GOLD PRICE OUTLOOK:Gold costs fell modestly because the 10-year inflation-indexed yield climbed after robust PPI readingsUS core

GOLD PRICE OUTLOOK:

- Gold costs fell modestly because the 10-year inflation-indexed yield climbed after robust PPI readings

- US core inflation, retail gross sales and Chinese language GDP knowledge can be in focus this week

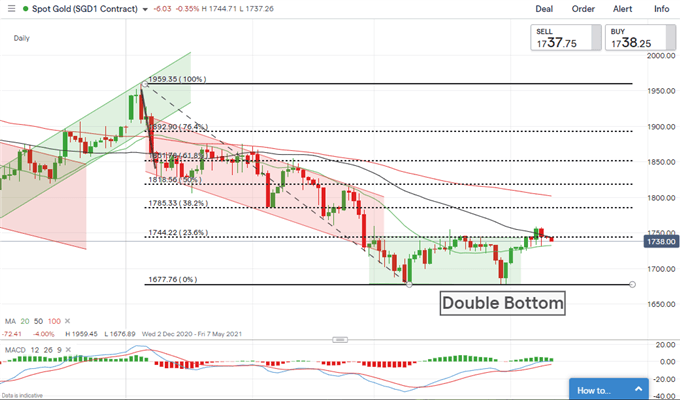

- Gold costs have possible shaped a “Double Backside” chart sample, which can level to beneficial properties forward

Really helpful by Margaret Yang, CFA

Easy methods to Commerce Gold

Gold costs retreated for a second day as actual yields edged up after each Chinese language and US PPI knowledge got here above market expectations on Friday. Value ranges of products at manufacturing unit door surged 4.4% in China final month, marking the most important rise seen since August 2018. The studying additionally beat the baseline forecasts of three.5%, suggesting that output costs are rising at a faster-than-expected tempo as demand picks up. Equally, US PPI in March got here in at 1.0%, half of a share increased than economists’ forecasts.

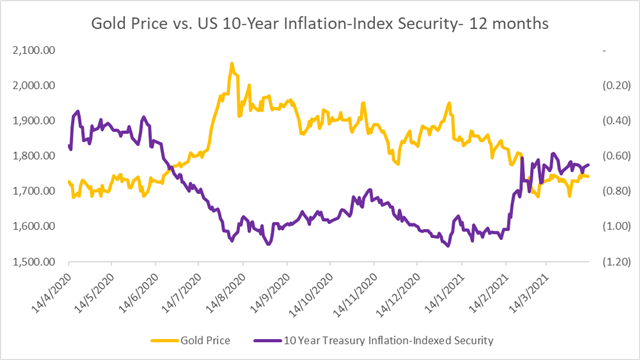

Rising worth ranges of products at manufacturing unit doorways trace at increased shopper worth ranges within the months to return, which led the longer-dated Treasury yields upward. The actual yield (nominal yield – inflation), as represented by the 10-year inflation-indexed safety, rose 2bps to -0.65% on Monday (chart under). Rising actual yields rendered the yellow metallic much less enticing as an funding asset as the chance value of holding it rises even when inflation is considered.

The DXY US Greenback index additionally edged up modestly , exerting downward stress on treasured metallic costs. Silver misplaced -0.60%, platinum retreated -0.16%, palladium was down -0.27% on Monday morning.

Wanting forward, Tuesday’s launch of US core CPI knowledge can be intently monitored by gold merchants. A better-than-expected studying could profit gold because the yellow metallic is extensively perceived as an inflation hedge. However in the intervening time it could additionally increase the markets’ expectation for Fed tapering and end in a stronger USD. Thursday’s US retail gross sales determine and China’s Q1 GDP knowledge on Friday are additionally in focus.

Gold Costs vs. 10-12 months Treasury Inflation-Indexed Security

Supply: Bloomberg, DailyFX

Technically, gold has possible shaped a “Double Backside” chart sample after hitting US$ 1,677 twice. The “Double Backside” sample normally seems on the finish of a downtrend and indicators potential development reversal. Costs are dealing with an instantaneous resistance stage at US$ 1,744, the place the 23.6% Fibonacci retracement and the 50-day SMA line intercept. A profitable try to breach this stage could open the door for additional upside potential with a watch on US$ 1,785 – the 38.2% Fibonacci retracement. A swing decrease nonetheless, could convey the subsequent help stage of US$ 1,677 (earlier low) into fucus.

Gold Value – Day by day Chart

| Change in | Longs | Shorts | OI |

| Day by day | 1% | 2% | 1% |

| Weekly | 2% | 15% | 4% |

— Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Feedback part under or @margaretyjy on Twitter

ingredient contained in the

ingredient. That is most likely not what you meant to do!nn Load your software’s JavaScript bundle contained in the ingredient as an alternative.www.dailyfx.com