XAU/USD PRICE OUTLOOK: GOLD SPIKING TO RECORD HIGHS ON ANTI-FIAT BID AS PRECIOUS METALS TRACK REAL YIELDS & US DOLLAR LOWERGo

XAU/USD PRICE OUTLOOK: GOLD SPIKING TO RECORD HIGHS ON ANTI-FIAT BID AS PRECIOUS METALS TRACK REAL YIELDS & US DOLLAR LOWER

- Gold costs have climbed over 30% year-to-date on the again of bullish basic tailwinds

- Gold and valuable metals are rallying as central financial institution liquidity sends actual yields plunging

- US Greenback weak spot doubtless exacerbated the parabolic rally being set forth by anti-fiat belongings

Gold efficiency continues to glisten. The valuable steel has staged a formidable 12% rally over the past three weeks, which simply catapulted XAU/USD to an all-time excessive above the $2,000-price stage. This current extension greater lifts gold worth motion to a 33% achieve year-to-date. What basic forces are fueling the gold breakout and is there potential for bullion to advance additional?

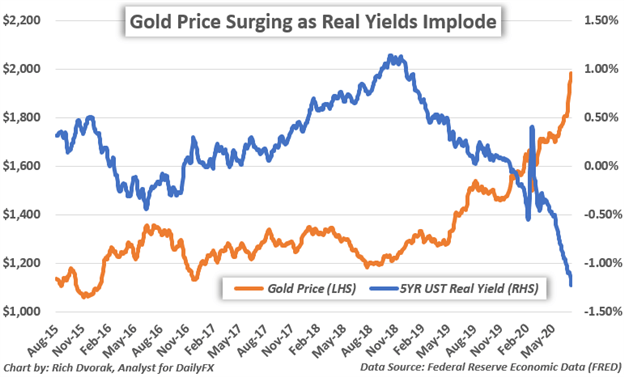

GOLD PRICE EXPLODING HIGHER AS REAL YIELDS CRASH (CHART 1)

The value of gold holds a powerful inverse relationship with actual yields, typically talking, and underscores a main driver of the yellow-metal’s broader path. To that finish, actual yields have been crashing decrease since August 2018, which simply so occurs to correspond with the place gold costs bottomed two years in the past.

Study Extra: The way to Commerce Gold – High Buying and selling Methods & Ideas

In mild of this sometimes unfavorable correlation maintained by gold and actual yields, it comes as little shock that XAU/USD worth motion is ballooning to report highs whereas actual yields sink to report lows. The newest stretch decrease in actual yields broadly follows unparalleled Fed asset purchases at the side of slashing benchmark rates of interest to zero, and judging by current commentary from Fed Chair Jerome Powell, the central financial institution seems set on sustaining its accommodative financial coverage stance for the foreseeable future.

| Change in | Longs | Shorts | OI |

| Every day | 14% | 3% | 11% |

| Weekly | 18% | -7% | 10% |

An uber-dovish Federal Reserve not solely stands out as the first catalyst serving to propel valuable metals greater just lately, however with the FOMC drowning the market in liquidity and different easy-money measures geared toward loosening monetary circumstances, plus staggering fiscal stimulus outlays resulting in historic deficit spending by the US Treasury, there was a resurgence of the anti-fiat narrative. That mentioned, on the again of a nasty acceleration in US Greenback weak spot final month, it seems this theme of foreign money devaluation is gaining traction, and sure contributes to bullish gold worth motion.

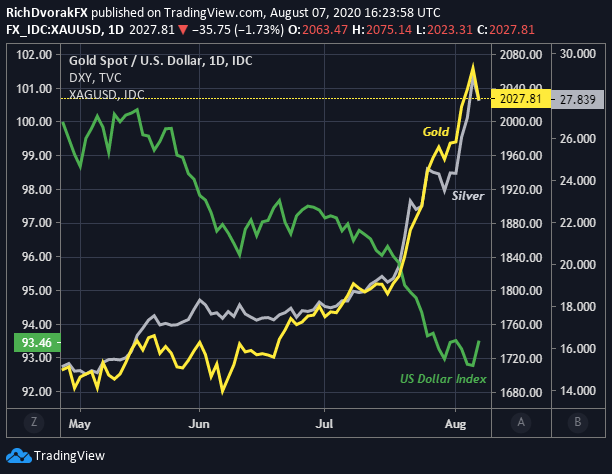

GOLD & SILVER PRICES GOING PARABOLIC AMID SHARP US DOLLAR WEAKENING (CHART 2)

Chart created by @RichDvorakFX with TradingView

Contemplating these aforementioned basic drivers have weighed positively on valuable metals just lately, and retaining in thoughts that the development is your pal, there could also be potential for gold and silver costs to proceed climbing within the days forward. If actual yields recoil and the US Greenback rebounds, nonetheless, gold and silver would possibly stumble decrease in response as this might correspond with a deterioration of the standing bull thesis.

Really helpful by Wealthy Dvorak

Foreign exchange for Freshmen

An inflow of widespread threat aversion – maybe earmarked by a steep reversal decrease in main inventory market indices – might spark XAU/USD promoting strain as buyers ‘sprint for money’ and liquidate positions like they did in the course of the March selloff. Nonetheless, threats from attainable headwinds hanging over gold and silver may show short-lived. That is owing to the notable likelihood that extra authorities and central financial institution intervention would doubtless observe the following materials downturn in financial exercise, which could preserve anti-fiat belongings reminiscent of gold, silver, and even bitcoin broadly in demand throughout longer time frames.

Study Extra: Methods & Ideas for Buying and selling the Gold-Silver Ratio

— Written by Wealthy Dvorak, Analyst for DailyFX.com

Join with @RichDvorakFX on Twitter for real-time market perception