Gold Value Speaking FactorsThe value of gold retraces the decline following the sudden rise in US Non-Farm Payrolls (NFP) because

Gold Value Speaking Factors

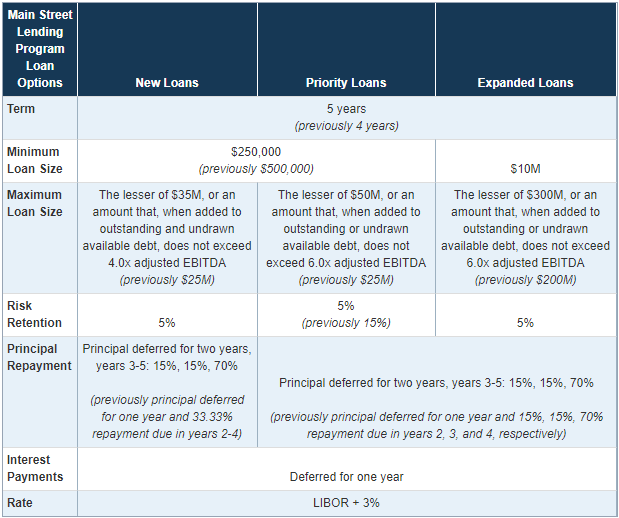

The value of gold retraces the decline following the sudden rise in US Non-Farm Payrolls (NFP) because the Federal Reserve expands the scope of the “Major Road Lending Program to permit extra small and medium-sized companies to have the ability to obtain assist.”

Gold Value Fails to Clear Could Low Forward of FOMC Fee Choice

The value of gold traded to a recent month-to-month low ($1671) because the US NFP report confirmed employment rising 2.509 million in Could versus forecasts for a 7.500 million decline, whereas the jobless price narrowed to 13.3% from 14.7% in April amid projections for a 19.0% print.

The optimistic growth could push the Federal Open Market Committee (FOMC) to the sidelines as the information sparks hope for a V-shaped restoration, and Chairman Jerome Powell and Co. could merely try to purchase time on the subsequent rate of interest choice on June 10 because the central financial institution “expects the Major Road program to be open for lender registration quickly and to be actively shopping for loans shortly afterwards.”

Supply: FOMC

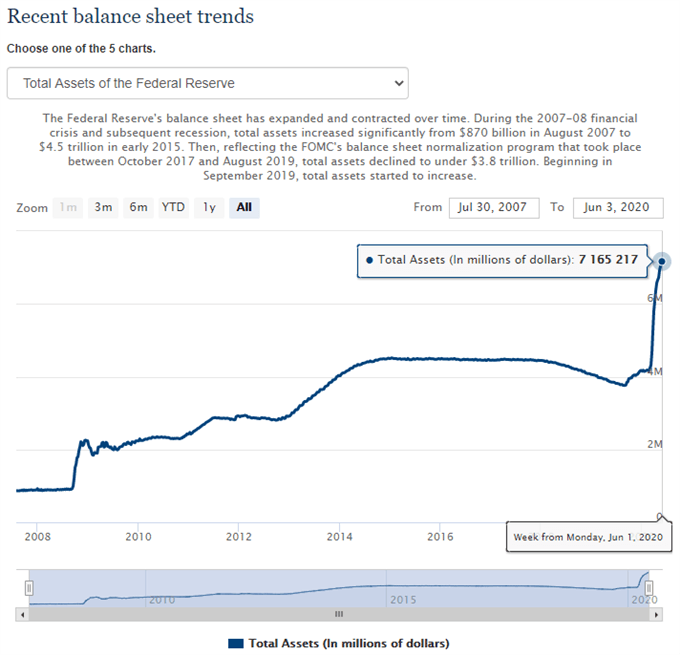

The brand new non-standard measure could encourage the FOMC to hold out a wait-and-see strategy over the approaching months because the stability sheet climbs above $7.1 trillion in June, and it stays to be seen if Fed officers will alter the ahead steerage for financial coverage as Chairman Powelltames hypothesis for a adverse rate of interest coverage (NIRP).

Supply: FOMC

Nonetheless, the FOMC could reiterate its dedication in “utilizing its full vary of instruments to assist the U.S. economic system on this difficult time” asFed officers specific blended views concerning the financial outlook, and the low rate of interest setting together with the ballooning central financial institution stability sheets could proceed to behave as a backstop for goldas marketcontributors search for an alternative choice to fiat-currencies.

Consider, the worth of gold has traded to recent yearly highs throughout each single month to date in 2020, and the dear metallic could proceed to exhibit a bullish conduct in June because the pullback from the yearly excessive ($1765) fails to provide a break of the Could low ($1670).

Advisable by David Track

Obtain the 2Q 2020 Forecast for Gold

Enroll and be part of DailyFX Forex Strategist David Track LIVE for a chance to debate potential commerce setups.

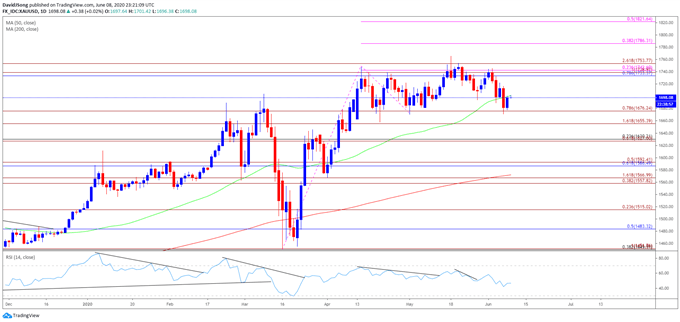

Gold Value Each day Chart

Supply: Buying and selling View

- The opening vary for 2020 instilled a constructive outlook for the value of gold as the dear metallic cleared the 2019 excessive ($1557), with the Relative Power Index (RSI) pushing into overbought territory throughout the identical interval.

- The same situation materialized in February, with the value of gold marking the month-to-month low ($1548) through the first full week, whereas the RSI broke out of the bearish formation from earlier this 12 months to push again into overbought territory.

- Nonetheless, the month-to-month opening vary for March as much less related amid the pickup in volatility, with the decline from the month-to-month excessive ($1704) resulting in a break of the January low ($1517).

- However, the response to the former-resistance zone round $1450 (38.2% retracement) to $1452 (100% enlargement) instilled a constructive outlook for bullion particularly because the RSI reversed course forward of oversold territory and broke out of the bearish formation from February.

- In flip, gold cleared the March excessive ($1704) to tag a brand new yearly excessive ($1748) in April, with the bullish conduct additionally taking form in Could as the dear metallic traded to a recent 2020 excessive ($1765).

- The bullish conduct could persist in June as the value of gold holds above the Could low ($1670), with the RSI highlighting the same dynamic because the indicator breaks out of the adverse slope from the earlier month.

- Failure to interrupt/shut under the $1676 (78.6% enlargement) area could generate vary sure costs for gold, however a break/shut above the Fibonacci overlap round $1733 (78.6% retracement) to $1743 (23.6% enlargement) opens up the $1754 (261.8% enlargement) area, with the subsequent space of curiosity coming in round $1786 (38.2% enlargement) adopted by the 2012 excessive ($1796).

Advisable by David Track

Traits of Profitable Merchants

— Written by David Track, Forex Strategist

Observe me on Twitter at @DavidJSong