GOLD prices closed at $1,767.80, after setting a high of $1,788.25, and a low of $1,765.25. After surging for two consecutive sessions, gold droppe

GOLD prices closed at $1,767.80, after setting a high of $1,788.25, and a low of $1,765.25. After surging for two consecutive sessions, gold dropped on Wednesday, amid the strength of the US dollar. On Wednesday, the greenback was strong across the board, reaching 93.51, which was its highest level since August 20. The US dollar pushed the price of gold down after the Federal Reserve signaled that it would ease its monthly bond purchases by next year and increase interest rates sooner than expected.

The appeal for the yellow metal was subdued after the US Federal Reserve mentioned in its latest policy meeting on Wednesday that tapering of economic support would begin this year, and interest rates could potentially rise next year, in response to inflation.

XAU/USD

As a result, the US Dollar Index reached a one-month high, decreasing the appeal of gold. The precious metal is often used a hedge against higher inflation. However, it tends to lose its value if the Fed increases its interest rates or reduces its support for the economy.

Meanwhile, on Wednesday, Fed Chair Jerome Powell said that the Fed was pushing ahead with its research into implementing its digital currency.

The Fed has also revealed its plans to release a paper on the matter shortly. According to Powell, no decision has been made regarding this issue as yet, and the Fed is not under any pressure to rush into a decision like this without doing proper research of its own.

Powell also said that the Federal Reserve could wrap up the tapering of its bond purchases by the middle of the next year. The central bank has been buying $120 billion a month in Treasuries and mortgage-backed securities, to support economic recovery from the coronavirus pandemic. These comments helped the US Dollar Index to achieve its highest level in one month and weighed heavily on the precious metal, turning its momentum red for the day. At 19:00 GMT, the existing home sales for August came in, remaining in line with the expectations of 5.87M. It had zero impact on the prices of the US dollar and GOLD.

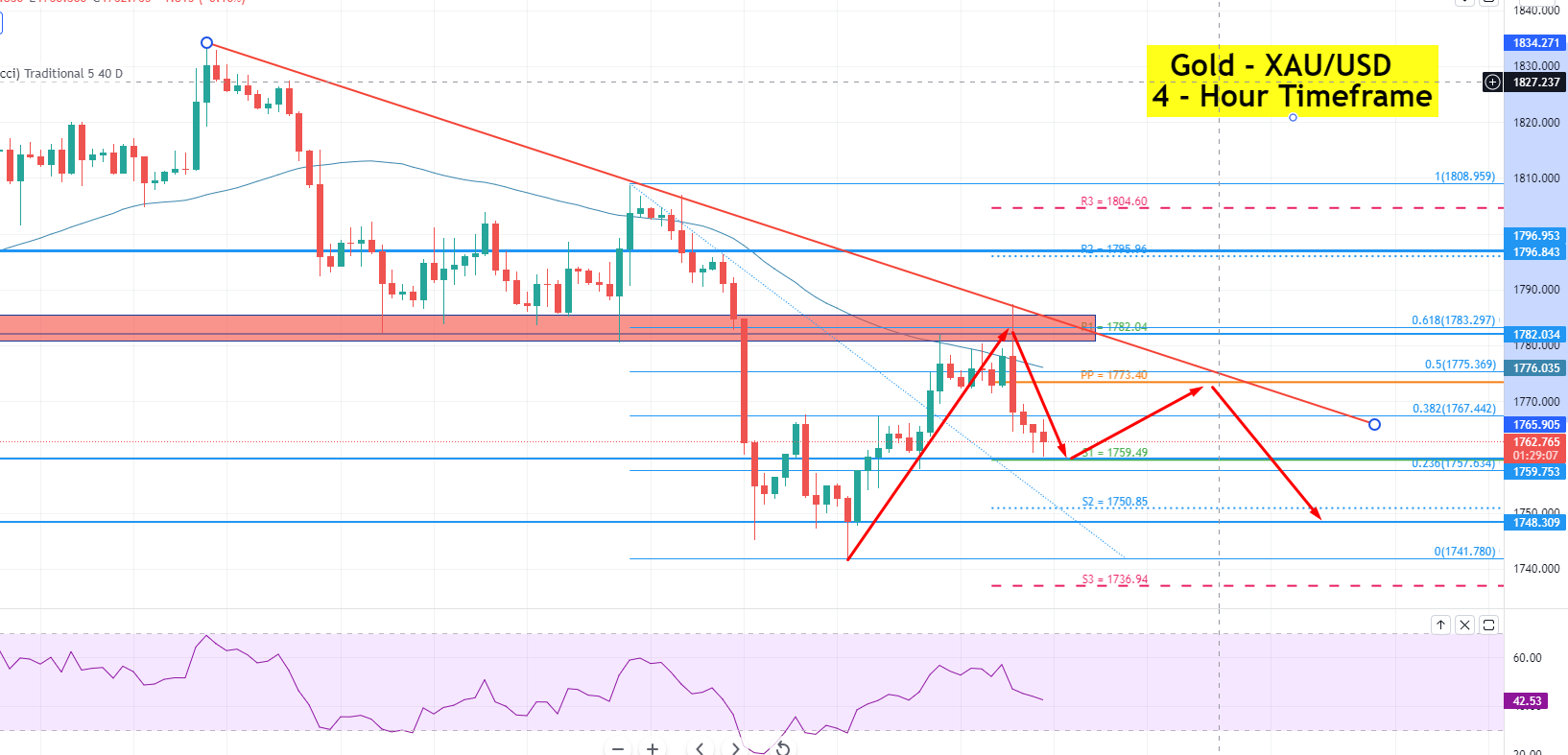

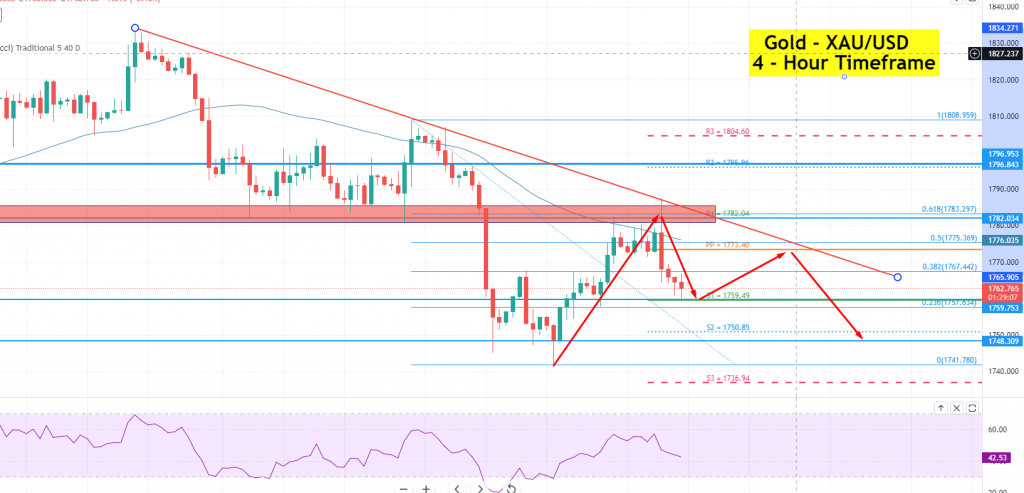

Gold – XAU/USD – Technical Outlook

Gold has fallen below the pivot point support level of 1,773, towards the next support level of 1,759. Gold prices will be exposed to an additional support mark of 1,750 if they break below the 1,759 level. A bullish crossover at 1,773 would also open the yellow metal to the 1,781 level.

Daily Technical Levels

www.fxleaders.com