Gold has rallied to its highest level since August 2020 as pandemonium has gripped markets in the fallout from Russia’s invasion of the Ukraine. Many

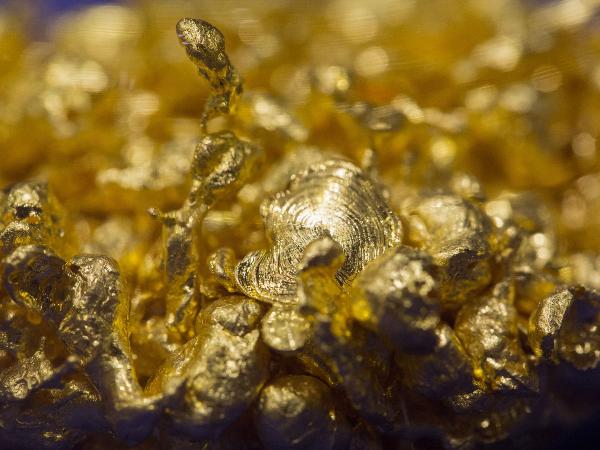

Gold has rallied to its highest level since August 2020 as pandemonium has gripped markets in the fallout from Russia’s invasion of the Ukraine.

Many Western countries are looking at imposing various sanctions against Russia and the commodities that they export are seeing the largest gains. These include oil, gas, nickel, copper and of course gold.

In reality though, gold has not seen the size of gains that these other markets have experienced. This is despite other tail winds supporting the precious metal.

Real yields in the US have been falling in the last few weeks as shown in the chart below. 10-year Treasuries have a notional yield of 1.79% while the market priced 10-year inflation rate expectation is 2.77%, to give a real yield of -0.98%.

Sinking real yields typically boosts gold prices as the alternative of investing in Treasuries becomes less attractive from a real return perspective.

US CPI will be published on Thursday and the market is anticipating an annual headline rate of 7.8% and 6.4% for the year-on-year core rate. Consistently high inflation could have ongoing implications for real yields.

The Federal Reserve is expected to raise rates by 25 basis points (bp) at their Federal Open Market Committee (FOMC) meeting next week.

The US Dollar has also benefitted from the uncertainty in markets and a more hawkish Fed has underpinned it. A strengthening USD normally works against a rising gold price, but that has been overwhelmed by the other factors already mentioned.

If the Fed sticks to its plan, it may not have much impact as it has been very well telegraphed. Any variation from a 25 bp hike could see further volatility.

Gold, US dollar (DXY) and US 10-year real yield

www.ig.com