It was Friday the 13th but the day was not a scary one for the markets. After sharp declines in the US stocks, bond yields and crypto coming into the day, today saw stocks rebound, yields moved back higher and bitcoin even rallied.

Fundamentally, however, there was a scare as the UMichigan preliminary consumer sentiment tumbled to 59.1 vs 64.0 estimate. That was the lowest level in 10 years.

Looking at the components they 2 showed weakness with current conditions in the expectations both falling sharply and inflation expectations remaining steady at high levels:

- Current conditions 63.6 vs 70.5 expected

- Expectations 56.3 vs 63.0 expected

- 1-year inflation expectations 5.4% vs 5.4% prior

- 5-10 year inflation expectations 3.0% vs 3.0% prior

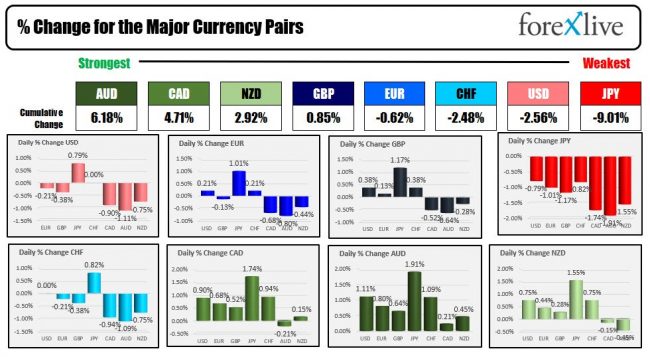

In the forex market today, the USD retraced some of the gains seen of late. The greenback moved lower vs. all the major currencies with the exception of the JPY.

The AUD, CAD and NZD were the strongest of the majors

Majors

There are hundreds of different currency pairs and crosses that can be traded. Major currency pairs or majors represent the most liquid pairs and widely traded. These include the EUR/USD, USD/JPY, GBP/USD, and USD/CHF.The reason for the popularity in these trading pairs are obvious, given they include currencies of some of the world’s most important economic centers. Additionally, these currencies comprising majors also constitute a significant share of global economic transactions.The US dollar, euro, Japanese yen, British pound, and Swiss franc are all amongst the top traded currencies worldwide. The EUR/USD alone is the world’s most widely traded currency pair, representing approximately 20% of all foreign exchange transactions.Why Retail Traders Prefer MajorsMajors are a ubiquitous offering amongst retail forex brokers and represent their most traded currency pairs. They are the most liquid and also usually possess the lowest spreads during normal trading periods.This differs from exotic pairs, which typically have lower volume or liquidity and thus have higher spreads. Majors trade engage in high volumes relative to minor or exotic pairs, which means that traders can seamlessly enter and exit the market, even with large position sizes. Another advantage of trading majors is the reduction in slippage that traditionally occurs with such trades. High volumes equate to higher numbers of traders willing to buy or sell at a given time. Consequently, there is a reduced chance of or smaller amount of slippage, which is an extremely sensitive issue amongst retail forex traders. These factors in turn ensure that majors are amongst the most traded currency pairs, especially in the retail space.

There are hundreds of different currency pairs and crosses that can be traded. Major currency pairs or majors represent the most liquid pairs and widely traded. These include the EUR/USD, USD/JPY, GBP/USD, and USD/CHF.The reason for the popularity in these trading pairs are obvious, given they include currencies of some of the world’s most important economic centers. Additionally, these currencies comprising majors also constitute a significant share of global economic transactions.The US dollar, euro, Japanese yen, British pound, and Swiss franc are all amongst the top traded currencies worldwide. The EUR/USD alone is the world’s most widely traded currency pair, representing approximately 20% of all foreign exchange transactions.Why Retail Traders Prefer MajorsMajors are a ubiquitous offering amongst retail forex brokers and represent their most traded currency pairs. They are the most liquid and also usually possess the lowest spreads during normal trading periods.This differs from exotic pairs, which typically have lower volume or liquidity and thus have higher spreads. Majors trade engage in high volumes relative to minor or exotic pairs, which means that traders can seamlessly enter and exit the market, even with large position sizes. Another advantage of trading majors is the reduction in slippage that traditionally occurs with such trades. High volumes equate to higher numbers of traders willing to buy or sell at a given time. Consequently, there is a reduced chance of or smaller amount of slippage, which is an extremely sensitive issue amongst retail forex traders. These factors in turn ensure that majors are amongst the most traded currency pairs, especially in the retail space.

Read this Term as risk on sentiment increased. The JPY – which traded to yet another 20 year high on Monday before reversing to the downside on Tuesday to Thursday, rebounded back higher today on the increased risk tone and exit out of the relative safety of the JPY

JPY

The Japanese yen (JPY) is the official currency of Japan and at the time of writing is the third most-traded currency in the world behind only the US dollar and euro.The JPY is used extensively as a reserve currency and is relied upon by forex traders as a safe haven currency.Originally implemented in 1871, the JPY has had a long history and has survived multiple world wars and other events. This was followed by the creation of the Bank of Japan (BoJ) in 1882 and the full oversight of the JPY by the Japanese government only in 1971.Japan has historically maintained a policy of currency intervention, continuing to this day. The BoJ also adheres to a policy of zero to near-zero interest rates and the Japanese government has previously had a strict anti-inflation policyWhat Factors Affect the JPY?The aforementioned role of the BoJ has dramatically shaped the JPY in forex markets. Any further changes in monetary policy by the central bank are closely watched by forex traders.Additionally, the Overnight Call Rate is the key short-term inter-bank rate. The BoJ utilizes the call rate to signal monetary policy changes, which in turn impact the JPY.The BoJ also purchases both 10- and 20-year Japanese government bonds (JGBs) on a monthly basis in order to inject liquidity into the monetary system. The consequent yield on the benchmark 10-year JGBs helps serve as a key indicator of long-term interest rates.Economic data is also very important to the JPY. The most important of these releases in Japan are gross domestic product (GDP), the Tankan survey (quarterly business sentiment and expectations survey), international trade, readings of unemployment, industrial production, and money supply (M2+CDs).

The Japanese yen (JPY) is the official currency of Japan and at the time of writing is the third most-traded currency in the world behind only the US dollar and euro.The JPY is used extensively as a reserve currency and is relied upon by forex traders as a safe haven currency.Originally implemented in 1871, the JPY has had a long history and has survived multiple world wars and other events. This was followed by the creation of the Bank of Japan (BoJ) in 1882 and the full oversight of the JPY by the Japanese government only in 1971.Japan has historically maintained a policy of currency intervention, continuing to this day. The BoJ also adheres to a policy of zero to near-zero interest rates and the Japanese government has previously had a strict anti-inflation policyWhat Factors Affect the JPY?The aforementioned role of the BoJ has dramatically shaped the JPY in forex markets. Any further changes in monetary policy by the central bank are closely watched by forex traders.Additionally, the Overnight Call Rate is the key short-term inter-bank rate. The BoJ utilizes the call rate to signal monetary policy changes, which in turn impact the JPY.The BoJ also purchases both 10- and 20-year Japanese government bonds (JGBs) on a monthly basis in order to inject liquidity into the monetary system. The consequent yield on the benchmark 10-year JGBs helps serve as a key indicator of long-term interest rates.Economic data is also very important to the JPY. The most important of these releases in Japan are gross domestic product (GDP), the Tankan survey (quarterly business sentiment and expectations survey), international trade, readings of unemployment, industrial production, and money supply (M2+CDs).

Read this Term.

In other markets:

- Spot gold fell another $10.89 -0.61% at $1811.72. The low price today did below the $1800 level for the 1st time since February 4. Last Friday, the price closed at $1882.99. The decline rate presents a 3.82% the fall for the current week.

- Silver rebounded today after the short fall this week. the spot level rose $0.41 or 2.06% $21.07. That compares to a close a week ago at $22.33. The $1.26 decline represents a -5.6% fall for the week.

- WTI crude oil futures are trading at $110.13 near the 5 PM level. That’s up around $4.03 on the day. The settlement price for the week was at $110.49

.

In the US stock market, the sentiment was more positive today after the S&P index got within a whisker of -20% from the all-time high during yesterday’s trade (at the low for the week, they S&P was down -19.92%).

The gains today were led by the NASDAQ index which rose 3.82%. The NASDAQ index has been hit the hardest in the move down in 2022 with the index reaching a low of –31.48% from the all-time high at session lows yesterday. The broader NASDAQ and S&P index were still lower for the 6th consecutive week, while the Dow industrial average fell for the 7th consecutive week.

In trading today, the major indices all gapped higher and did not trade lower on the day which was a breath of fresh air.

In the US debt market, after declines from Monday’s highs into today’s trading, the yields along the yield curve saw a rebound back to the upside.

Fed members this week continued to stress that rates would go higher until they reached a more neutral level around 2.5%. With the current yield at 1.0%, that leaves room for at least another 150 basis points.

Most expressed the desire to raise ratees by 50 basis points the next 2 meetings. After that there is some debate.

Fed’s Bullard, the most hawkish of members, said this week that he would like to see to the Fed to tighten to 3.5% by the end of the year. Others are more in the 2.5% camp but would be willing to increase the rates if warranted.

This week, the CPI data showed a higher than expected increase (although the rate was lower from the previous month). With crude oil prices higher and gasoline price also moving higher ahead of the Memorial Day holiday, the hopes for relief from lower oil prices does not seem encouraging. That could lead to a more tight Fed, but could also lead to slower growth at the same time.

Hope you all have a good weekend. Thank you for your support.

www.forexlive.com