The market is grappling with a few, sometimes conflicting themes at the same time today.1) Hopes for a Russia-Ukraine ceasefireUkraine said its negoti

The market is grappling with a few, sometimes conflicting themes at the same time today.

1) Hopes for a Russia-Ukraine ceasefire

Ukraine said its negotiating stance hasn’t changed but I wouldn’t expect them to concede anything publicly so I don’t think that’s a tell.

What was more constructive was a comment from Ukranian negotiator Mykhailo Podolyak who said:

“I think that we will achieve some results literally in a matter of days.”

Russian negotiator Leonid Slutsky was equally optimistic: “According to my personal expectations, this progress may grow in the

coming days into a joint position of both delegations, into documents

for signing.”

There’s a good question about whether a ceasefire materially lowers commodity prices because of the harsh sanctions but at the same time. Russia is opening up direct currency trading with India and there are no Russian sanctions so those are two export markets with nearly half the globe’s population.

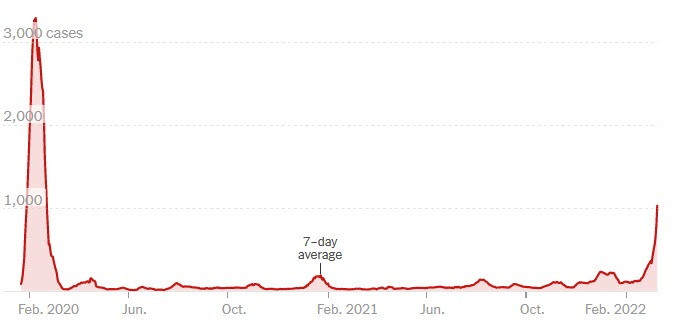

2) China lockdowns

The covid risk in China is one that I’ve highlighted for months. It’s come into focus with lockdowns in Shenzhen, Shanghai and the entire province of Jilin.

The market was hit by a headline that Foxconn had shut down iPhone production. The hope for now is that it will be a short-term problem that’s quickly resolved. The lockdowns are scheduled to end on March 20 but we’ve all seen how these things can go sideways. The good news (so far) is that the ports are still open.

3) Iran strikes on Iraq

Iran’s national guard claimed responsibility for strikes against Erbil with a US complex nearby. The moves could help to scuttle an Iran nuclear deal. Russia is also proving to be a roadblock as it wants to ensure that its trade with Iran isn’t sanctioned. Ultimately I think this deal still gets done because the US and Iran want that to happen but others strongly disagree. But despite this, WTI crude oil is down 4% today in a sign that China closures and hopes for Russian peace are the larger drivers.

4) Fed week

Bonds aren’t in a good place. US 2-year yields are up 7 bps to 1.815% with similar-sized moves all the way out the curve. The market is grappling with a continued onslaught of supply chain and inflationary news. The Fed has boxed itself into 25 bps this meeting and the market shows just a 7% chance of 50 bps but the odds of a faster pace of hikes at the May 4 or June 15 meeting are growing.

The FOMC decision is on Wednesday.

www.forexlive.com