Here's what you want to know on Tuesday, July 7: Markets have stabilized and the US greenback is making an attempt restoratio

Here’s what you want to know on Tuesday, July 7:

Markets have stabilized and the US greenback is making an attempt restoration after a risk-on Monday, fueled by China’s inventory market surge and decrease US coronavirus considerations. A mixture of figures and COVID-19 statistics are set to rock markets.

Danger-on Monday: Chinese language state media touted a “bullish inventory market” triggering a rally and a surge in searches for opening fairness accounts. Alongside upbeat figures from the world’s second-largest financial system, optimism despatched world shares larger and the safe-haven greenback decrease.

Gold has been in a position to advance regardless of the risk-on temper and has consolidated above $1,780. It could be well-positioned to proceed larger.

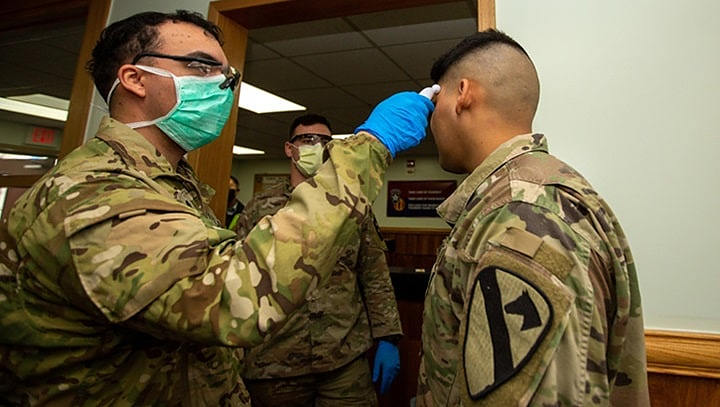

US coronavirus figures for the Sunday had been comparatively low – the well-known “weekend impact” however traders ignored it and despatched shares larger for the fifth consecutive day. The each day variety of new infections dipped under 50,000 and deaths slipped beneath 300.

Anthony Fauci, America’s main epidemiologist, warned that the US continues to be “knee-deep” within the first wave and that the scenario is “not good.” New statistics due out from Florida, California, and Texas are eyed.

The US ISM Non-Manufacturing Buying Managers’ Index shot larger to 57.1, smashing expectations and reflecting optimism within the providers sector as of early June. Most parts leaped however the employment one remained under 50, reflecting contraction. The JOLTs job openings figures for Might are due out on Tuesday. Regardless of the late publication, the Federal Reserve is eyeing the information.

Raphael Bostic, President of the Atlanta department of the Federal Reserve, instructed the FT that the US restoration could also be “leveling off.” His colleague Randal Quarles will converse afterward Tuesday.

Melbourne has been put beneath a strict six-week lockdown, weighing on the Australian greenback. AUD/USD is retreating from the 0.70 mark. The Reserve Financial institution of Australia left rates of interest unchanged at 0.25% as anticipated and didn’t launch any hints about future coverage.

GBP/USD is holding above 1.25 forward of a public look by Rishi Sunak, Chancellor of the Exchequer. He’ll converse with MPs forward of unveiling new stimulus. Particulars of inexperienced funding have been unfavorable compared to a number of European international locations’ parallel plans. Brexit talks proceed.

EUR/USD is buying and selling above 1.13 after reaching the very best in practically two weeks. The main focus stays on the bold EU restoration fund, which has but to be authorized.

USD/JPY is regular above 107 as instances in Tokyo proceed climbing however the authorities is just not contemplating new steps.

Brazil’s president Jair Bolsonaro has been taken to a lung examination after reportedly affected by fever and was seen carrying a face cowl. Bolsonaro beforehand dismissed COVID-19. USD/BRL is buying and selling above 5.30.

Coronavirus deaths surpassed the 20,000 mark India and instances stand above 700,000. USD/INR is edging up towards 75.

Cryptocurrencies moved up on Monday, with Bitcoin buying and selling above $9,200.

Extra If the US presidential election had been at the moment? Nevertheless it’s not.