Spencer Platt A Quick Take On GoDaddy GoDaddy (NYSE:GDDY) reported its Q3 2022 financial results on November 3, 2022, missing revenue but beating E

Spencer Platt

A Quick Take On GoDaddy

GoDaddy (NYSE:GDDY) reported its Q3 2022 financial results on November 3, 2022, missing revenue but beating EPS estimates.

The firm provides website hosting and related services worldwide.

GDDY’s growth is slowing, and management is noting the ‘pull-forward’ effects of the pandemic and now foreign exchange headwinds.

For the near term, I’m on Hold for GDDY.

GoDaddy Overview

Tempe, Arizona-based GoDaddy was founded in 2014 to provide a suite of website hosting services to organizations around the world.

The firm is headed by Chief Executive Officer Aman Bhutani, who was previously President, Brand Expedia Group, and Technology Senior Director at JPMorgan Chase.

The company’s primary offerings include:

-

Website Hosting

-

SSL Certificates

-

Website Creation Software

-

Digital Marketing

-

Business Applications

-

Payments

-

Search Engine Optimization

GDDY serves individuals, businesses, developers, and domain investors.

GoDaddy’s Market & Competition

According to a 2020 market research report by Grand View Research, the global market for web hosting services was an estimated $56.7 billion in 2019 and is forecast to reach $180 billion by 2027.

This represents a forecast strong CAGR of 15.5% from 2020 to 2027.

The main drivers for this expected growth are the growing number of individuals and companies seeking a web presence and an increased desire to perform more business functionality in the cloud.

Also, the onset of the COVID-19 pandemic has generated strong growth in Internet-based activity, providing a boost to the industry.

Major competitive or other industry participants include:

-

Automattic (MATIC)

-

Wix (WIX)

-

Weebly

-

Shopify (SHOP, SHOP:CA)

-

BigCommerce (BIGC)

-

Squarespace (SQSP)

-

MailChimp

-

MindBody

-

Others

GoDaddy’s Recent Financial Performance

-

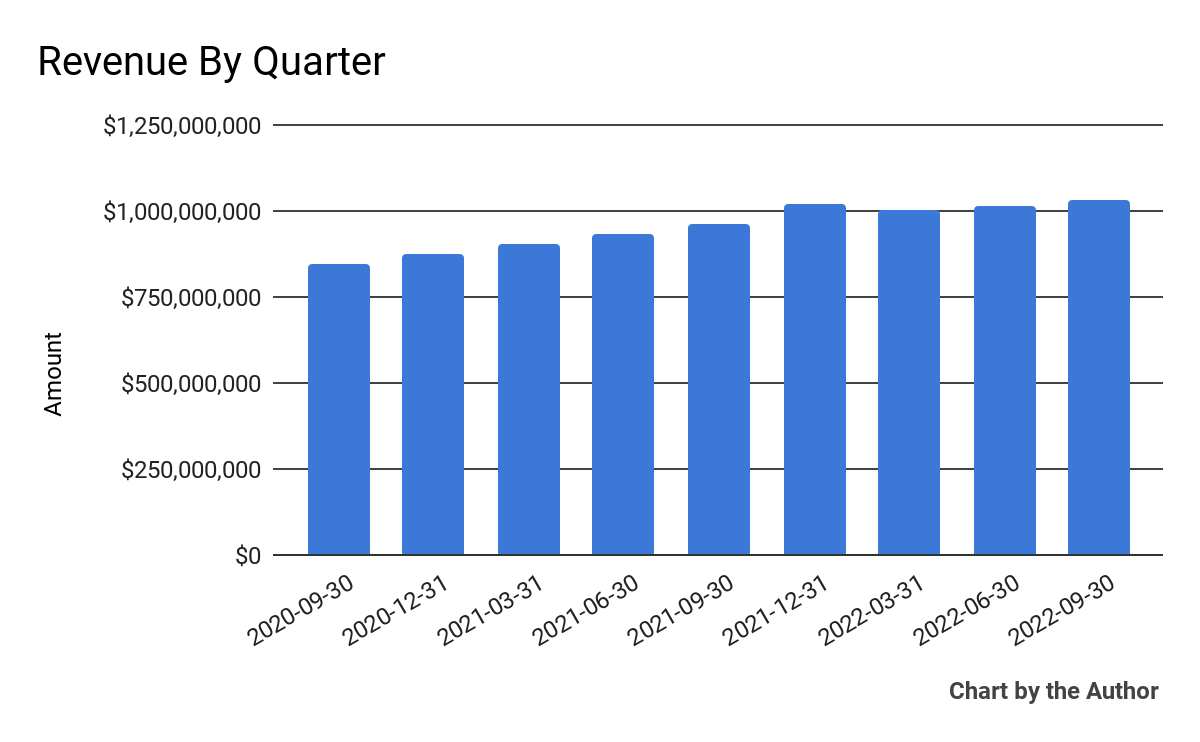

Total revenue by quarter has risen per the following chart:

9 Quarter Total Revenue (Financial Modeling Prep)

-

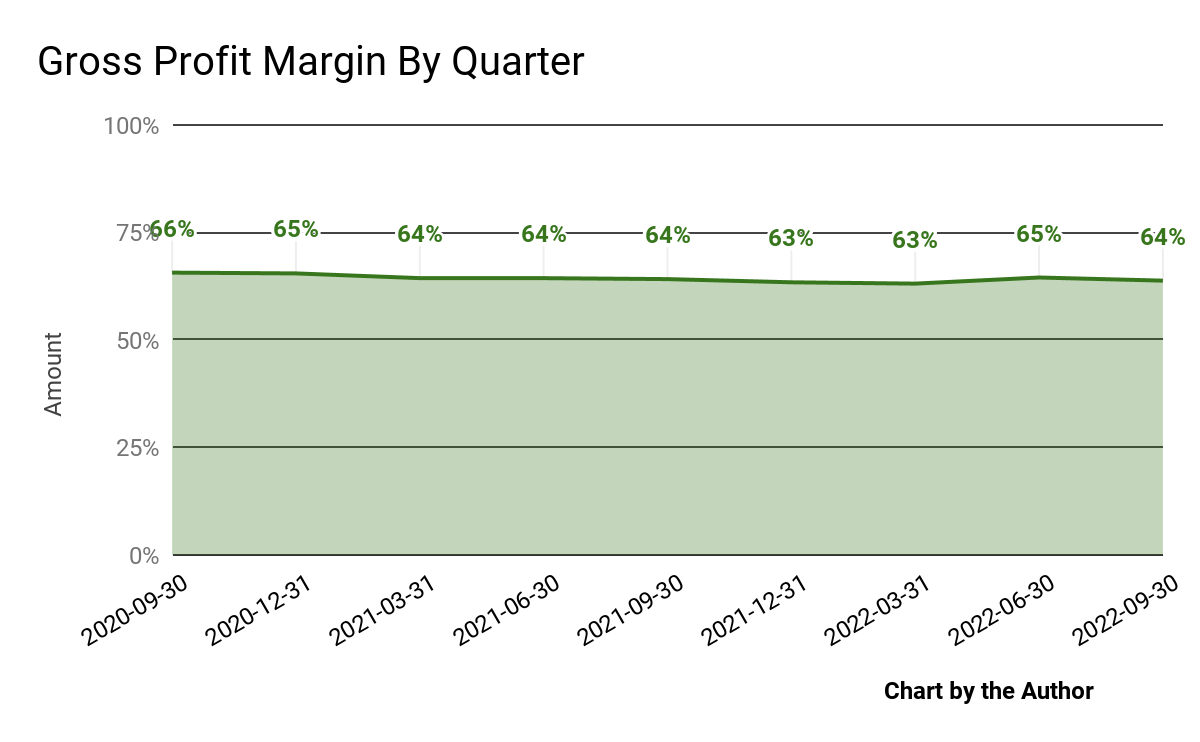

Gross profit margin by quarter has remained relatively flat, as shown below:

9 Quarter Gross Profit Margin (Financial Modeling Prep)

-

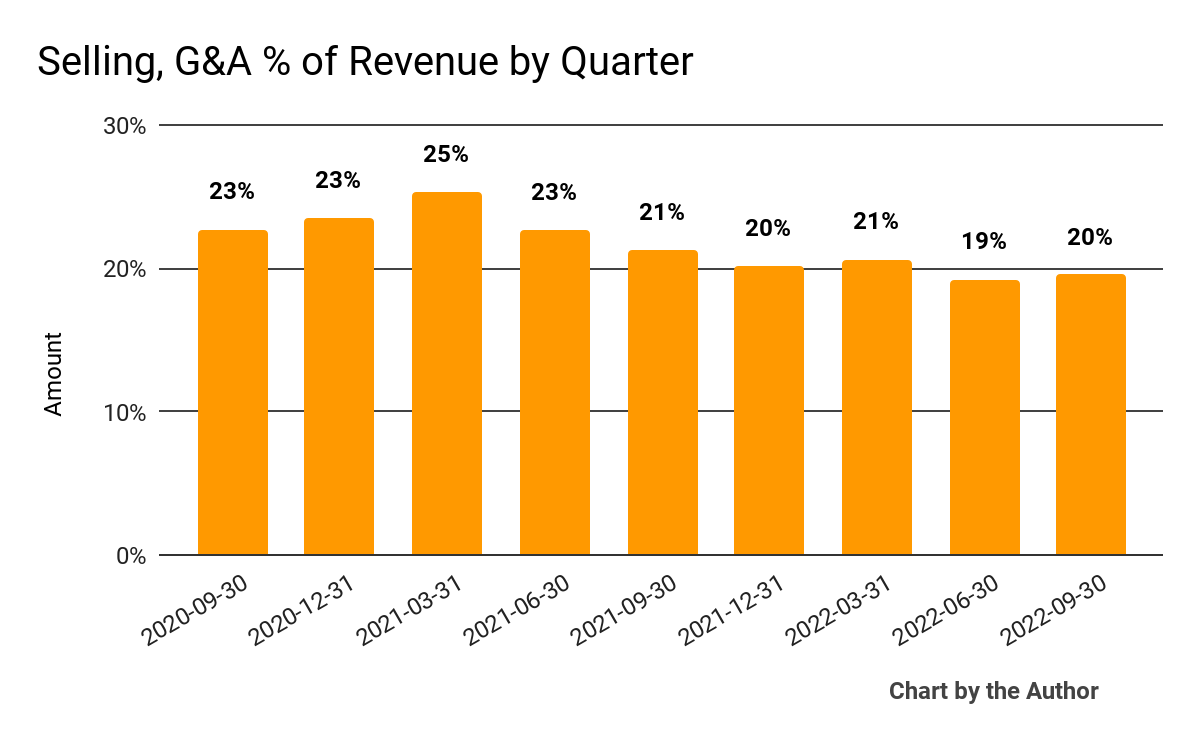

Selling, G&A expenses as a percentage of total revenue by quarter have trended lower in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Financial Modeling Prep)

-

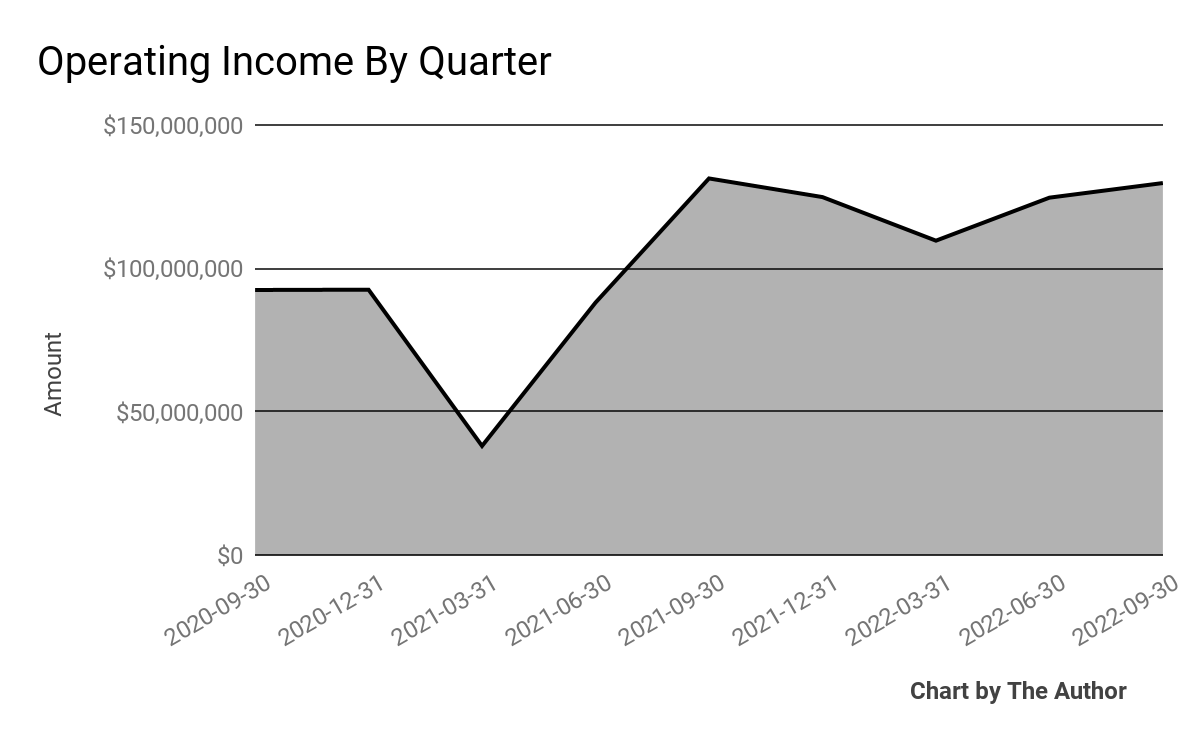

Operating income by quarter has risen more recently:

9 Quarter Operating Income (Financial Modeling Prep)

-

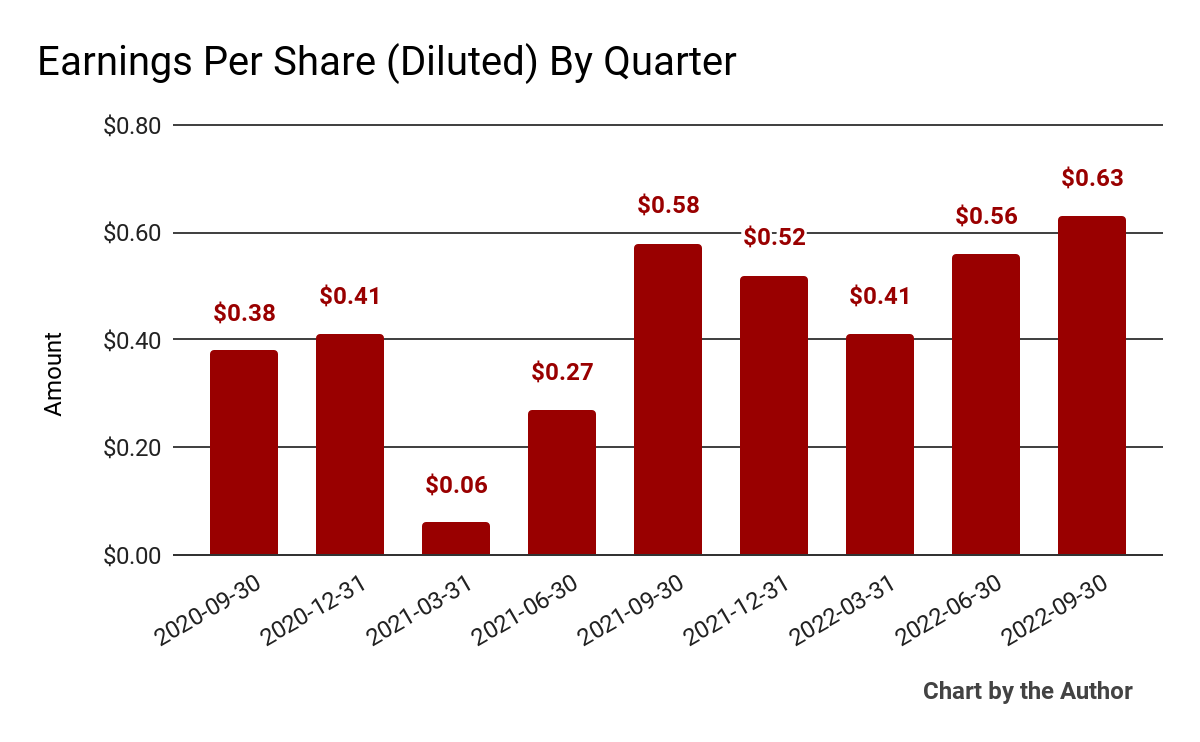

Earnings per share (Diluted) have reached their highest result in the most recent quarter:

9 Quarter Earnings Per Share (Financial Modeling Prep)

(All data in the above charts is GAAP)

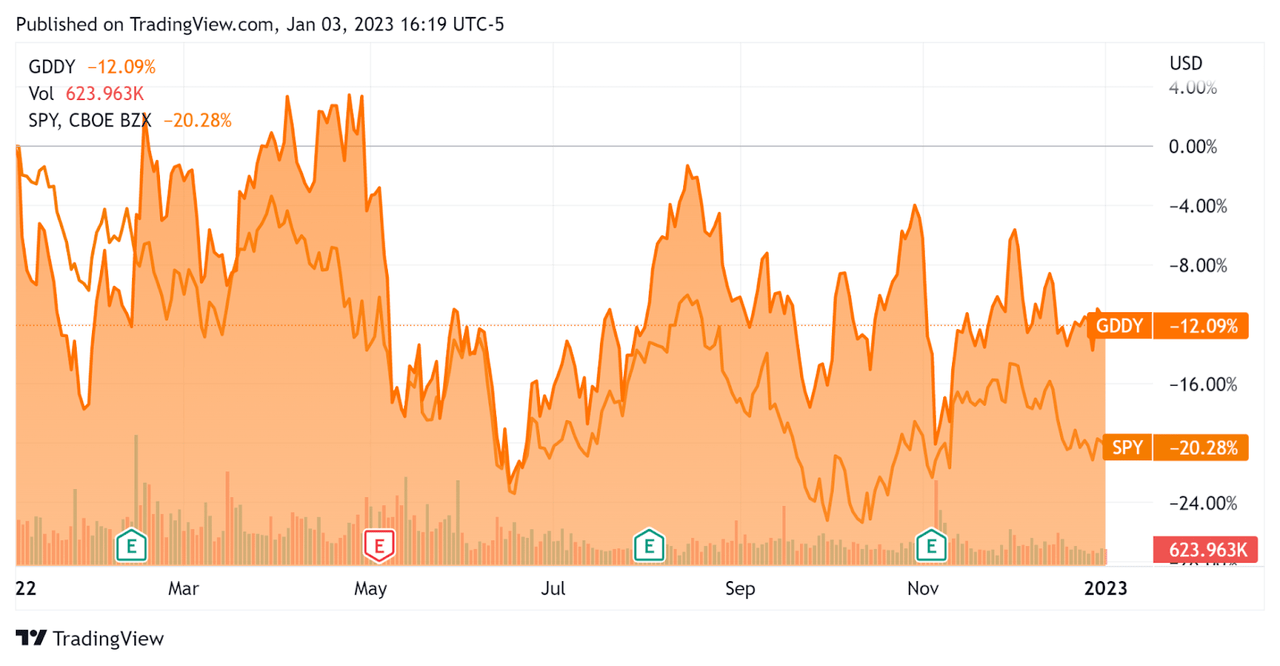

In the past 12 months, GDDY’s stock price has fallen 12.1% vs. the U.S. S&P 500 index’s drop of around 20.3%, as the chart below indicates:

52-Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For GoDaddy

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

3.7 |

|

Enterprise Value / EBITDA |

21.8 |

|

Revenue Growth Rate |

10.9% |

|

Net Income Margin |

8.5% |

|

GAAP EBITDA % |

16.8% |

|

Market Capitalization |

$11,712,547,840 |

|

Enterprise Value |

$14,895,724,260 |

|

Operating Cash Flow |

$943,900,000 |

|

Earnings Per Share (Fully Diluted) |

$2.12 |

(Source – Financial Modeling Prep)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

GDDY’s most recent GAAP Rule of 40 calculation was 27.7% as of Q3 2022, so the firm is in need of some improvement in this regard, per the table below:

|

Rule of 40 – GAAP [TTM] |

Calculation |

|

Recent Rev. Growth % |

10.9% |

|

GAAP EBITDA % |

16.8% |

|

Total |

27.7% |

(Source – Financial Modeling Prep)

Commentary On GoDaddy

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the foreign exchange headwinds the company is experiencing due to the strong US dollar as hampering revenue growth results somewhat.

Leadership also noted the evidence that the pandemic period resulted in a significant ‘pull-forward’ effect.

The firm has been attempting to expand its service offerings into commerce and payments to make up for the likely revenue trajectory disappointment as we exit the pandemic period.

As to its financial results, revenue rose 7% year-over-year on an as-reported basis versus 9% on a constant currency basis.

The company’s customer retention rate was 85%, which management characterized as ‘strong.’

The firm’s Rule of 40 results have been mediocre, with a tepid revenue result bested by a stronger operating result contributing to a figure for this metric that needs improvement.

Normalized EBITDA rose 15% due to management’s ‘continued discipline in spending.’

For the balance sheet, the firm finished the quarter with $1.129 billion in cash, equivalents, and trading asset securities and $3.87 billion in total debt.

Over the trailing twelve months, free cash flow was approximately $1.04 billion, of which capital expenditures accounted for $60.0 million.

Looking ahead, management guided full-year 2022 revenue growth to be around 7% on an as-reported basis.

The company intends to increase its borrowing capacity and refinance some of its existing loans to limit its exposure to further interest rate increases.

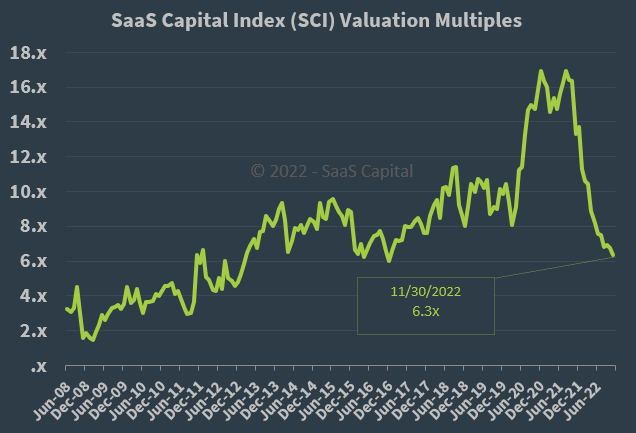

Regarding valuation, the market is valuing GDDY at an EV/Sales multiple of around 3.7x.

The SaaS Capital Index of publicly-held SaaS software companies showed an average forward EV/Revenue multiple of around 6.3x on November 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, GDDY is currently valued by the market at a significant discount to the broader SaaS Capital Index, at least as of November 30, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may produce lower conversion rates and reduce its revenue growth trajectory.

A potential upside catalyst to the stock could include a further uptake of its commerce and payments offerings.

With slow growth expected from management of around 2% in Q4 indicating a slowing environment, I’m not optimistic about GDDY’s near-term performance.

I’m on Hold for GDDY for the next few quarters.

news.google.com