S&P 500 Worth Outlook:S&P 500 Forecast: Fund Flows Reveal Tech, Treasury and Gold Weak pointThe S&P 500, Nasdaq 100 a

S&P 500 Worth Outlook:

S&P 500 Forecast: Fund Flows Reveal Tech, Treasury and Gold Weak point

The S&P 500, Nasdaq 100 and Dow Jones have been subjected to appreciable volatility to begin the month as every index negotiates both elementary headwinds or technical ranges of notice. Whereas US Treasury yields have slowed their ascent, ETF flows reveal buyers are nonetheless hesitant to pile into a few of the lately weak areas of the market like tech shares, US Treasuries and gold.

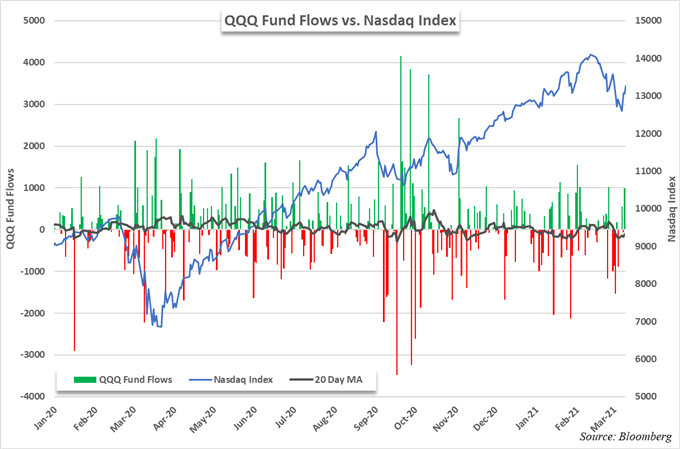

Nasdaq-Monitoring ETF Sees Outflows on Common

To that finish, trade traded fund movement knowledge reveals withdrawals from the Nasdaq-tracking QQQ ETF proceed to outpace inflows though current classes have seen buyers wade again into the fund. Within the year-to-date, nevertheless, QQQ has seen practically $3.2 billion go away its coffers. The index has gained practically 3% in the identical interval, however additional demand could be required earlier than the Nasdaq 100 can look to proceed its upward trajectory over the longer-term.

Advisable by Peter Hanks

Commerce FX with Your Inventory Buying and selling Technique

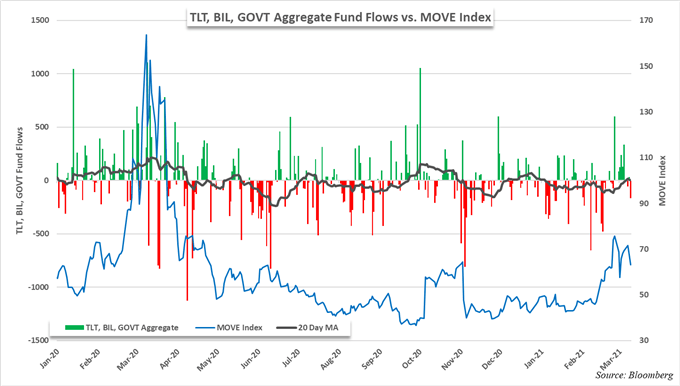

Buyers Take a look at the Waters in US Treasury-Monitoring ETFs

Alternate traded funds that monitor US Treasuries are in an analogous state of affairs. Outflows have vastly outpaced inflows within the year-to-date and up to date classes have seen the development reverse considerably. Nonetheless, the 20-day transferring common stays destructive whilst US Treasury yields tread water round current ranges.

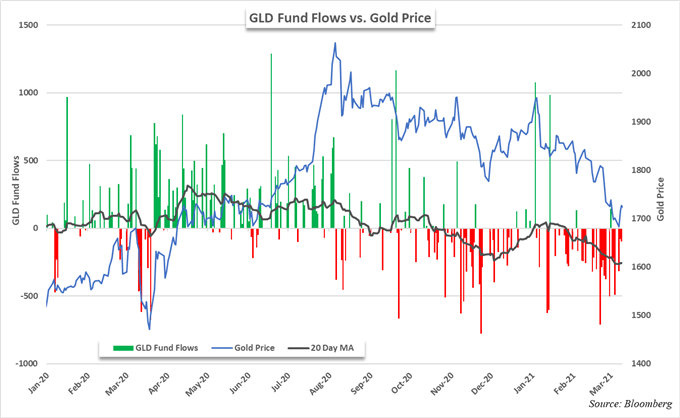

Gold Continues to Clock Outflows as Losses Mount

Whereas tech shares and US Treasuries present indicators their fortunes may quickly shift, gold continues to see losses mount. Maybe unsurprisingly, the GLD ETF has endured a cataclysmic wave of withdrawals as greater than $6.2 billion has been pulled from the fund within the year-to-date. Whereas a pop larger within the shorter-term may materialize as gold seems to be to consolidate current losses, the constant stream of outflows may counsel gold will proceed decrease within the longer-term.

Within the meantime, comply with @PeterHanksFX on Twitter for updates and evaluation.

Advisable by Peter Hanks

Commerce Gold

–Written by Peter Hanks, Strategist for DailyFX.com

Contact and comply with Peter on Twitter @PeterHanksFX

https://www.dailyfx.com/schooling/understanding-the-stock-market/stock-sectors.html?ref-author=phanks&QPID=917701&CHID=9

aspect contained in the

aspect. That is most likely not what you meant to do!nn Load your software’s JavaScript bundle contained in the aspect as a substitute.www.dailyfx.com