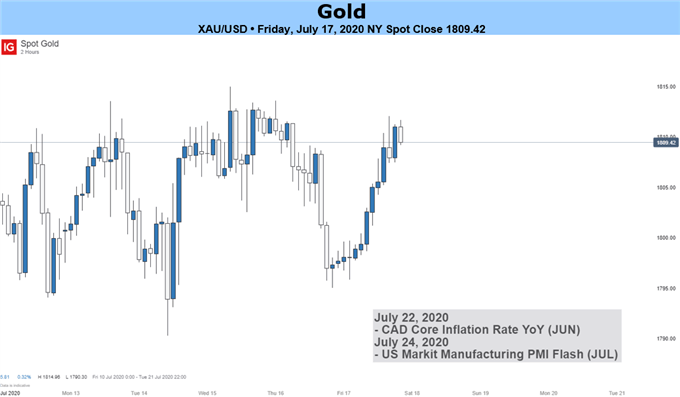

Supply: IG Charts GOLD FUNDAMENTAL HIGHLIGHTS:Gold Above $1800, What Subsequent?Gold Buoyed By Deeper Detrimental Actual YieldsF

Supply: IG Charts

GOLD FUNDAMENTAL HIGHLIGHTS:

- Gold Above $1800, What Subsequent?

- Gold Buoyed By Deeper Detrimental Actual Yields

- Fed Members Signalling Its Willingness to Run the Economic system Scorching

Gold Above $1800, What Subsequent?

Gold costs are on track for a 6th consecutive weekly achieve, the primary time in over a yr. Nevertheless, upside momentum has slowed with spot costs within the final week rising a marginal 0.5%. In flip, this raises the query that with $1800 breached, what subsequent?

{Gold}

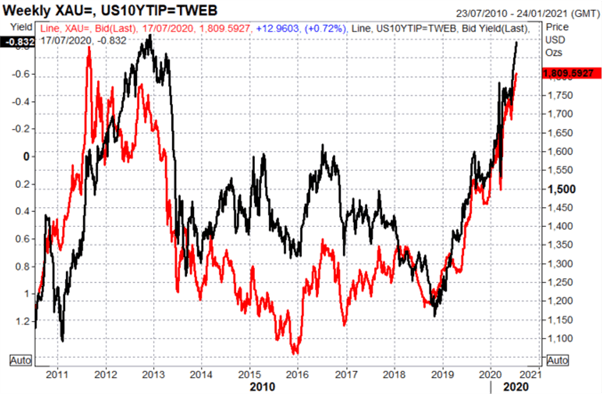

Final month we highlighted that US actual yields matter extra for gold than the US Greenback on its march to $1800, which to a big extent has been true with Gold hovering round 9yr highs. Because it stands, US actual yields (TIPS) have slipped beneath -0.8%, edging ever so nearer to 2012 lows of -0.9%. As such, gold stands to be probably the most notable beneficiary of actual yields shifting deeper into unfavourable territory, due to this fact signalling that buyers are unlikely to tug away from gold any time quickly.

| Change in | Longs | Shorts | OI |

| Every day | -10% | 19% | -2% |

| Weekly | -1% | 17% | 4% |

Gold Buoyed By Deeper Detrimental Actual Yields

Supply: Refinitiv, US 10yr TIPS Yield (Inv), Gold (RHS)

Fed Members Signalling Its Willingness to Run the Economic system Scorching

“With inflation exhibiting low sensitivity to labor market tightness, coverage mustn’t preemptively withdraw assist based mostly on a traditionally steeper Phillips curve that’s not at the moment in proof. As an alternative, coverage ought to search to realize employment outcomes with the type of breadth and depth that have been solely achieved late within the earlier restoration”

Fed’s Brainard, July 14th

A speech by Fed’s Brainard, who has been in favour of the Fed adopting yield-curve management (YCC) additional hints that stimulus measures are right here for the long term, permitting for the financial system to run sizzling, which in flip bodes effectively for the dear metallic. Nevertheless, the priority within the brief time period is the scale of the appreciation in gold for the reason that starting of the yr.

Financial Information Missing, Rising Virus Instances Stays a Concern

Looking forward to subsequent week, the fallout of the EU summit is more likely to set the tone to start the week. Nevertheless, whereas financial information is moderately muted all through nearly all of the week, the important thing focus shall be on the newest world PMI figures for July. Other than PMIs, exterior elements involving rising virus circumstances within the Southern US states are more likely to proceed garnering consideration as issues improve over potential state-wide lockdowns.

Gold Worth Chart: Weekly Time Body

Supply: IG Charts