US STIMULUS, STOCKS, DOLLAR, YIELDS, POUND, BOE, CRUDE OIL – TALKING POINTS:

- Markets cheer after US Senate passes $1.9 trillion fiscal stimulus enhance

- US Greenback might resume rally as reflation bets maintain driving yields larger

- British Pound eyes BOE Governor Bailey commentary for coverage clues

Really useful by Ilya Spivak

Get Your Free Prime Buying and selling Alternatives Forecast

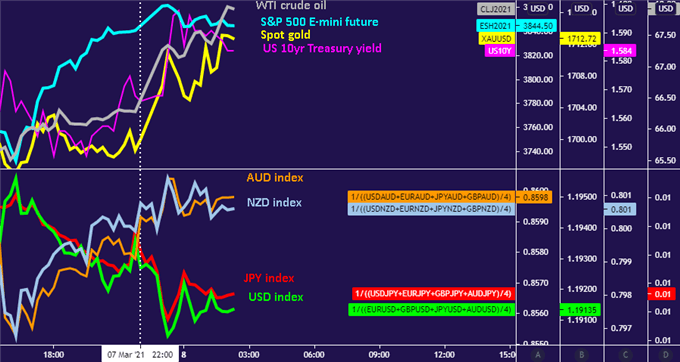

A cautiously optimistic tone prevailed in Asia-Pacific commerce at the beginning of the worldwide buying and selling week. Regional shares rose alongside bellwether S&P 500 inventory index futures and cyclical currencies just like the Australian, New Zealand and Canadian {Dollars}. In the meantime, the anti-risk US Greenback, Japanese Yen and Swiss Franc declined alongside Treasury bond futures amid ebbing demand for security.

The upbeat backdrop in all probability mirrored the near-certain passage of the US$1.9 trillion fiscal stimulus plan favored by the Biden administration after the laws cleared the US Senate. It should now head again to the Home of Representatives for one more vote, the place the Democratic majority appears very prone to cosign it. That can push the invoice to the President’s desk for his signature.

On the commodities entrance, gold costs rose because the considerably weaker Dollar buoyed the enchantment of the standby anti-fiat different. Crude oil costs jumped to the best stage in over two years after Houthi rebels – the Iran-backed facet within the Yemen civil struggle – attacked vitality amenities in Saudi Arabia. Whereas the strike didn’t seem to affect manufacturing, it does appear to mark escalation that portends future disruption.

Chart created with TradingView

BRITISH POUND EYES BAILEY SPEECH, US STIMULUS MAY SEND YIELDS HIGHER

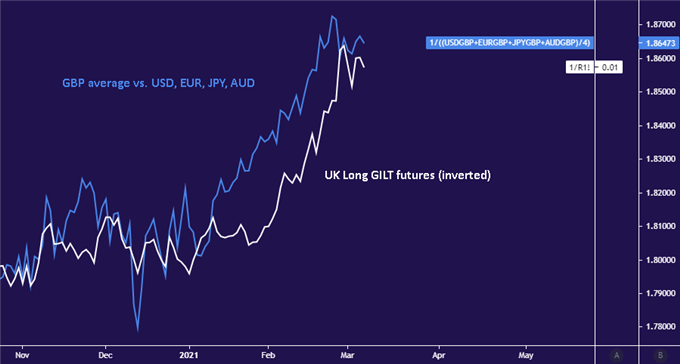

The info docket is comparatively quiet in European buying and selling hours. Financial institution of England Governor Andrew Bailey is because of talk about the UK financial outlook at a digital occasion hosted by the Decision Basis, which can inform FX merchants’ view of the British Pound. The forex has rallied to this point in 2021, helped by a supportive shift in priced-in coverage bets (implied in fee futures) amid firming indicators of financial restoration.

Chart created with TradingView

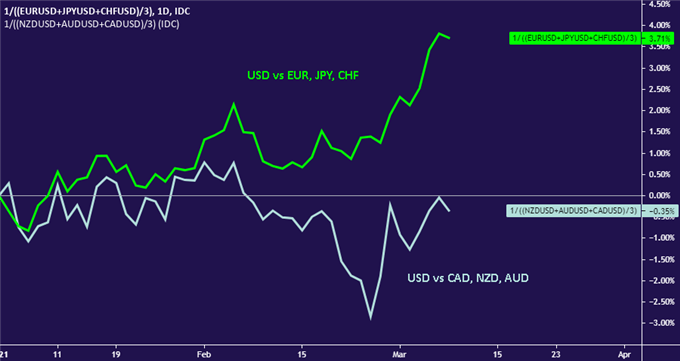

Past that, sentiment traits are prone to stay on the forefront. Whereas a beneficiant top-up of US stimulus is understandably supportive for threat urge for food in that it’s prone to buoy development, its optimistic affect on cyclical belongings could also be moderated as buyers ponder what it’d imply for already-ascendant inflation expectations. Merchants have anxious that this would possibly power the Fed to drag again financial assist sooner, lifting yields.

That may revive the US Greenback’s fortunes, particularly towards these currencies whose central banks have set rates of interest in detrimental territory. The unit has tellingly added over 3.5 p.c towards a median of the Euro, Japanese Yen and Swiss Franc because the starting of the 12 months. It’s modestly decrease towards these of its counterparts with larger return potential as development picks up: the so-called ‘commodity currencies’.

Chart created with TradingView

FX TRADING RESOURCES

— Written by Ilya Spivak, Head Strategist, APAC at DailyFX.com

To contact Ilya, use the feedback part under or @IlyaSpivak on Twitter

aspect. That is in all probability not what you meant to do!nnLoad your utility’s JavaScript bundle contained in the aspect as a substitute.

Greenback Might Rise as Stimulus Boosts Yields, Pound Eyes Bailey Feedback

US STIMULUS, STOCKS, DOLLAR, YIELDS, POUND, BOE, CRUDE OIL – TALKING POINTS:Markets cheer after US Senate passes $1.9 trillion fi

US STIMULUS, STOCKS, DOLLAR, YIELDS, POUND, BOE, CRUDE OIL – TALKING POINTS:

Really useful by Ilya Spivak

Get Your Free Prime Buying and selling Alternatives Forecast

A cautiously optimistic tone prevailed in Asia-Pacific commerce at the beginning of the worldwide buying and selling week. Regional shares rose alongside bellwether S&P 500 inventory index futures and cyclical currencies just like the Australian, New Zealand and Canadian {Dollars}. In the meantime, the anti-risk US Greenback, Japanese Yen and Swiss Franc declined alongside Treasury bond futures amid ebbing demand for security.

The upbeat backdrop in all probability mirrored the near-certain passage of the US$1.9 trillion fiscal stimulus plan favored by the Biden administration after the laws cleared the US Senate. It should now head again to the Home of Representatives for one more vote, the place the Democratic majority appears very prone to cosign it. That can push the invoice to the President’s desk for his signature.

On the commodities entrance, gold costs rose because the considerably weaker Dollar buoyed the enchantment of the standby anti-fiat different. Crude oil costs jumped to the best stage in over two years after Houthi rebels – the Iran-backed facet within the Yemen civil struggle – attacked vitality amenities in Saudi Arabia. Whereas the strike didn’t seem to affect manufacturing, it does appear to mark escalation that portends future disruption.

Chart created with TradingView

BRITISH POUND EYES BAILEY SPEECH, US STIMULUS MAY SEND YIELDS HIGHER

The info docket is comparatively quiet in European buying and selling hours. Financial institution of England Governor Andrew Bailey is because of talk about the UK financial outlook at a digital occasion hosted by the Decision Basis, which can inform FX merchants’ view of the British Pound. The forex has rallied to this point in 2021, helped by a supportive shift in priced-in coverage bets (implied in fee futures) amid firming indicators of financial restoration.

Chart created with TradingView

Past that, sentiment traits are prone to stay on the forefront. Whereas a beneficiant top-up of US stimulus is understandably supportive for threat urge for food in that it’s prone to buoy development, its optimistic affect on cyclical belongings could also be moderated as buyers ponder what it’d imply for already-ascendant inflation expectations. Merchants have anxious that this would possibly power the Fed to drag again financial assist sooner, lifting yields.

That may revive the US Greenback’s fortunes, particularly towards these currencies whose central banks have set rates of interest in detrimental territory. The unit has tellingly added over 3.5 p.c towards a median of the Euro, Japanese Yen and Swiss Franc because the starting of the 12 months. It’s modestly decrease towards these of its counterparts with larger return potential as development picks up: the so-called ‘commodity currencies’.

Chart created with TradingView

FX TRADING RESOURCES

— Written by Ilya Spivak, Head Strategist, APAC at DailyFX.com

To contact Ilya, use the feedback part under or @IlyaSpivak on Twitter

aspect contained in the

aspect. That is in all probability not what you meant to do!nnLoad your utility’s JavaScript bundle contained in the aspect as a substitute.www.dailyfx.com

RECOMMENDED FOR YOU