British Pound Outlook:The British Pound’s sturdy efficiency firstly of 2021 was derailed in current weeks, however worth motion by way of the fli

British Pound Outlook:

- The British Pound’s sturdy efficiency firstly of 2021 was derailed in current weeks, however worth motion by way of the flip of April means that higher days could also be forward.

- Each GBP/CAD and GBP/NZD made significant technical reversals on Monday, whereas GBP/AUD proceed to raise itself away from current vary assist.

- Based on the IG Consumer Sentiment Index, the British Pound has a bullish bias.

Commodity Foreign money GBP-crosses Regaining Upside Momentum

The British Pound’s sturdy efficiency firstly of 2021 was derailed in current weeks, thanks partially to considerations round potential slowdowns in vaccine provides and thus vaccination charges. Alas, because of stability in UK Gilt yields – experiencing much less draw back than a few of their developed market counterparts – the British Pound stays basically well-positioned, all-in-all.

The technical facet of the equation has began to replicate the altering fundamentals too. Certainly, price motion by way of the flip of April means that higher days could also be forward. Each GBP/CAD and GBP/NZD made significant technical reversals on Monday, whereas GBP/AUD proceed to raise itself away from current vary assist.

Learn extra: Weekly Basic British Pound Forecast: Sterling In search of Semblance of Stability

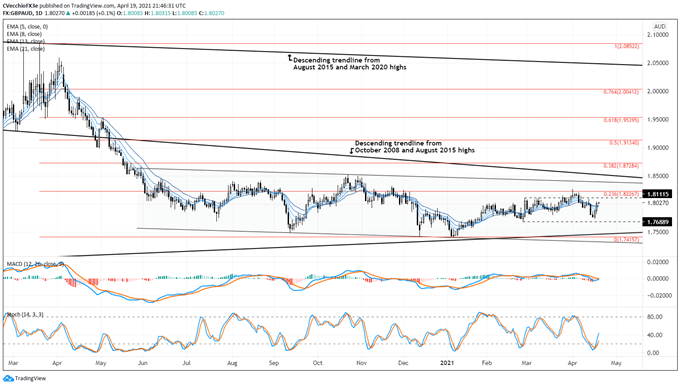

GBP/AUD RATE TECHNICAL ANALYSIS: DAILY CHART (January 2020 to April 2021) (CHART 1)

GBP/AUD has remained steady since early-March, barely breaking the February excessive (1.8112) for a couple of days whereas by no means cracking the February low (1.7689). And whereas the trendless worth motion continues, a sequence of ‘greater highs and better lows’ has been carved out in January, February, and now April. But additionally it is true that the pair failed to interrupt by way of the 23.6% Fibonacci retracement of the 2020 excessive/2021 low vary at 1.8227; retrospectively, the realm round 1.8327 has proved resistance since November 2020.

Provided that GBP/AUD stays trapped in a barely descending parallel channel relationship again to late-Might 2020, it nonetheless holds that “the pair appears to be like destined to remain rangebound for the foreseeable future; higher alternatives could come up elsewhere amongst GBP-crosses within the subsequent week.”

Beneficial by Christopher Vecchio, CFA

Constructing Confidence in Buying and selling

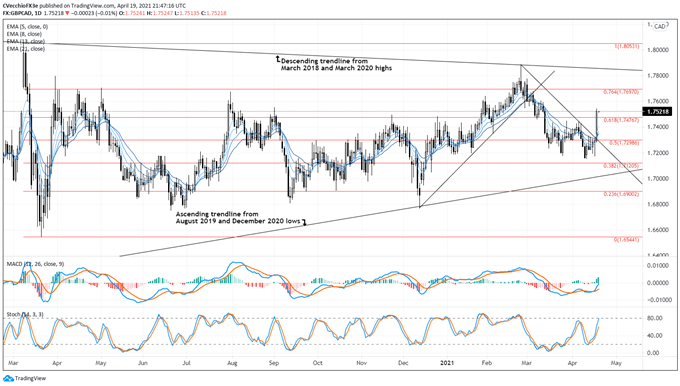

GBP/CAD RATE TECHNICAL ANALYSIS: DAILY CHART (February 2020 to April 2021) (CHART 2)

GBP/CAD is as soon as once more essentially the most energetic commodity forex GBP-crosses, having vigorously damaged by way of the downtrend from the late-February and early-April swing highs, all of the whereas clearing out the 61.8% Fibonacci retracement (1.7477) to the topside. Bullish momentum is starting to rapidly collect tempo. GBP/CAD charges are above their day by day 5-, 8-, 13-, and 21-EMA envelope, which is now in bullish sequential order. Every day Gradual Stochastics have abruptly reached overbought territory, whereas day by day MACD has began to edge above its sign line. A transfer above the 61.8% retracement will increase the percentages of a steeper rally in direction of the 76.4% retracement at 1.7697 (earlier than an try on the yearly excessive as soon as extra).

Beneficial by Christopher Vecchio, CFA

Foreign exchange for Newbies

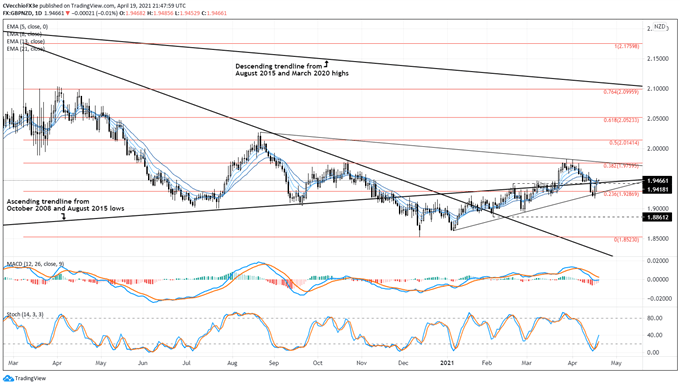

GBP/NZD RATE TECHNICAL ANALYSIS: DAILY CHART (January 2020 to April 2021) (CHART 3)

GBP/NZD’s worth motion on the finish of final week resolve itself in a day by day bullish key reversal on Friday, organising a rebound from the rising trendline from the January and March swing lows – yearly uptrend assist, in impact. The pair additionally was in a position to carve out assist close to the 23.6% Fibonacci retracement of the 2020 excessive/2021 low vary at 1.9287, all of the whereas retaking the ascending trendline from the October 2008 and August 2015 lows. It could be the case {that a} extra vital rally will emerge by way of the rest of the month in direction of the 38.2% retracement at 1.9760; a breach of this stage would additionally represent a break of potential symmetrical triangle resistance relationship again to the August 2020 swing excessive.

Beneficial by Christopher Vecchio, CFA

Get Your Free GBP Forecast

— Written by Christopher Vecchio, CFA, Senior Foreign money Strategist

aspect contained in the

aspect. That is most likely not what you meant to do!nn Load your software’s JavaScript bundle contained in the aspect as an alternative.www.dailyfx.com