Gold Value (XAU/USD) Evaluation, Value and ChartGold touches $1,800/oz. as patrons stay in management.Overbought sign could couns

Gold Value (XAU/USD) Evaluation, Value and Chart

- Gold touches $1,800/oz. as patrons stay in management.

- Overbought sign could counsel short-term consolidation.

Really helpful by Nick Cawley

Obtain our Up to date Q3 Gold Forecast

Gold Continues to Respect Development Help

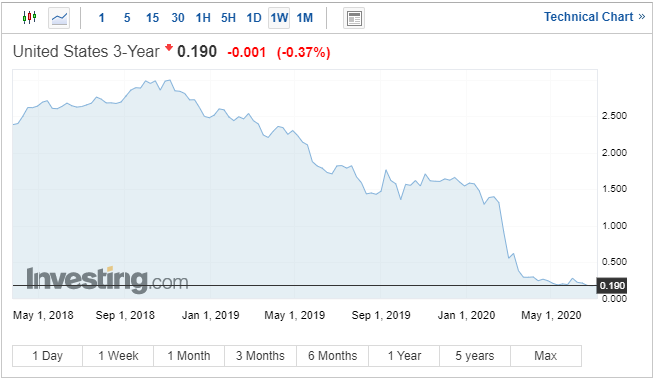

Gold has simply made a brand new eight-year excessive and is urgent the $1,800/oz. degree as patrons proceed to dominate value motion. A slight risk-off tone in international markets in the present day has underpinned the transfer whereas decrease US Treasury yields reinforce the underlying energy of the transfer increased within the treasured metallic. On Tuesday, the US Treasury offered $46 billion of 3-year notes at a yield of simply 0.189%. The three-year UST began the 12 months yielding round 1.55%.

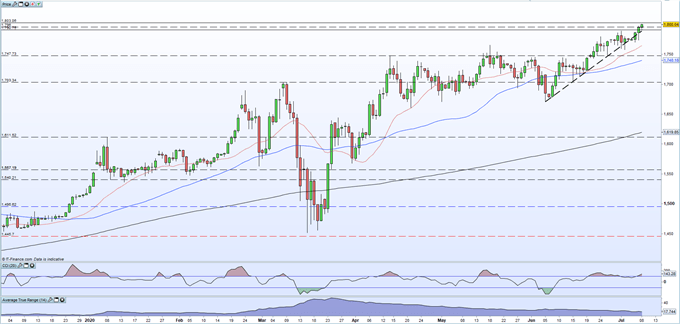

The rally off the early June low at $1,671/oz. has produced a robust supportive trendline that continues to be revered. The sharp angle of this transfer increased now warrants a word of warning as a steep trendline will be damaged simply when market circumstances get pushed to excessive ranges. The CCI indicator is now in overbought territory, suggesting that the market may have a interval of consolidation whether it is to press increased. At this time’s buying and selling vary of round $9/oz. can be half of the present 14-day common true vary which leaves each a break under assist or a run above $1,800/oz. on the desk. If gold breaks increased there may be little in the best way of sturdy resistance on the day by day chart to forestall a long-term run on the September 2011 excessive at $1,921/oz. A break and shut under the supportive trendline, at the moment at $1,789/oz. would then see gold again amongst a cluster of supportive lows all the best way again right down to horizontal assist at $1,750/oz. Gold wants a interval of consolidation earlier than making the following transfer.

Gold Every day Value Chart (December 2019 – July 8, 2020)

Really helpful by Nick Cawley

Enhance your buying and selling with IG Consumer Sentiment Information

What’s your view on Gold – are you bullish or bearish?? You may tell us through the shape on the finish of this piece or you possibly can contact the writer through Twitter @nickcawley1.