Gold costs are climbing increased in early buying and selling on Thursday, buoyed by the Fed’s plans to stay dovish for longer, as was anticipated

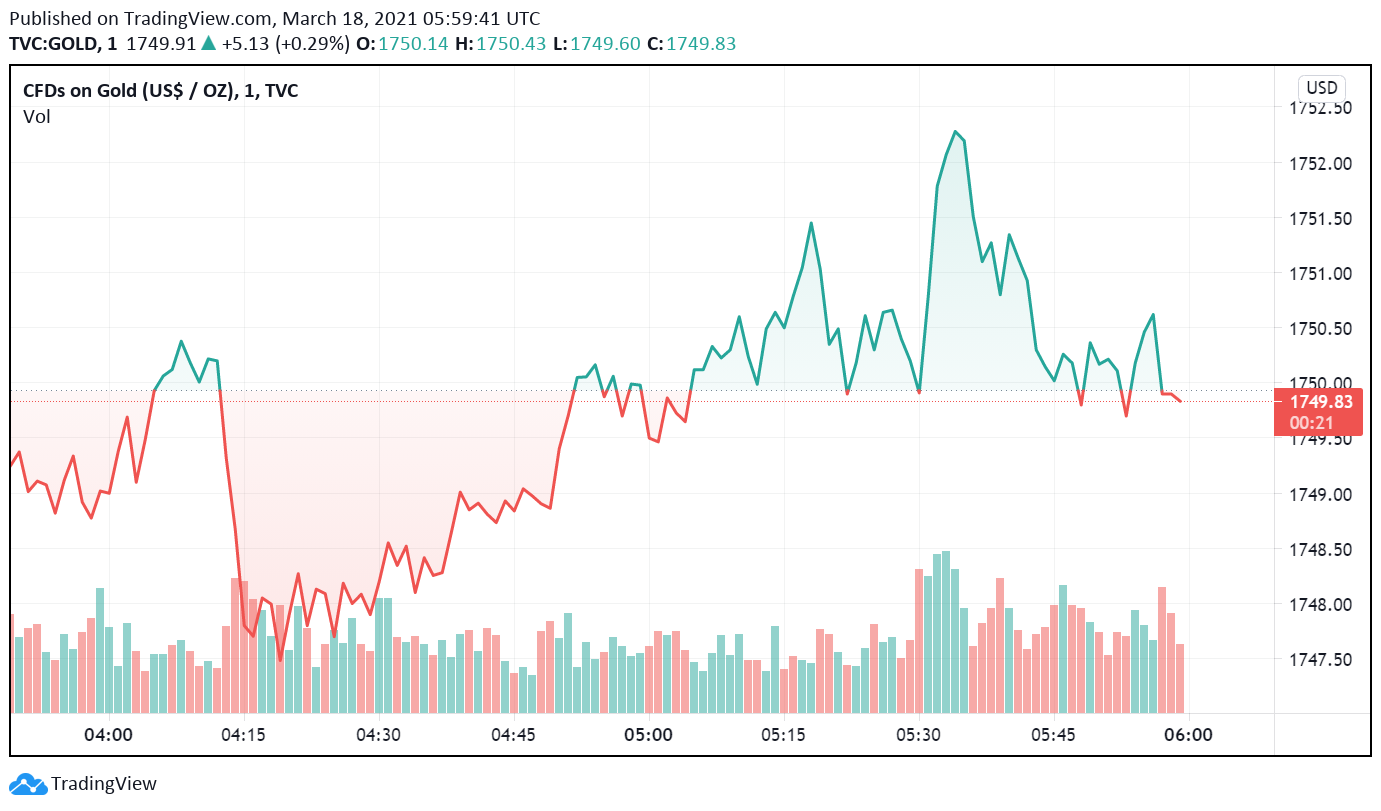

Gold costs are climbing increased in early buying and selling on Thursday, buoyed by the Fed’s plans to stay dovish for longer, as was anticipated by the markets, which in flip have brought about a weak point within the US greenback. On the time of writing, GOLD is buying and selling at slightly above $1,749.

By the earlier session, gold held regular as markets eagerly awaited to listen to from the US central financial institution on its financial coverage resolution and financial development projections. As was extensively anticipated, the Fed selected to maintain its rates of interest on maintain, however what boosted the secure haven enchantment of the steel was the announcement that the charges would stay low by means of 2023.

Even because the Fed upgraded US financial system’s development outlook for the present 12 months, forecasting a pointy, V-shaped restoration within the aftermath of the coronavirus disaster, it held on to its earlier plans to take care of a dovish stance for an prolonged time period. This despatched the greenback weaker, which as we all know, shares a unfavourable correlation with gold, serving to increase its costs.

Nonetheless, beneficial properties in gold stay restricted on the upbeat forecast for US financial restoration – the Fed has upgraded GDP estimates from 4.2% earlier to six.5% for the present 12 months. This is able to be the quickest tempo of development the US financial system has seen since 1984.