuing claims, which have hovered near cyclical highs, are anticipated to rise marginally to 1,909,000 from last week’s 1,908,000. Despite these changes, the labor market shows little indication of significant strain.

Yesterday markets experienced some heightened volatility, which sent risk assets such a stock markets and commodity dollars higher initially, only to reverse lower again. As a result, traders got caught by the whipsaw in the price action. We opened 9 trading signals, ending the day with four winning forex signals and two losing ones.

Gold Finds Support at the 200 SMA

Gold experienced a $100 decline following Middle East peace talks yesterday but has since steadied above $2,600. The metal’s movement reflects lingering uncertainty, fueled by Donald Trump’s recent announcement of potential tariffs on imports from Canada, China, and Mexico. Solid U.S. economic data also contributed to gold’s consolidation. The market remains cautious as traders assess the implications of these trade developments.

XAU/USD – H4 Chart

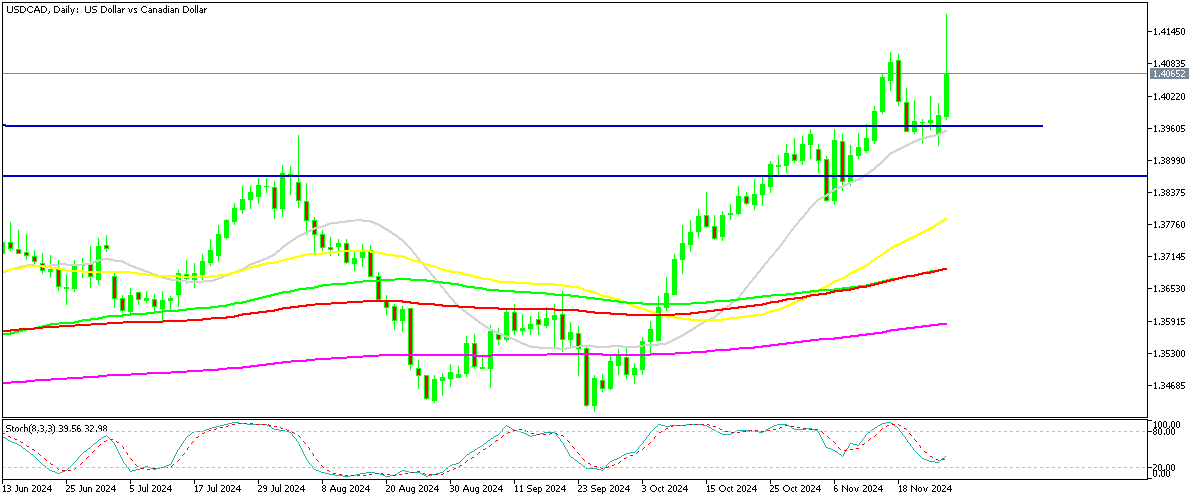

USD/CAD Bounces 2 Cents but Gives Back 1 Cent

The announcement of a 25% tariff on Canadian imports triggered a 2-cent spike in USD/CAD to a four-year high of 1.4177. However, as markets absorbed the information, the pair retreated below 1.41, erasing half of its earlier gains. While the initial reaction was sharp, sentiment has since improved, with U.S. indices recovering and stock markets turning positive.

USD/CAD – Daily Chart

Cryptocurrency Update

Bitcoin Within Touch of 100K

BTC/USD – Daily chart

Ethereum Bounces Off the $3,000 Level

Ethereum mirrored Bitcoin’s volatility, briefly falling below $2,500 before rallying to $3,450. Bitcoin also managed to reclaim its 50-day simple moving average (SMA), signaling renewed technical strength. These rebounds highlight improved investor confidence and point to a positive outlook for the broader digital asset market, even as cryptocurrencies remain sensitive to market dynamics.

ETH/USD – Daily chart

www.fxleaders.com