Early on Thursday, gold costs are sliding decrease on the again of a a strengthening within the US greenback, whilst rising expectations of furthe

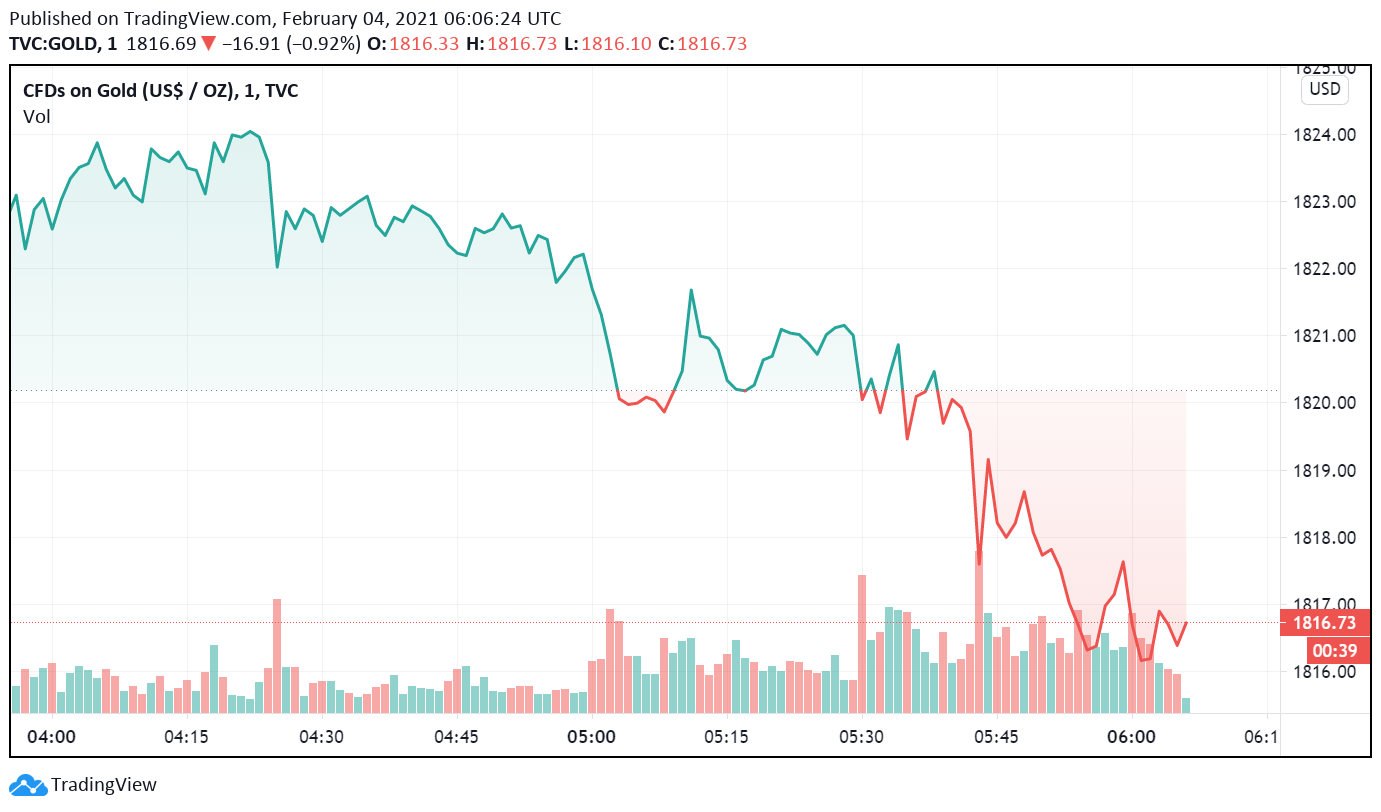

Early on Thursday, gold costs are sliding decrease on the again of a a strengthening within the US greenback, whilst rising expectations of further fiscal stimulus measures dashing up financial restoration within the US weigh on the protected haven attraction of the dear steel. On the time of writing, GOLD is buying and selling at a bit above $1,816.

The US greenback shares a detrimental correlation with gold, as at any time when it strengthens, it turns into costlier for holders of different currencies to purchase bullion. Costs of the yellow steel have additionally eased following a strengthening in US Treasury yields, which have additional weakened its attraction as a protected haven asset.

Throughout the earlier session, President Biden’s proposed fiscal stimulus bundle was handed by the US Home of Representatives with out the help of Republican senators. Markets broadly anticipate the subsequent spherical of stimulus measures to additional strengthen financial restoration throughout the US within the wake of the coronavirus disaster.

Gold can also be anticipated to weaken in direction of the tip of this week on the discharge of a robust employment report from the US. Economists have forecast an addition of 50okay jobs to the economic system throughout January, a major enchancment after 140okay jobs had been shed in December as a result of resurgence in coronavirus circumstances throughout the nation.