As per environment friendly market speculation, it's nearly not possible to outperform the market. The motive is that market’

As per environment friendly market speculation, it’s nearly not possible to outperform the market. The motive is that market’s effectivity ensures that related particulars of an asset are included in the prevailing buying and selling value. It signifies that, theoretically, there is no such thing as a risk of shopping for and promoting an asset low and excessive respectively. Thus, a dealer can outperform the market solely by means of the buy of riskier belongings. Nonetheless, virtually, it’s not at all times the case. There are cases the place a foreign money stays undervalued or overvalued for a extended interval of time. This contradiction will be defined solely by means of the influence of merchants’ sentiment on the market.

This text seems at the sentiment evaluation, which is popping right into a

Introduction to sentiment evaluation

A sentiment is only a sign, indicating the possible route of the value motion of an asset. The sentiment evaluation or opinion mining is the strategy of assessing the undertone of a monetary market by finding out the most related and latest details about a specific asset or the market as a entire.

The sentiment evaluation is completed primarily based on the behavioral assumption that some optimistic alerts will lure extra merchants to purchase the asset, thereby leading to a rise in the value and

Measuring sentiment evaluation

The value motion of an asset has a sturdy correlation with the market sentiment. This correlation will be analyzed. The sentiment will be assessed by deciding on the related information or info,

Categorizing the temper of market individuals

The first step in the sentiment evaluation is validating the temper of the market individuals. Broadly talking, a participant in Foreign exchange or another monetary market is liable to 4 totally different sorts of temper swings: happiness, unhappiness, calmness, and disappointment. In normal, when the financial information that emerges out of some nation seems to be

Figuring out the information sources

To start with, the Foreign exchange dealer ought to first of all establish the correct information supply for evaluation. Normally, when performing the sentiment evaluation utilizing social alerts, the analysts take a look at the following networking platforms:

- Fb (teams associated to the Foreign exchange or fairness markets)

- Foreign exchange associated dialogue boards

- Fairness associated dialogue boards in the case of sentiment evaluation for an asset buying and selling in the fairness market. For instance, TradingView concepts can present possible materials.

- Financial and political information web sites (Bloomberg, Wall Road Journal, Monetary Instances, Reuters, CNBC, Forbes, CNN Cash, Market Watch, and many others.)

Information collector

Analysts obtain information from the sources by means of RSS feeds or comparable strategies. It’s then saved in a database (e.g., XML file), which can be referred to as the collector.

Key phrase listing

Key phrases allow additional classification of the obtained information. Whereas doing a sentiment evaluation in the Foreign exchange market, the key phrases will be the names of the foreign money pairs (EUR/USD, USD/CHF, GBP/JPY, and many others.), an essential financial occasion (nonfarm payroll, jobless claims, GDP, rate of interest), or a political occasion (Brexit referendum for instance). The key phrase triggers a specific occasion information to be saved individually for additional processing. In the case of a sentiment evaluation for an fairness market, the frequent key phrases can be the identify of the fairness, ticker image, 12-month excessive/low, bonus, dividend, inventory break up, merger, acquisition, takeover bid, efficacy ratio, and many others.

The key phrases stay in the database and will be altered if essential. Normally, as many as 5,000 key phrases (D1) can be current in the information base. The above phrases can solely draw the related information however can not replicate the opinion of the crowd. To achieve this, particular phrases that may replicate the opinion of the market individuals with respect to a Foreign exchange pair or another asset being analyzed are used. The parsing algorithm takes care of that course of as defined in the subsequent part.

Filtering

The parsing algorithm removes the areas, punctuation, emoticons, and all different generally discovered syntax from the obtained information. Uncorrelated information, if any, can be eliminated by the filter.

In the database, there might be one other set of phrases (D2) primarily based on the established Profile of Temper States (POMS) questionnaire (psychometric). If essential, extra phrases will be added to it, relying on the nature of the asset being handled. The thesaurus permits identification of the temper of an investor or speculator. For instance, ‘wow’, ‘beat’, ‘tops’, ‘exceeds’, and ‘surpasses’ point out a pleased or bullish temper. As soon as a match is discovered, the corresponding temper swing is allotted to that information. Moreover, a rating of ‘+1’ is given to a optimistic temper swing, ‘-1’ to a unfavourable temper swing, and ‘0’ to a impartial temper swing. The filter additionally ensures that information older than a

- Information feed is filtered utilizing the key phrase (D1). Inappropriate content material is deleted.

- Filtered information is now matched with the thesaurus (D2).

- At any time when there’s a match, the corresponding temper swing is allotted.

- For every optimistic or bullish temper swing, a rely of +1 is given.

- For every unfavourable or bearish temper swing, a rely of -1 is given.

- For every calm or impartial temper swing, a rely of Zero is given.

Particular person rating computation

On a given day, the variety of optimistic, unfavourable, and impartial cases for each key phrase is calculated. By including the optimistic, unfavourable, and impartial values, the total worth of the temper swing for that key phrase is discovered. In the identical method, the total worth of the temper swing for all of the key phrases pertaining to an asset being analyzed is calculated. Lastly, the common rating of all of the key phrases are calculated to arrive at the opinion of the market in regards to the asset.

Let’s assume that the sentiment evaluation is completed for the British pound. In this case, the information collector will obtain the information from a number of sources mentioned above and reserve it as an XML file. Utilizing the key phrase listing (D1), all of the information and associated information pertaining to the pound might be retrieved. The POMS world listing (D2) will then be matched with the retrieved information to establish the optimistic, unfavourable, and impartial occasion.

Let’s assume that for a given key phrase, the optimistic, unfavourable and impartial cases are 5, 3, and 2 respectively. As talked about earlier, for each optimistic and unfavourable occasion, a rating of ‘+1’ and ‘-1’ respectively is offered. Equally, a rating of ‘0’ is offered for a impartial occasion. So, the rating for the key phrase can be +2 (5–3+0). In the identical method, the rating for each key phrase pertaining to that asset is calculated.

Once more, for the ease of calculation, let’s assume that the variety of key phrases is Three and the rating for every of the key phrase is +2, +3, and -1. Now, the total sentiment is calculated by calculating the common rating of the key phrases. The calculation leads to a rating of +1.3. This means that the sentiment is bullish with a slight optimistic rating of 1.3.

Creating rating map

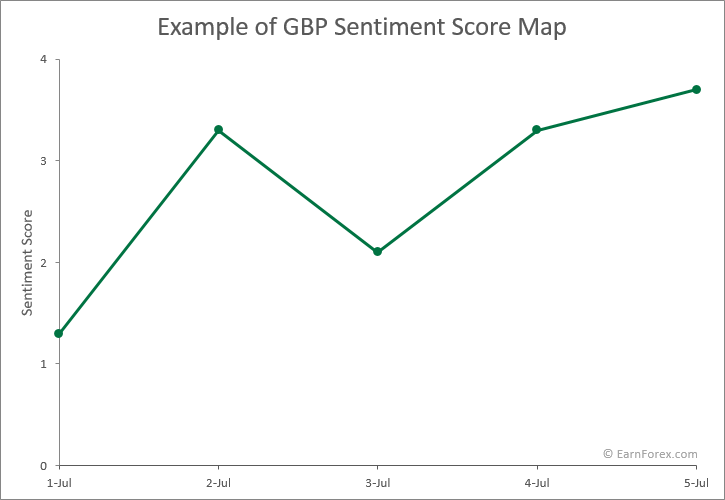

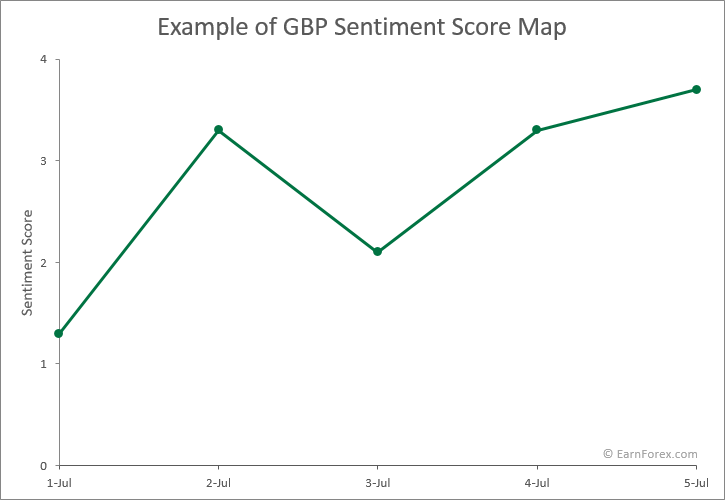

In the instance mentioned above, the calculated rating of +1.Three is for a single day. In the identical method, the scores are calculated on a every day foundation and then plotted in a chart with dates on the

By taking a look at the graph, we will conclude the total opinion of the market individuals in regards to the asset being studied. The above chart reveals that the sentiment of the merchants is turning into more and more bullish. Values and dates are purely fictional and the chart is merely meant to exhibit the evaluation method.

Figuring out the total sentiment is little simpler once we are coping with an fairness, commodity, or index. In the case of foreign money pairs, the sentiment evaluation needs to be achieved individually for each currencies and two rating maps needs to be created. By evaluating the rating map of one foreign money with the different in the identical chart, we will resolve the total dealer’s sentiment in direction of the foreign money pair.

Growing accuracy

By and massive, the methodology mentioned above is utilized by most of the information analysts with minor modifications. We’ve not gone into the particulars equivalent to making a program utilizing MATLAB and bettering the accuracy utilizing a number of regression fashions. Lastly, the accuracy is examined earlier than utilizing it for buying and selling in the Foreign exchange market.

Sentiment evaluation primarily based on merchants’ orders

Skilled merchants know that

So, validating the lengthy and quick positions in the market would positively give a clue in regards to the prevailing market’s sentiment in direction of the traded asset. Nonetheless, it’s not an simple job like calculating the

Earlier than we perceive the method in which the information pertaining to the lengthy and quick positions are obtained, segregated, and lastly interpreted, we will take a look at some primary data associated to the Foreign exchange market.

Spot and derivatives market

For greater than 90% of the time, the time period Foreign exchange market is used to refer the spot market the place the bulk of foreign money change transactions happen on a every day foundation. Most of the on-line Foreign exchange brokers provide a facility to commerce in the spot market solely. Moreover,

Aside from the spot market, there exists the derivatives market, which incorporates the forwards, futures, and choices. Whereas forwards is an over the counter contract, normally between a financial institution and a consumer (for instance, exporters who want to shield from change conversion price associated losses), the futures and choices are standardized

Just like another by-product contract, the forwards, futures, and choices contracts have an expiry date and an order dimension. The expiry time interval can range between one month and six months or much more (close to, subsequent, and far contracts). The foreign money futures and choices contracts commerce on regulated exchanges equivalent to the Chicago Mercantile Change (CME), Eurex, and ICE (Intercontinental change).

The

Legacy COT report

The by-product market isn’t a passive follower of the spot market. The motive is that enormous institutional gamers, by means of their very own

There is no such thing as a particular data relating to the

Calculating the open curiosity

The open curiosity displays the place held by merchants in the market. The COT report displays the open curiosity for an asset in the derivatives change. In case of a foreign money, the open curiosity is calculated by summing up the complete variety of futures and choice contracts that are nonetheless open and but to be offset by a transaction or in another method (supply, train, and many others.). As it may be understood, the futures and choices are totally different sorts of by-product merchandise and straight summing up the lengthy and quick contracts doesn’t make any sense. So, the solely strategy to go about it’s to convert the choices contracts into equal futures contracts.

In case of COT, the dealer’s positions in the choices market are transformed right into a

For instance, if the delta issue offered by the change is 0.50, then a dealer holding 500 open choice contracts might be thought of as holding 250 futures (500×0.50) by-product contracts. Now, the

Classes of merchants as per COT report

The COT report divides merchants into three important teams:

- Commercials (plotted in purple shade on the chart)

Non-Commercials or massive speculators (plotted in inexperienced shade)- Small speculators (plotted in blue shade)

Business and non-commercial merchants

A dealer who makes use of futures contracts to hedge threat is categorized as a business dealer. Normally, merchants submit kind 40 to disclose their buying and selling intention to the CFTC. A dealer who speculates in the market is categorized as a

Reportable and non-reportable positions

Clearing members, futures fee retailers, and international brokers ought to compulsorily file every day report as lengthy as their web positions are above particular ranges stipulated by the CFTC. The ranges are up to date by the CFTC relying on the current market situations. In normal, the reported positions can be between 70% and 90% of the complete open curiosity in the market. The open pursuits of these merchants who’ve insignificant quantity (under the degree prescribed by the CFTC) come beneath the

Disaggregated COT report

Starting from 2009, CFTC began publishing the Disaggregated Dedication of Merchants (Disaggregated COT) report together with the legacy COT report.

The Disaggregated COT report is one other try by the CFTC to enhance transparency. The report segregates the merchants into 4 totally different classes:

- Producer/Service provider/Processor/Person

- Swap sellers

- Managed cash

- Different reportables

The Disaggregated COT report is printed together with the legacy COT report.

Producer/Service provider/Processor/Person

Entities that deal with commodities bodily come beneath this class. Such enterprises use futures to hedge dangers.

Swap sellers

Any group which offers in swaps and makes use of the futures market to hedge threat comes beneath this class. The counter celebration to a swap vendor could be a speculative dealer, hedge fund, or even a business dealer. It needs to be famous that swaps are usually not change traded contracts. These

As of 2011, the monetary establishments that dominated the swap market had been:

- JPMorgan Chase

- Citibank

- Financial institution of America

- Goldman Sachs

- HSBC Financial institution USA

In keeping with the Financial institution for Worldwide Settlements (BIS), the notional worth of swap contracts traded in 2012 was $642.1 trillion. The swap sellers have an affiliation named Worldwide Swaps and Derivatives Affiliation (ISDA). When the CFTC began publishing the Disaggregated COT report, the ISDA made a number of makes an attempt to take away their transactions from the business merchants’ class. Such is the significance of the group’s exercise in the worldwide monetary markets.

Cash managers

People registered with the CFTC as a Commodity Buying and selling Advisor (CTA) or Commodity Pool Operator (CPO).

Different reportables

Another sort of dealer who doesn’t come beneath any of the classes talked about above.

It needs to be famous that Disaggregated COT report is on the market just for the commodity markets. Foreign money, bond, and index merchants should use the legacy COT report and/or Merchants in Monetary Futures (TFF) report.

Interpretation of COT report

A typical Disaggregated COT report for the crude oil is offered under:

The

The chart reveals that as the web lengthy positions of massive speculators begins declining (October 2015 — February 2016), the crude oil continues to decline. Equally, an enhance in the web lengthy positions of massive speculators (

The

Now, let’s examine the legacy COT chart of the euro (EUR/USD):

As mentioned earlier, an enhance in the web lengthy place (December 2015 — Could 2016) of the massive speculators propels the change price of the euro and vice versa.

In the identical method, an enhance in the web lengthy positions (December 2015 — June 2016) of leveraged funds flip the foreign money bullish and

By finding out the web lengthy and quick positions of massive speculators and swap sellers, a dealer can interpret the current sentiment in the commodity market. Equally, by finding out the web lengthy and quick positions of massive speculators and leveraged funds, a dealer can interpret the current sentiment in the foreign money, bond, and indices market.

A number of Foreign exchange brokers present particulars relating to the lengthy and quick positions of merchants on their web site. This contains Oanda, Saxo Financial institution, and Dukascopy.

Effectiveness of sentiment evaluation

Usually, a seasoned Foreign exchange dealer or an fairness investor provides due consideration to the following three traits of an asset, earlier than making an funding choice. They’re:

- Volatility

- Liquidity

- Returns

We are able to positively say that the sentiment evaluation is dependable as lengthy as there may be empirical proof of the influence of sentiment on the volatility and liquidity of an asset.

Impact of sentiment on volatility

The impact of sentiment on the Foreign exchange volatility was studied by Goddard, Arben Kita, and Qingwei Wang of Bangor Enterprise College (UK) and College of Groningen (Netherlands). Since there is no such thing as a single or reliable supply to observe the exercise of retail merchants, solely the actions of massive institutional merchants had been correlated with the change in the Google Search Quantity Index (SVI) after giving due consideration to the macroeconomic fundamentals.

The Search Quantity Index (SVI) is the ratio of worldwide search on particular key phrases to the complete variety of searches in a given interval. The ensuing worth is normalized and scaled between Zero and 100 for the ease of comparability. For the examine, the information pertaining to seven main foreign money pairs (USD/JPY, GBP/USD, USD/AUD, EUR/USD, EUR/GBP, EUR/JPY, and GBP/JPY) was downloaded for the interval from January 2004 to September 2011. The mixture SVI information for a foreign money pair in each orders (USD/JPY and JPY/USD for instance) was used throughout the examine.

The implied volatility information for a foreign money pair was obtained from Bloomberg. A unit enhance in the SVI was statistically discovered to enhance the weekly buying and selling quantity by ¥500 trillion to ¥600 trillion in the USD/JPY pair. Thus, it may be argued that SVI is an acceptable information, primarily based on which the impact of sentiment on the volatility will be studied.

The examine clearly indicated that there exists a small optimistic correlation of 0.31 between the traders’ sentiment and USD/JPY volatility. Nonetheless, the impact is statistically and economically important. When SVI elevated above the common, the volatility elevated two to 5 occasions larger than what it was when the SVI was under the common. The analysis additionally confirmed that the SVI is expounded to the carry commerce returns and the foreign money threat premium. The optimistic correlation elevated to 0.75 when the total Foreign exchange market volatility was considered as a substitute of simply the USD/JPY pair.

Examples

In Japan, the victory of Shinzo Abe in 2012 election resulted in a sharp decline of about 1,000 pips in the USD/JPY foreign money pair. Shinzo Abe was voted to energy primarily based on his promise to take the inflation to 2% by means of stimulus measures. Abe’s victory kindled the bearish sentiment on the Japanese yen, leading to a sharp decline to the price of 84.50 towards the US greenback. The volatility elevated merely out of bearish sentiment in this case.

The final result of the collection of surveys carried out earlier than the Brexit voting tremendously impacted the sentiment on the Nice Britain pound, thereby growing the volatility. Throughout these durations of excessive volatility, there have been a number of optimistic financial information bulletins rising out of the UK. Sadly, the market discarded the data and moved in line with the sentiment created by the Brexit associated surveys. Once more, in this case, the volatility was pushed by the sentiment slightly than financial information.

The depth of the crash in the US fairness markets in 1987 was primarily because of the bearish sentiment that grew out of a collection of unfavourable financial information.

Impact of sentiment on liquidity

When volatility will increase in a Foreign exchange market, the liquidity suppliers widen the spreads, thereby making a cushion for the threat they bear. A analysis carried out by

In the case of an announcement, the market is normally properly ready to react. On the different hand, it takes time for the market to course of the data and assess the professionals and cons earlier than reacting to information. Throughout this era, the market individuals might be typically unwilling to commerce and this dries the liquidity quickly. Such a habits sample was recognized by the examine carried out by PricewaterhouseCoopers. It might take wherever between a few seconds to a number of days for the liquidity to return to regular. The 9/11 incident will be quoted as an instance for this. The markets had been shut down by regulators for a number of days, fearing an uncontrollable crash because of lack of liquidity. Thus, it may be understood that surprising information would have an effect on the total sentiment and not directly have an effect on the liquidity in the market.

Examples

On January 15, 2015, the Swiss Nationwide Financial institution unexpectedly deserted its 3-year coverage of limiting the rise of the Swiss franc towards the euro. The information caught the market by shock. The unfold widened by greater than 50 pips. The franc appreciated by practically 41% to hit a excessive of 0.8517 towards the Euro. It is a traditional instance of bullish sentiment affecting the liquidity of a monetary market. As soon as the market individuals began taking rational selections, the franc misplaced a portion of the acquire to commerce at about 1.0500 towards the euro.

Likewise, the shock final result of the Brexit referendum noticed the pound decline sharply towards the main currencies. The bearish sentiment eliminated the liquidity from the marketplace for a quick span of time, thereby inflicting large erosion in the change price of the pound.

The bearish sentiment created by the 2008 credit score disaster (chapter submitting by Lehman brothers, the acquisition of Merrill Lynch by Financial institution of America, and the rescue of AIG by the Federal Reserve) had a great unfavourable influence on the liquidity of the monetary markets. This unfavourable influence of bearish sentiment on the liquidity was studied in element by Kurshid Ahmad (College of Pc Science and Statistics at Trinity School Dublin).

Impact of sentiment on the value

There are conditions the place even the slightest optimistic information would propel the market in a massive method. The sturdy uptrend can be attributed to the bullish sentiment prevailing in the market. The Fed’s dialogue paper on the influence of macroeconomic bulletins on actual time Foreign exchange charges of rising markets confirms this.

The Japanese yen is a traditional instance of the case mentioned above. When the Financial institution of Japan made a shock price lower into the unfavourable territory on January 29, 2016, the market reacted by pushing the yen to a low of 121.20 towards the US greenback. Nonetheless, the prevailing bullish sentiment (protected haven attraction of the yen) introduced the USD/JPY foreign money pair again to ranges close to 117.00 in a matter of three days.

Impact of COT report on the liquidity and volatility

Thus far we mentioned how the bearish or bullish sentiment created by the information, boards, and social media platforms triggers a change in the liquidity and volatility. Now, let’s perceive how the sentiment primarily based on orders in the futures market impacts the liquidity and volatility in the spot market.

A comparability of the positions of massive speculators in the futures market and the corresponding value motion in the spot market will reveal the influence of sentiment primarily based on orders.

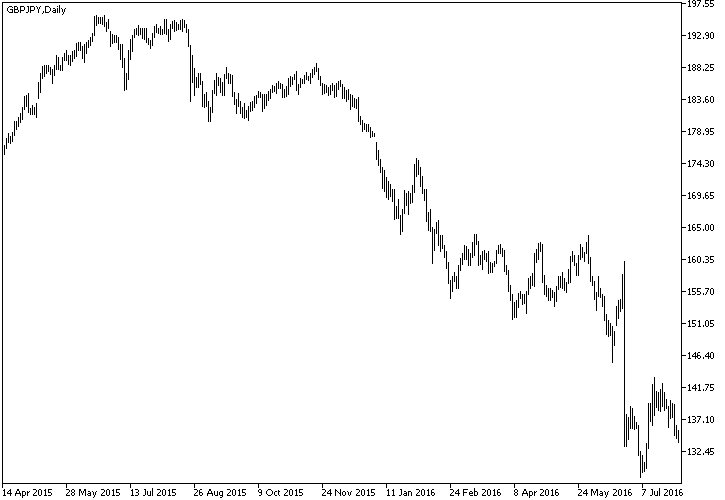

Between October 2015 and June 2016, the massive speculators elevated their web quick positions in the pound.

Concurrently, the massive speculators elevated their web lengthy positions in the Japanese yen. The COT chart under reveals that fairly clearly.

When massive traders take reverse positions in two currencies, the corresponding foreign money pair would exhibit sharp a rise in volatility in the spot market. In this case, the GBP/JPY exhibited a steep decline as proven under.

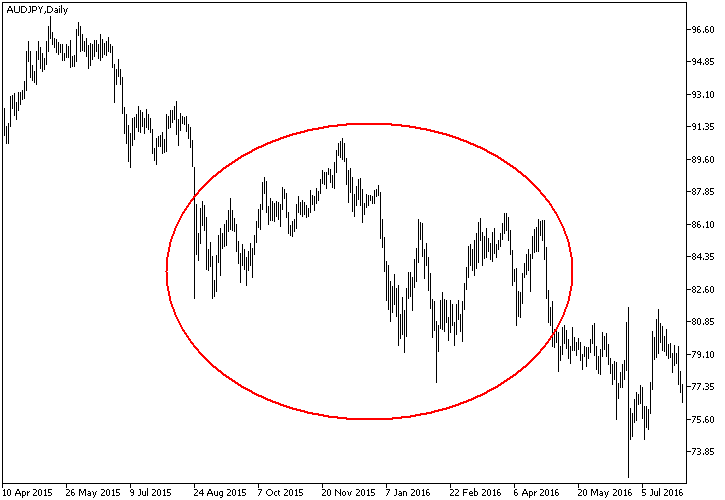

On the different hand, if the massive speculators take a comparable place in two currencies in the futures market, then the volatility is not going to be excessive in the corresponding foreign money pair. The COT chart for the Australian greenback will be seen under.

The COT chart for Japanese yen is repeated right here:

The cumulative impact is demonstrated on the chart under:

It may be famous that in the futures market, massive speculators had been bullish in each currencies. Moreover, the massive speculators have diluted their lengthy positions as soon as in a whereas in the Aussie. On the different hand, starting from January 2016, the massive speculators held nearly the identical quantity of lengthy contracts in the Japanese yen. This enabled the yen to flip mildly bullish towards the Aussie in the spot market. In the end, this strengthened the JPY barely towards the AUD in the spot market. Nonetheless, the web volatility is comparatively low when in comparison with the GBP/JPY pair. This reveals that orders that stream in the futures market are inclined to create a bullish or bearish sentiment in the spot market and lastly influence the volatility.

In the case of commodity markets, as a substitute of finding out the positions of massive speculators or leveraged funds, a dealer can take a look at the web lengthy or quick positions of swap sellers. Normally a swap vendor buys or sells an asset in the spot market and correspondingly opens an reverse commerce in the futures market both to mitigate threat or to handle the future commitments. Thus, for each contract bought or purchased in the futures market, a comparable quantity is traded in the spot market. Thus, any enhance in the liquidity and volatility in the futures market will even end in a corresponding enhance in the spot market. Nonetheless, it needs to be remembered that swap sellers take mutually reverse positions in the spot and futures market. Thus, web positions and value development can be inversely correlated.

Conclusion

From the above dialogue, it may be understood that sentiment has a confirmed and credible influence on the monetary markets. Time and once more,

Do you’ve gotten any expertise in utilizing sentiment evaluation in Foreign currency trading? How did it carry out? What was the methodology of your evaluation? Please share the particulars with different merchants utilizing our group discussion board.

If you wish to get information of the newest updates to our guides or the rest associated to Foreign currency trading, you’ll be able to subscribe to our month-to-month e-newsletter.