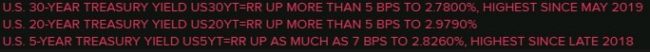

The 10 year US Treasury yield is higher, hitting 2.76% for the first time since pre-pandemic (back in early 2019). Yield gains were spread more widely too:

Speaking of yields, in China its 10-year yield fells below that for the US for the first time in 12 years (since 2010).

Otherwise it was an active session. EUR/USD traded to above 1.0930 in the very early hours of Monday (when it was only New Zealand FX active, and early for them even). The French presidential election was cited (round 1). Macron came out ahead in this vote, but it was very, very close and eyes will be on the April 24 second round of votes, the run-off for the presidency.

EUR/USD spent the balance of the session retracing this ‘gap’ to be very little net changed on the session as I post.

Other currencies have net lost ground against a strong US dollar. CAD has been further kicked by the fall in oil prices on Sunday evening US time futures trade.

- AUD, NZD, GBP, CHF are all down against the dollar on the session.

As is yen, with USD/JPY approaching, but not piercing, 125.00. Both Governor Kuroda and the official who heads up the monetary policy unit of the Bank of Japan reitereated today, in separate sets of comments, that the BOJ remains committed to its ultra-loose monetary policy and will ease even further if it sees fit.

The Shanghai COVID-19 outbreak worsened, cases mounted to new daily highs again over the weekend, for the two days in succession. Food shortages continue, as do widespread protests. There is no end to the lockdown of the city in sight. Jilin remains in its month-long+ lockdown. Cases are rising in Guangzhou.

www.forexlive.com