The Monday After....The US jobs report on Friday showed non-farm payroll rising much more than expectations at 272K vs 185K estimate. Average yearly e

The Monday After….

The US jobs report on Friday showed non-farm payroll rising much more than expectations at 272K vs 185K estimate. Average yearly earnings were higher as well (+0.4% vs 0.3% estimate). However, the household survey actually showed a decline of around -400K jobs. That helped to increase the unemployment rate of 4% above expectations of 3.9%.

Nevertheless, on Friday yields moved sharply higher. The USD moved higher. Gold tumbled as did silver. Stocks were down but not by much.

It was “The Monday After”today and the EURUSD continued its move to the downside after gapping lower. Admittedly, it was held by the weekend EU elections which showed a weakening of the right.

- France’s President Macron called a snap election.

- Yields in the EU moved higher.

However technically, support held in the EURUSD pair between 1.0722 and 1.0735. Buyers in the EURUSD entered after the 2nd try lower could not muster support below the low of the target (the low reached 1.0732).

Buyers pushed the price of the EURUSD back above the 50% midpoint of the move up from the April low to the May high. That level comes in at 1.07588. The price is trading at 1.0761 going into the close.

Going forward, on more momentum into the new trading day, the 200-day moving average at 1.0754 will be a key target. However, I would expect sellers to lean against the level on the first test at least (with stops on a momentum move above) whom.

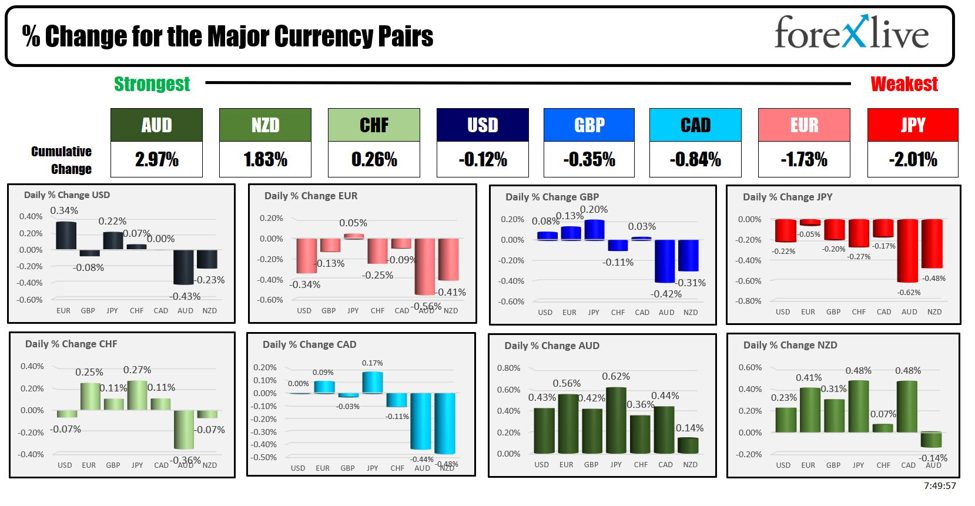

Looking at the major currency pairs today, the AUD is ending the day as the strongest of the major currencies (followed by the NZD). THe JPY and EUR are the weakest.

The AUD and the NZD got their strength as a result of the reversal of commodities like gold (it fell -2.45% on Friday, and rebounded 0.69% today), silver (down -6.817% on Friday, and rebounded 1.80% today. Copper futures also rose by 1.46%, and oil advanced by 2.36%. When commodities rise it can have a positive impact on both the AUD and the NZD. Ironically, the CAD fell today vs the major currencies despite the rise in the price of oil. Go figure.

Overall, the USD was mixed today with gains versus the EUR, JPY, CHF and declines versus the AUD, NZD and GBP.

Yields continued its move to the upside today. A NY Fed consumer survey showed that the 1-year inflation expectations dipped slightly to 3.2% from 3.3%, but the 5-year survey showed a rise to 3.0% from 2.8% last month. What helped to keep yields elevated was the three year note auction which was met with below average demand. The U.S. Treasury will auction off 10-year and 30-year coupon issues on Tuesday and Thursday respectively (before and after the FOMC rate decision on Wednesday). The sloppy auction is a bad omen for those auctions.

A snapshot of the levels across the yield curve shows:

- 2 year yield 4.84%, +1.5 basis points

- 5-year yield 4.43%, +3.2 basis points

- 10 year yield 4.467%, +3.9 basis points

- 30-year yield 4.595%, +4.8 basis points

www.forexlive.com