The highlight this previous week in monetary markets gave the impression to be on treasured metals. Gold and silver costs soared

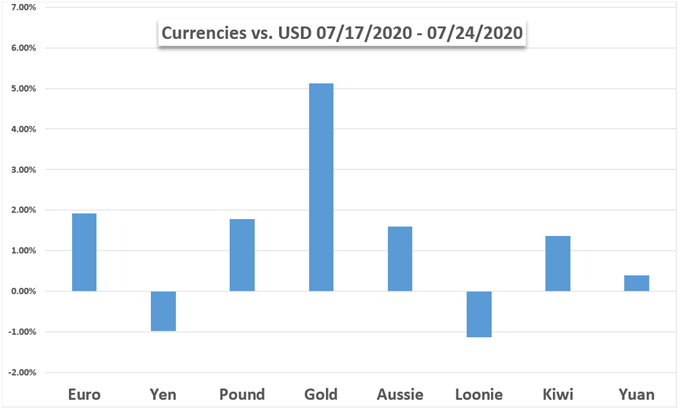

The highlight this previous week in monetary markets gave the impression to be on treasured metals. Gold and silver costs soared with the latter seeing the perfect week since 1998. That is because the haven-linked US Greenback skilled its worst week towards its main counterparts on common since early June. The Euro and growth-linked Australian Greenback soared, with the latter trimming a few of its features afterward.

Really helpful by Dimitri Zabelin

Are retail merchants leaning into momentum or combating it?

Market sentiment turned bitter into the top of final week, with the S&P 500, Dow Jones and Nasdaq Composite giving up features. Escalating US-China tensions over the closure of consulates, worse-then-expected US preliminary jobless claims and disappointing earnings from Microsoft (following Netflix’s dismal report earlier) appeared to have contributed to the pessimistic tone in market temper.

The latter could possibly be a sticking level for monetary markets in a jam-packed week of occasion danger forward. Tech firms resembling Amazon, Alphabet, Apple and Fb are releasing earnings studies, defending their comparatively elevated inventory valuations. Different extra industrial-oriented firms to be careful for embrace Boeing and Airbus.

Nations are poised to enter technical recessions forward. International locations like the USA, Germany, Spain and Italy will report second-quarter GDP. Understand that markets are ahead wanting, and a few of these prints could not come as a shock absent vital misses in expectations. All eyes flip to what’s anticipated to be extra stimulus from the US on the finish of the week.

Really helpful by Dimitri Zabelin

Don’t give into despair, make a sport plan

Uncover your buying and selling character to assist discover optimum types of analyzing monetary markets

Basic Forecasts:

Gold Worth Outlook Bullish on FOMC Price Determination & US Reduction Invoice

Gold costs could prolong their rally if the FOMC charge resolution and outlook reinforces the narrative of financial stabilization in tandem with progress on one other coronavirus aid invoice.

British Pound Forecast: GBP/USD Might Fall Amid Renewed ‘No Deal’ Brexit Fears

The basic outlook for the British Pound appears to be like comparatively bleak amid renewed ‘no deal’ Brexit issues and escalating UK-China tensions.

Nasdaq Might Fall as Valuation Stretched Shut To “Bubble” Degree

The Nasdaq inventory index could face a significant pullback within the weeks to return as traders eye profit-taking after a historic 41% rally within the three month by means of June 2020.

USD/JPY Weekly Outlook – Testing Multi-Month Lows because the US Greenback Slides

The Japanese Yen is ending the week on a really constructive be aware towards the US greenback, and trades under USD/JPY 106 in holiday-thinned circumstances.

US Greenback Ripe for Reversal: GDP, Fed, Earnings Increase Volatility Danger

The US Greenback could backside out in a jam-packed week of occasion danger that would rekindle market volatility. All eyes are on the Fed, US GDP, the earnings season and extra fiscal stimulus.

Euro Forecast: Outlook for EUR/USD Nonetheless Constructive However Beware Revenue-Taking

Having damaged above the 1.15 degree, EUR/USD is nicely positioned to problem the 1.1621 excessive reached in October 2018. Nonetheless, a pullback is feasible first after the pair’s latest robust features.

Technical Forecasts:

Oil Worth Forecast: Break Above June Excessive Knocks Out Bearish RSI Pattern

The value of oil could keep afloat going into the top of July because it clears the June excessive ($41.63), whereas the RSI seems to be breaking out of a bearish development.

EUR/USD Worth Forecast: Might Fall After Resistance Holds

This week, EUR/USD rallied to a multi-month excessive. Will the pair proceed bullish worth motion within the coming days?

US Greenback Forecast: Pivotal Week Forward, DXY at a Huge Spot

The Greenback decline might quickly come to a halt if main worth and development help can maintain, but when damaged a wider decline could also be underway.

S&P 500, FTSE 100 Technical Outlook For Subsequent Week

S&P 500 raises danger of wider pullback on bearish divergence, whereas FTSE 100 dangers breaking of vary.

Australian Greenback Outlook: AUD/USD Breakout Provides- Exhaustion Forward?

Australian Greenback closed a five-week profitable streak with the Aussie breakout hovering to recent 2020 highs. Listed below are the degrees that matter on the AUD/USD technical chart.

Gold Worth Forecast: Gold Goes Increase, Bulls Drive Contemporary Highs

Gold costs put of their seventh consecutive week of features and pushed as much as the 1900 degree for the primary time in virtually 9 years. However can it final?

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD