Month-end buying and selling noticed Wall Avenue tip decrease on revenue taking however following document highs final week. T

Month-end buying and selling noticed Wall Avenue tip decrease on revenue taking however following document highs final week. Treasuries have been little modified. Chips have been taken off the desk as November got here to a detailed after a stellar month for shares that noticed double digit positive aspects and recent document highs final week. November had a document rally for the USA500 and Russell 2000, and the perfect efficiency for the USA30 since 1928. The USA100 evidenced its greatest November since 2001.

-

Sturdy begin for equities to the month in Asia – JPN225 up 1.3%.

-

Markit/Caixin Manufacturing PMI for China hit a decade excessive.

-

Japan’s studying was the very best since August final yr, which boosted restoration hopes.

-

Confidence that vaccination packages will assist to get the world financial system again on monitor helped to bolster threat urge for food and the US 10-year yield lifted 0.Three bp to 0.84%. Moderna accomplished its COVID-19 immunization Section Three trial, confirming round 94% efficacy.

-

RBA vowed to do extra if wanted whereas stressing that the restoration will want substantial financial and financial assist to spice up employment and raise wages and inflation in the long run.

-

GER30 and UK100 are posting positive aspects of 0.4% and 0.1%.

-

NO signal of an settlement on the Brexit entrance and the ECB stays on track to ship further stimulus subsequent week.

-

The US Greenback and Yen retreated amid threat urge for food.

USD set to submit its worst month since July

-

EUR and GBP rising in opposition to a largely weaker USD

-

EUR – up at 1.1964, above PP with subsequent Resistance at 1.1980

-

GBP – spiked to 1.3392, retesting 3-month peak once more.

-

JPY – barely decrease after yesterday’s peak at 104.45

-

CAD – resuming a fall from 1.300, subsequent Assist at 1.2945 and 1.2922

-

AUD – comfortably above 0.7300. Presently above PP at 0.7365 with R1 at 0.7385

-

USOIL – regular on the $44-$45 space as OPEC+ continues to debate an extension of output cuts, with out an settlement to date. Will now meet once more on Thursday

-

GOLD – resuming some positive aspects at $1770 – Presently at $1788 space

-

BITCOIN – new excessive at 19,855

Right now – Right now’s Eurozone HICP studying for November might shock on the draw back after weaker German numbers yesterday, which might solely add to the arguments of the dovish camp in Frankfurt. Closing manufacturing PMI readings for the Eurozone and the UK in the meantime are more likely to affirm that the manufacturing sector not less than continues to profit from the continuing restoration in main export markets resembling China. The US ISM manufacturing index is anticipated to ease. Chair Powell will testify on the CARES Act on Capitol Hill, to the Senate Banking Committee.

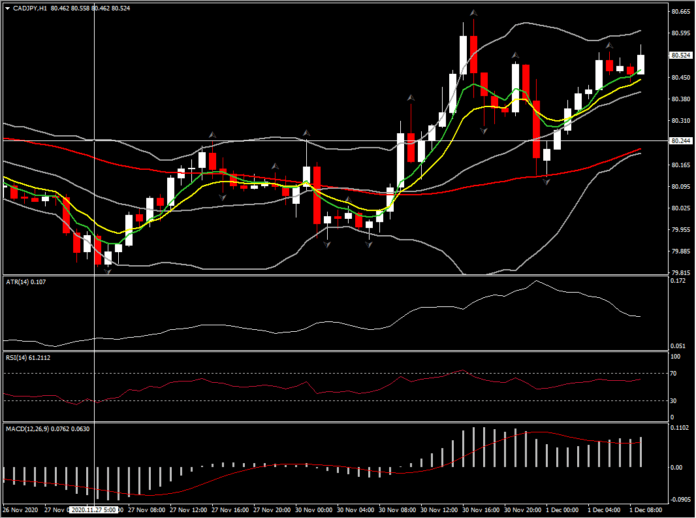

Greatest (FX) Mover – CADJPY up at 0.45% – The asset prolonged its rally to 80.35 with intraday momentum indicators pointing additional northwards. The quick MAs resumed the incline with RSI at 61 and MACD posted a bullish cross. Nevertheless the asset stays under November’s peak at 81.45. H1 ATR 0.107, Day by day ATR 0.538.