Indian Rupee, USD/INR, China-India Border Dispute, Nifty 50 – TALKING POINTSIndian Rupee, Nifty 50 susceptible to escalating Chin

Indian Rupee, USD/INR, China-India Border Dispute, Nifty 50 – TALKING POINTS

- Indian Rupee, Nifty 50 susceptible to escalating China-India tensions

- Coronavirus instances spike in China, India wrestles with deep recession

- USD/INR could rise after resistance break, will Nifty 50 clear help?

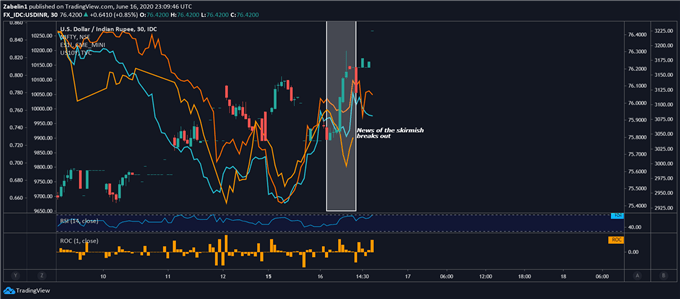

The US Greenback rose versus the Indian Rupee after information broke of a skirmish between Indian and Chinese language troopers alongside a disputed border – referred to as the Line of Precise Management (LAC) – within the Himalayan Mountains. The following danger aversion pressured US fairness futures and India’s benchmark Nifty 50 inventory index whereas Treasury yields briefly spiked together with the anti-risk Japanese Yen.

Beneficial by Dimitri Zabelin

Discover ways to change into a extra constant foreign exchange dealer

USD/INR Surged With Treasury Yields as SPX Futures, Nifty Index Dipped – 15-Minute Chart

USD/INR chart created utilizing TradingView

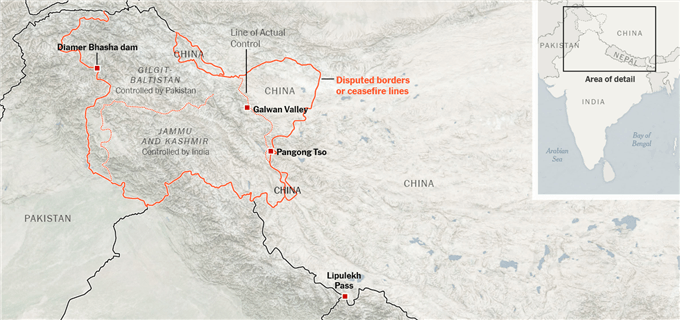

Preliminary stories point out roughly 20 Indian troopers had been killed after – in response to officers in New Delhi – Chinese language troopers provoked an assault. Beijing retorted that it was the Indian troops who had initiated the hostilities. The final time each nuclear powerhouses noticed this diploma of battle was again within the 1970’s, however this incident comes on account of elevated tensions over the previous few months.

Each China and India have been growing efforts in direction of to increase infrastructure tasks and navy installations within the disputed area as a approach to restrict the opposite’s territorial ambitions. The consequence has been an notable improve of tensions and better charges of non-lethal engagements between troopers starting from shouting matches to full-on brawls.

Dean of the Jindal Faculty of Worldwide Affairs Sreeram Chaulia says China’s bolder motion right now could also be a strategic exploitation of India’s present circumstances. Because the latter makes an attempt to take care of the well being and financial disaster of Covid-19, the allocation of assets to these points might hinder a immediate and powerful response to issues within the Himalayan Mountains.

It could additionally give Beijing “an opportunity to edge its forces deeper into the disputed territory in hopes of obstructing New Delhi’s border infrastructure improvement” (WSJ). Having stated that, within the months main as much as this battle, China and India have mobilized 1000’s of further troops and navy {hardware} to strategic, high-altitude factors.

Beneficial by Dimitri Zabelin

How will you overcome widespread pitfalls in FX buying and selling?

Line of Precise Management

Supply: New York Instances

The geographical specification is vital: throughout the summer season months, greater temperatures trigger the snow to soften, thereby making patrolling and infrastructure improvement comparatively simpler. Different officers state that India’s robust response to China comes amid worry of the Asian big’s political ambitions given its actions in Hong Kong, the South China Sea and continuous rigidity with Taiwan.

If tensions between China and India proceed to develop, the cross-asset influence could also be significantly bigger now than earlier than given the vulnerability of the worldwide financial system amid the coronavirus pandemic. Beijing is reporting one other spike of infections whereas India – the fourth most-infected nation on the planet behind Russia – wrestles with what might be its worst recession because the 1970’s.

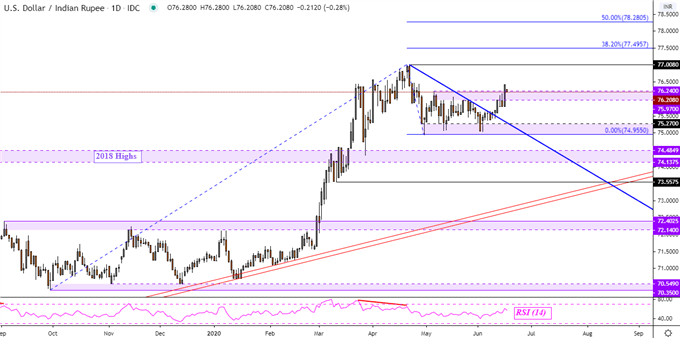

Indian Rupee Technical Evaluation

That is because the Indian Rupee might be prone to additional losses in opposition to the US Greenback. On the every day chart under, USD/INR is making an attempt to push above key resistance which is a spread between 75.97 – 76.24. This follows a push above close to time period falling resistance from April’s high – blue line. Upside follow-through is missing at this level, however one other shut above resistance might pave the way in which for a take a look at of 77.

Past present 2020 peak, which can also be the report excessive, sits the 38.2% Fibonacci extensions at 77.49. Pushing above this value exposes the midpoint of the extension at 78.28. Ought to USD/INR descend alternatively, costs could bounce off help (74.95 – 75.27). If sufficient sellers overpower patrons, additional losses from there could place the give attention to key rising help from July 2019 – purple strains.

USD/INR – Every day Chart

USD/INR Chart Created in TradingView

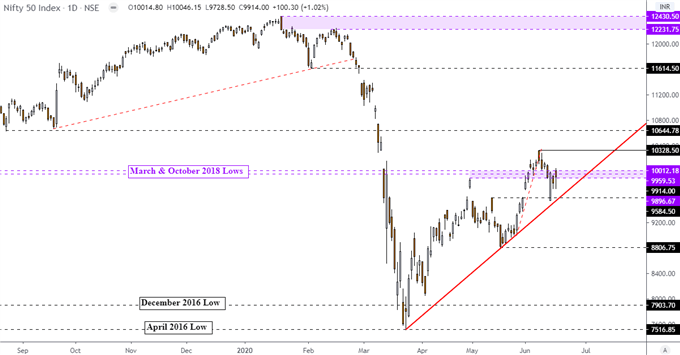

Nifty 50 Technical Evaluation

Regardless of latest losses, the Nifty 50 stays in its key uptrend since costs bottomed in late March. That is outlined by rising help – purple line on the every day chart under. Costs not too long ago bounced off this slope of appreciation, pressuring the 9959 – 10012 inflection level. Additional features from right here might see the Nifty 50 take a look at resistance at 10328.

If costs push above the latter, that may expose the August 2019 low at 10644 which might stand in the way in which as new resistance. A push above this value might pave the way in which for a take a look at of 11614 which is the January low. India’s benchmark inventory index could set course for a reversal if the rising pattern line falls aside. A doubtlessly key stage of help to observe for follow-through appears at 9584. Additional losses exposes the Could trough at 8806.

Nifty 50 – Every day Chart

Nifty 50 Chart Created in TradingView

— Written by Dimitri Zabelin and Daniel Dubrovsky, Foreign money Analysts for DailyFX.com

To contact Dimitri and Daniel, use the feedback part under or @ZabelinDimitri and @ddubrovskyFXTwitter