The markets started the NY session with the wall of worry and pain at high levels. The S&P was looking to open in bear market territory (-20

The markets started the NY session with the wall of worry and pain at high levels.

- The S&P was looking to open in bear market territory (-20%).

- The Nasdaq was down over 32% from it’s all time high.

- Yields were pumped even higher, as a weekend of mulling the CPI and what that might mean for the FOMC decision on Wednesday pointed more and more toward 75 basis points (do I hear 100?).

- The dollar was moving higher

- Bitcoin was reeling after a bitcoin lender Celcius announced over the weekend, they were closing down redemptions. Is the house of cards falling?

Things did not get any better as the day progressed.

- In the US stocks, the Nasdaq index traded below its 200 week MA for the first time since the pandemic. That 200 week MA comes in at at 10795 The low price reached 10775 before bouncing into the close to end at 10809.24. The 200 week MA will be a key barometer going forward into the Fed decision on Wednesday. The Nasdaq is down -33.3% from its all time high.

- For the S&P it is indeed closing in bear market territory at -22.18%. All the 11 sectors of the S&P are now down for the month. For today, the best performing sector was consumer staples at -2.18%. The worst performing sector was energy at -5.13%.. This was despite the price of crude oil moving up around $0.16. Good thing crude oil is not down on the day.

- The Vix volatility index moved to a 35.05% from 27.75% from Friday. Traders are looking for volatility to spike up to 40+ At least that is within shouting distance as traders start to panic a bit.

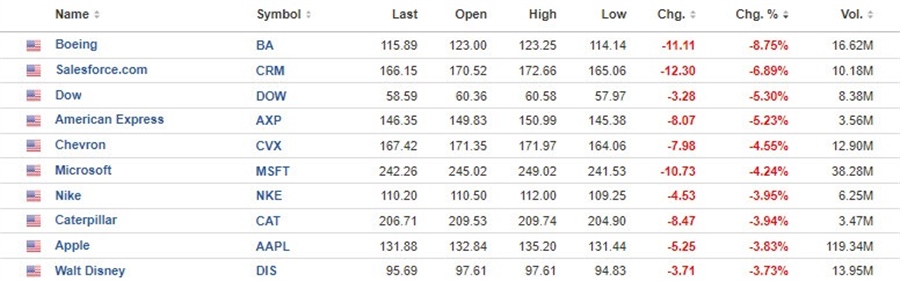

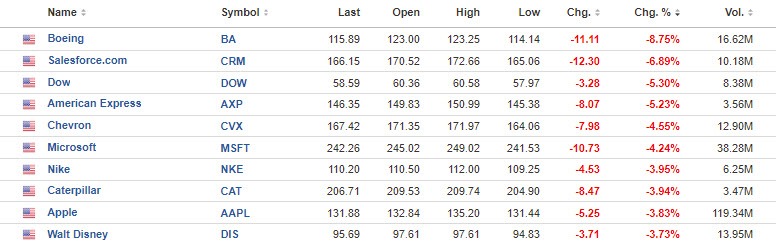

- McDonald’s was the only Dow stock that was positive for the day. at +1.16%. The top 10 Dow losers today looked like this:

- In the US debt market yields were up around 12 or so basis points at the start of the trading day. By the end of the day, the 2 year was up close to 30 basis points at 3.37% and at the highest level since November 2007. The 10 year yield is trading up 22 basis points at 3.379%. That’s its highest level since April 2011. The 2 – 10 year spread his back down within shouting distance of inverted for the 2nd time this year. Helping the move to the upside was a Wall Street Journal article saying “A string of troubling inflation reports in recent days is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected 0.75-percentage-point interest rate increase at their meeting this week,”. Since then, Barclays and J.P. Morgan have raised their expectations for a 75 basis point hike on Wednesday from 50 basis points.

In the forex, the USD moved higher against all the major currencies (including the JPY is a late day run higher in the USDJPY). The dollar moved to new session highs vs the EUR, GBP, CHF, CAD, AUD and NZD in the last hour or so of trading. The USD was virtually unchanged vs the JPY (as traders in times of trouble still move into the JPY), but rose from 0.92% (vs the CAD) and 1.8% (vs the AUD).

In other markets:

- spot gold fell $-51 or -2.74% to $1819.69

- SPot silver fell $-0.78 or -3.53% to $21.08

- WTI crude oil is trading up $0.16 or 0.13% at $120.83

- Bitcoin is off its low of $22,600, but is still sharply lower at $23,260

www.forexlive.com