Markets:

- Gold up $9 to $1846

- US 10-year yields up 6.7 bps to 2.91%

- WTI crude oil up 6-cents to $114.73

- S&P 500 down 31 points to 4101

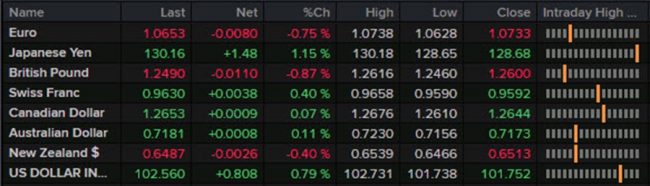

- CHF leads, JPY lags

The yen once again finds itself struggling in almost every environment. Today it was a risk-off mood driven by rising yields and the yen slumped across the board. It’s the third straight day of heavy yen selling after a six-week-long respite. The rally leaves it about 130 pips from the May 9 multi-year high and that’s something to watch this week.

The UK is headed for a two-day holiday starting on Thursday so cable trading was rushed. There was someone determined to sell ahead of the London close as wave after wave took the pair down 115 pips on the day in what had previously been flat trading. After London headed home, there was a small bounce then sideways trade.

The euro tracked cable lower in what was a broad USD-move but that also peaked right at the London close.

The commodity currencies were taken for a bit of a ride. AUD/USD hit a session high in a quick 30-pip rally early in New York trade but gave it back even more quickly. The move came at the same time as the data and BOC decision. It’s tough to sift through that and see a real catalyst though. Yes, the ISM data was hot and the BOC was a bit more hawkish but there wasn’t anything there to prompt a big rethink.

The BOC 50 bps hike was totally expected but the statement did say they were prepared to act forcefully. That’s a hint at another 50 bps to come, though it had the usual conditions. That wasn’t in the previous statement but it’s something Macklem has been saying so this was more of a formalization than a shift. CAD managed to hang with the dollar all day but it was a chop in an 80-pip range.

www.forexlive.com