Gold, XAU/USD, Crude Oil, Coronavirus, OPEC, Technical Evaluation - Speaking Factors:Gold costs weakened as US Greenback gained a

Gold, XAU/USD, Crude Oil, Coronavirus, OPEC, Technical Evaluation – Speaking Factors:

- Gold costs weakened as US Greenback gained amid wobbly sentiment

- Crude oil struggled capitalizing on OPEC plan to increase output cuts

- XAU/USD ‘Dying Cross’ stays in play, WTI consolidation eyed

Anti-fiat gold costs declined over the previous 24 hours because the liquid US Greenback managed to get well extra losses within the aftermath of the US presidential election. Traders poured capital again into tech shares because the Nasdaq 100 soared and the Dow Jones barely weakened. Issues over rising coronavirus instances globally dented sentiment, depriving growth-linked crude oil costs from positive aspects earlier within the session.

OPEC’s president alluded to the potential for extending output cuts into subsequent yr, maybe by three to six months. That’s doubtless what propelled power costs earlier than pulling again throughout the Wall Road session. The USA set one other every day document for coronavirus instances, rising by 146,149. Ney York State ordered bars and eating places closed at 10pm native time. Ohio is reviewing shutting down eating and gymnasiums.

Really helpful by Daniel Dubrovsky

Don’t give into despair, make a sport plan

Hopes of a Covid-19 vaccine doubtless stored sentiment from deteriorating additional. Futures monitoring Wall Road are pointing decrease heading into the European and North American buying and selling classes. Falling Treasury yields may cushion draw back potential in gold nonetheless. Crude oil costs are trying weak. The EIA is anticipating a 0.8m barrel drawdown in stockpiles final week, opening the door to taming weak spot in oil costs forward.

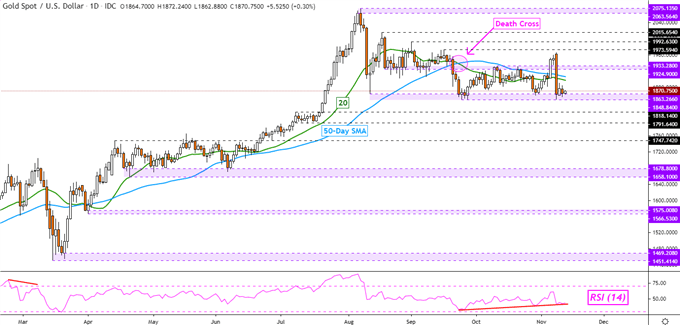

Gold Technical Evaluation

Gold costs are idling above the important thing 1848 – 1863 help zone after costs tumbled over 5 p.c firstly of the week. That is preserving the bearish ‘Dying Cross’ in play after the 20-day Easy Shifting Common (SMA) crossed beneath the 50-day one. Optimistic RSI divergence does present that draw back momentum is fading, which may at occasions precede a flip increased. In such an final result, keep watch over the 1924 – 1933 inflection zone.

Really helpful by Daniel Dubrovsky

What’s the highway forward for gold this quarter?

XAU/USD Day by day Chart

Chart Created Utilizing TradingView

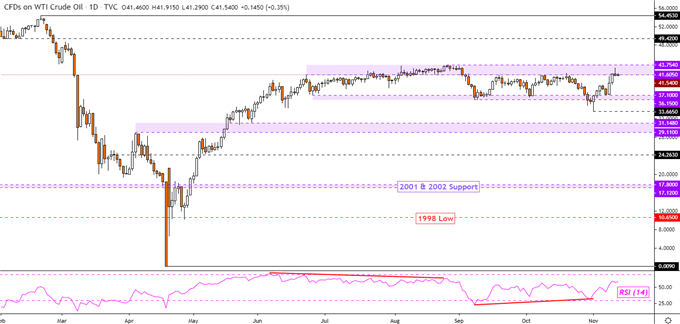

Crude Oil Technical Evaluation

WTI crude oil costs are on the cusp of the 41.61 – 43.75 resistance zone which has been in play since June, preserving the commodity in a consolidative state. In late October, oil tried to breach key help (36.15 – 37.10) however finally did not breakout. With that in thoughts, a maintain at resistance right here might open the door to a different flip decrease, prolonging range-bound worth motion.

Really helpful by Daniel Dubrovsky

What’s the highway forward for crude oil this quarter?

WTI Crude Oil Day by day Chart

Chart Created Utilizing TradingView

— Written by Daniel Dubrovsky, Forex Analyst for DailyFX.com

To contact Daniel, use the feedback part beneath or @ddubrovskyFX on Twitter