This is a bit of an ICYMI, a note from HSBC earlier in November.

Analysts at the bank acknowledge that there are ‘headwinds’ persisting but “remain constructive on China and keep our 5.2% growth forecast for 2023”.

HSBC’s base case (in brief):

- One of the key assumptions embedded in our growth forecast is a gradual relaxation of the COVID-19

Covid-19

Covid-19 or the novel Coronavirus is a pandemic that has yielded wide ranging economic turmoil and volatility across financial markets in 2020. The first cases of Covid-19 were reported in Wuhan, China in late 2019. Since then, the virus has expanded globally, infecting millions worldwide. The virus has been extremely controversial, namely in the United States, which became heavily politicized during the 2020 presidential election. The Covid-19 pandemic is completely unprecedented in modern times, with the most recent example being the influenza outbreak in 1918. Financial markets and global economies were completely unprepared for the scope of the virus, causing massive shutdowns, unemployment, and other hardships in an effort to contain and mitigate the virus. How Has Covid-19 Affected Markets? Virtually every asset has in some way been affected by Covid-19. Early on, financial markets and equities collapsed, with the nadir coming in March 2020 in the United States and Europe. Widespread lockdowns led to an economic standstill, resulting in stimulus packages to help keep domestic economies functioning. The result of this has been a depreciation of currencies such as the US dollar, with the Federal Reserve printing billions of dollars to pare economic losses. Forex markets have since experienced historic levels of volatility, leading some to classify the Covid-19 pandemic as a Black Swan event. Financial markets have for the most part rebounded in 2020 at the time of writing, though many headwinds remain in terms of economic recovery. Presently, unemployment rates and other indicators remain problematic, and when coupled with rising rates of infection, portend additional monetary policy action or stimulus in both Europe and the US. At the time of writing there is no vaccine for Covid-19 though several companies such as Pfizer and Moderna are close to producing a viable vaccine.

Covid-19 or the novel Coronavirus is a pandemic that has yielded wide ranging economic turmoil and volatility across financial markets in 2020. The first cases of Covid-19 were reported in Wuhan, China in late 2019. Since then, the virus has expanded globally, infecting millions worldwide. The virus has been extremely controversial, namely in the United States, which became heavily politicized during the 2020 presidential election. The Covid-19 pandemic is completely unprecedented in modern times, with the most recent example being the influenza outbreak in 1918. Financial markets and global economies were completely unprepared for the scope of the virus, causing massive shutdowns, unemployment, and other hardships in an effort to contain and mitigate the virus. How Has Covid-19 Affected Markets? Virtually every asset has in some way been affected by Covid-19. Early on, financial markets and equities collapsed, with the nadir coming in March 2020 in the United States and Europe. Widespread lockdowns led to an economic standstill, resulting in stimulus packages to help keep domestic economies functioning. The result of this has been a depreciation of currencies such as the US dollar, with the Federal Reserve printing billions of dollars to pare economic losses. Forex markets have since experienced historic levels of volatility, leading some to classify the Covid-19 pandemic as a Black Swan event. Financial markets have for the most part rebounded in 2020 at the time of writing, though many headwinds remain in terms of economic recovery. Presently, unemployment rates and other indicators remain problematic, and when coupled with rising rates of infection, portend additional monetary policy action or stimulus in both Europe and the US. At the time of writing there is no vaccine for Covid-19 though several companies such as Pfizer and Moderna are close to producing a viable vaccine.

Read this Term policy next year. However, any shift would hinge on a few essential conditions, including sufficient vaccination coverage, treatment drug availability, and a global scientific consensus on the pandemic. - To be clear, we do not expect any major policy shifts in the near term, but we acknowledge China is making steady progress in its vaccination coverage, upgrading its vaccines, as well as medicine development.

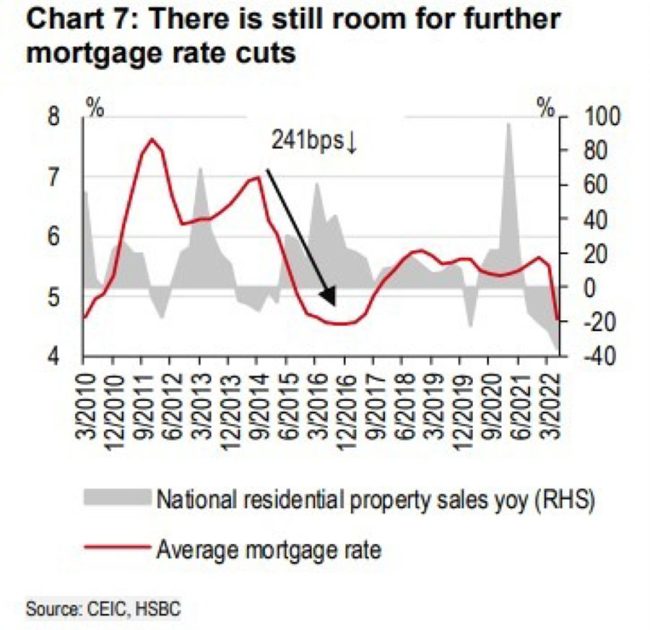

- Regarding the housing market, more measures are being rolled out to provide funding and stabilise expectations. We also expect more stimulus policies and better implementation following the recent political reshuffle.

news.google.com